There has been increasing speculation of a bubble in technology stocks of late, with the Bank of England (BoE), International Monetary Fund (IMF) and high-profile figures in financial institutions voicing their concerns. Technology stocks seen as winners from artificial intelligence (AI) have made large gains over the last three years but while there are a growing number of warning signs that the current dynamic is unsustainable, the rally has been built on fairly firm foundations and investor sentiment appears to still be some way shy of the heady heights of the dotcom boom around the turn of the millennium.

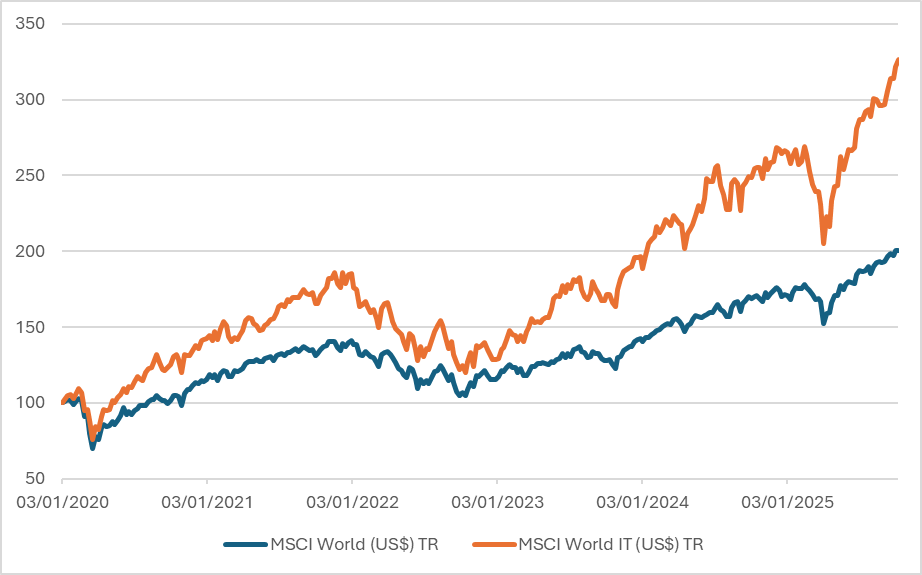

Tech stocks have clearly outperformed since 2020

Source: LSEG Datastream, Quilter Cheviot Limited 10/10/2025.

These figures refer to the past and past performance is not a reliable indicator of future results.

The outperformance of technology stocks began during 2023, when the launch of ChatGPT brought widespread recognition of the benefits of AI. The outperformance increased until early 2025 when the launch of Deepseek — an app that trained AI models for a fraction of the cost of training a conventional model — and then the market turmoil around trade tariffs saw tech stocks fall back to nearly in line with the broader market.

Since then, there has been a resurgence in tech stocks, thanks to strong corporate earnings and also a growing expectation of Federal Reserve rate cuts. It is this strong performance in the last six months in particular that has led to calls of a tech bubble and comparisons with the dotcom era. It is well known that bubbles tend to occur after a structural bull market and there is some sense that this is playing out.

Warning signs

1. Vendor financing

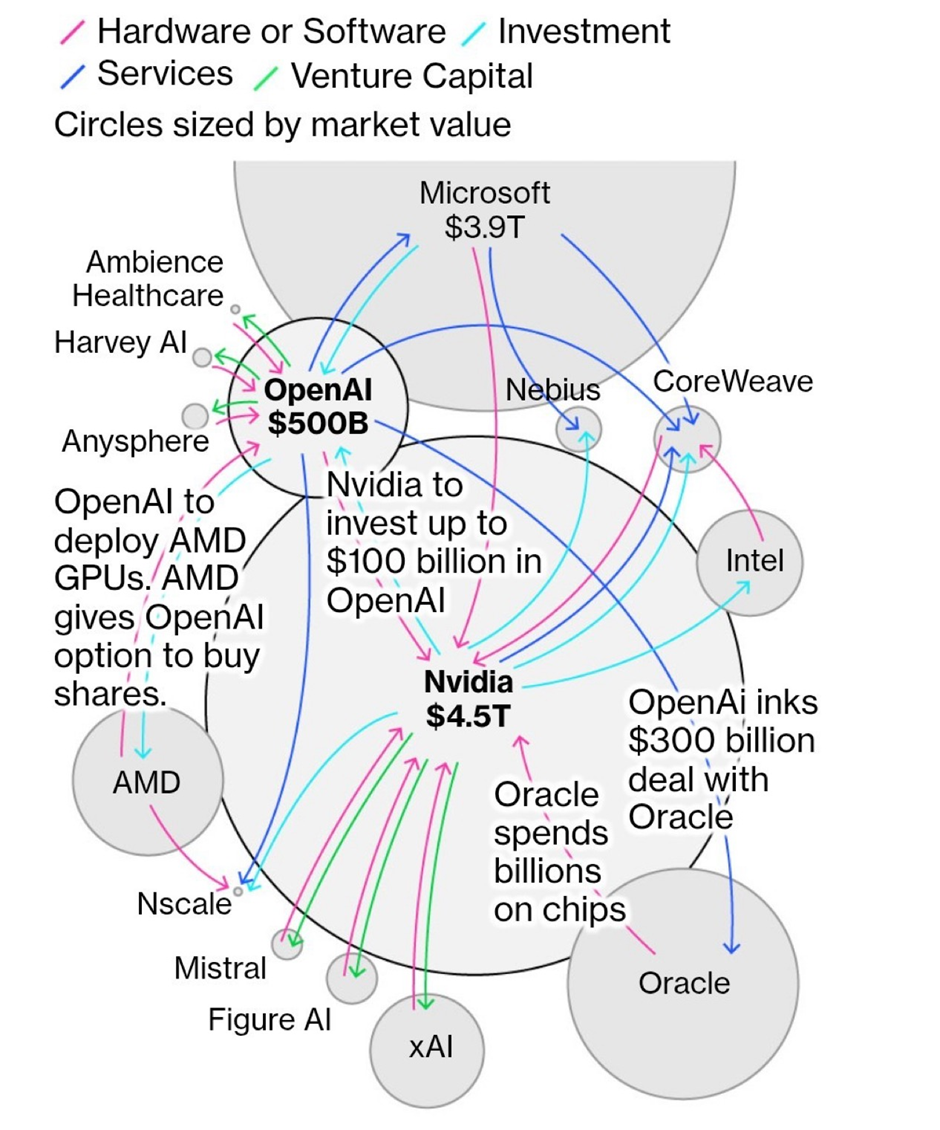

Perhaps the biggest red flag for those concerned about the US tech sector is the interconnected nature of businesses at the forefront of AI development. There has been a spate of deals within the tech sector in recent weeks. OpenAI is going on a spending spree looking to be the ultimate winner of the AI race, but how it pays for this remains to be seen. The likes of Nvidia and AMD are helping to finance this, but that in itself is a cause for concern given the uncertain nature of how transformational AI will really be.

Being financed by your customers and your wider ecosystem is not a positive sign, nor is it sustainable. What we need to see is demand from corporate, consumers and governments to provide returns on these investments.

Source: Bloomberg news reporting

Mitigating factors

Although the levels of vendor financing are a concern, there may be some justification for these. Technology companies have posted superior growth for quite some time now and therefore can be viewed as attractive investment opportunities. If the businesses truly believe that AI will deliver higher productivity, then there is some sense in investing in businesses that stand to benefit from this.

2. Capital expenditure to sales rising

The view that companies will either be an AI winner or nowhere has led to large-scale investment in the space. The ratio of capital expenditure (capex) to sales has risen significantly in recent years, as companies have piled money into developing their AI capabilities. The current level of datacentre capex, in the region of 25% of mega-cap tech sales, is at a comparable level to that of the Telecom capex-to-sales ratio seen during the dotcom bubble.

Mitigating factors

The source of the increased capex spend is important when looking at the risks involved. The majority of capex is coming from free cash flow, as companies are reinvesting profits into developing their AI capabilities. This is clearly less risky than if companies are taking on debt to finance these operations. Oracle is an example of a company that is increasing debt to fund large-scale investments in AI infrastructure and should this become more widespread, then the risks would increase.

3. Market concentration

The strong performance of technology stocks means they now account for a relatively large amount of not only the US stock market, but also global equities. As of 30 September, the technology sector accounted for one third of the MSCI North America Index[1]. Eight of the top 10 constituents by weighting are technology stocks and the top three — Nvidia, Apple and Microsoft — account for 20%. These companies are also the three largest in the MSCI All Country World Index[2] and their combined 13% weighting is greater than the combined weighting for Japanese, Chinese and UK stocks!

Mitigating factors

While the concentration of mega-cap technology stocks poses some risk to the broader market, rising stock prices have been supported by rising earnings. This has meant that the valuations, as measured by price/earnings (P/E), are somewhere in the region of 30X for the Mag6 (Alphabet, Amazon, Apple, Meta, Microsoft and Nvidia). Although 30X is higher than the broader market (MSCI North America = 23X, MSCI AC World =19X) there is some justification for this premium based on earnings growth. US technology stocks grew their earnings by 30% in 2024, compared to 5.2% for the rest of the US market. In 2025 earnings growth is expected to be 20% for technology stocks versus 3.4% for the rest of the market, according to FactSet. This differential is forecast to narrow further in 2026, with technology stocks seen as growing earnings by 16% while earnings for the rest of the market grows 12%.

30X P/E is also substantially lower than previous bubbles. During the dotcom peak in 1999 the market reached a P/E of 60X. The Nifty Fifty in the 1970s reached 45X and Japan hit 72X in the late 1980s.

Reassuringly, mega-cap stocks have outperformed while being supported by strong earnings growth. This is a clear distinction with the .com bubble where many of the high-flying stocks were unprofitable.

Summary

We believe that AI is a potentially transformative technology and there remains considerable growth potential ahead. That said, from an investment perspective, we now see risks as more evenly balanced than they were a couple of years ago when they were more skewed in favour of a more aggressive approach. While technology stocks are still expected to deliver higher earnings growth, the differential with the rest of the market is narrowing, putting their clear recent outperformance at risk. The current environment requires a higher degree of selectivity. We are focusing on growth at a reasonable price, not at any price, and believe that some caution should be heeded in certain areas.

Ultimately the picture is uncertain and for investors this means diversification is crucial. Not just from a sector perspective, but also within any tech allocations to ensure there is not overexposure to one chip vendor or one AI provider. It is vital to watch how corporate IT spending progresses over the course of this year and into 2026 to see how sustainable this growth can be. Should we start to see that slow, or even digital advertising or capex, then the market may start to get jittery. For now, it is time to hold your nerve and stay level-headed. We are not yet in bubble territory but given how the market is beginning to raise some flags, it may be prudent to be a little more cautious at this time.

Forecasts are not a reliable indicator of future results.

Investors should remember that the value of investments, and the income from them, can go down as well as up and that past performance is no guarantee of future returns. You may not recover what you invest. This document is not intended to constitute financial advice; investments referred to may not be suitable for all recipients. Any mention of a specific security should not be interpreted as a solicitation to buy or sell a security.

Approver: Quilter Cheviot, 13 October 2025