Are we in a bubble?

First, some general rules on bubbles.

Rule#1 - if everyone is saying the same thing, it’s probably not true.

Rule#2 - you don’t know if a bubble exists until after the event.

Rule#3 - bubbles can go on for a long time.

Turning to today’s markets, it’s easy to see why there’s talk of bubbles. Take tech. Since 2020, tech is up around 320%; the wider equity market 200%. Tech is a handsome outperformer. The outperformance has meant valuations are handsome too. That said, valuations are not in 1999 dotcom bubble territory. Back then, tech names were trading on much larger price-earnings multiples. In 1999, Cisco and Microsoft were on 60x earnings. Today, Nvidia and Microsoft are on 30-35x. Not cheap but not silly.

Bubbles aren’t confined to valuations. Earnings can join the party too. Here, there could be cause for concern. Thanks to seemingly impenetrable moats and market shares to die for, mega-tech stocks are currently generating stellar earnings growth and margins. Those heady rates though need to be maintained to justify current valuations. Trouble is, if more players enter the market, then those growth rates will likely come under pressure. For an idea on tech’s current earnings growth rates, the overall US market is expected to grow by 13.4% over the next 12 months. Strip out the AI-tech giants and this falls to 9.4%. That means AI-stocks are forecast to grow at 23.6%, a high number by any measure.

And then there’s the increase seen in vendor financing. Up until recently, tech spending had been funded through free cash flow generated – a clear differentiator with 1999 when much of the growth was funded through debt issuance and the leveraging up of balance sheets. This is changing, however. Both Oracle and Meta have recently issued debt, the first time major tech has done so. Nvidia, meanwhile, is increasingly funding its various customers in return for the promise of contracts. The whiff of 1999 is potentially getting stronger.

So, James and I agree that the short answer to ‘is there a tech bubble?’ is, on balance, no not yet. We also agree with Quilter Cheviot’s Global Head of Technology Research and Investment Strategist, Ben Barringer, who in his recent article 'Tech bubble 2.0?' wrote, “The current environment requires a higher degree of selectivity. We are focusing on growth at a reasonable price, not at any price, and believe that some caution should be heeded in certain areas.”

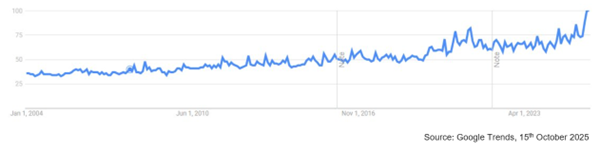

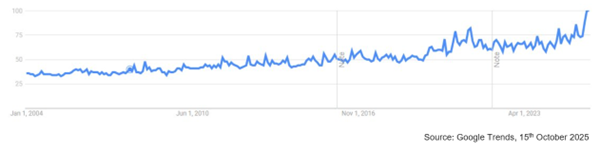

What about a gold bubble? A look at the chart shows the price has quadrupled to US$4,200 since 2011 with most of the gains made in the last 12-18 months; while a check on Google Trends shows current search interest in the term gold is at an all-time high. As for what’s pushing gold prices higher, this is harder to pin down as what drives gold varies over time. The yellow metal can be viewed as an inflation hedge, but it does not always behave that way. Gold can also be a hedge against things breaking or a hedge to equity markets, but as past performance shows this is not always the case. Exceptional price movement. Tick. Strong interest. Tick. Drivers. Not clear. Conclusion, gold possibly nearer a bubble than AI.

Gold: all that glistens

Web searches for gold increasing

Past performance is not a reliable indicator of future performance