Access to active management offers several potential advantages in terms of flexibility, returns and risk management.

There are three features which characterise a ‘typical’ MPS:

- It is composed of a blend of externally managed funds.

- This blend typically comprises both active and passive holdings.

- It is rebalanced on a periodic (prescriptive) basis.

From our previous experience, we know that these factors limit a manager’s ability to implement swift, decisive portfolio change. Externally managed active funds cost more than direct equities, bonds or passive investments, and so cost targets force many managers to adopt a hybrid active/passive approach.

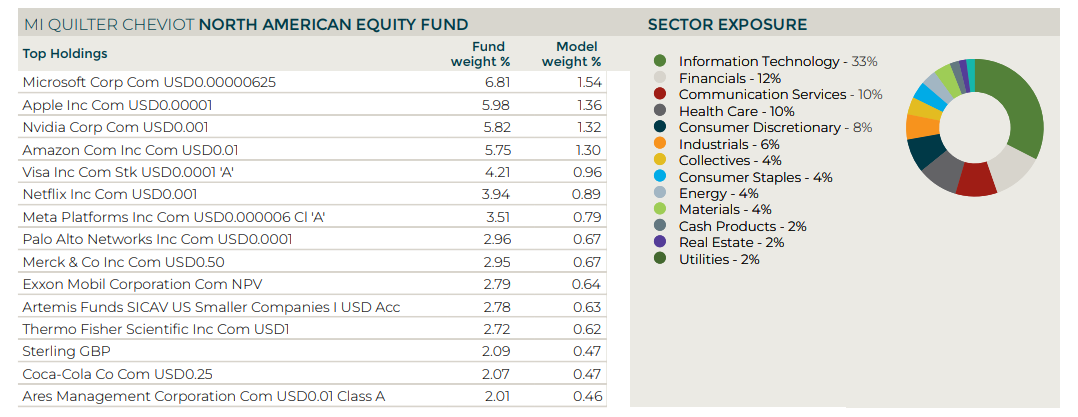

The nature of third party funds also means that managers investing in them are buying a group of securities, rather than specifying exactly how much of each individual security they would like to own. This can lead to them owning more of some securities and/or less of others than they want, settling for a broad, or partial, approximation rather than being able to choose precisely the desired exposure.

It is not unusual for ‘traditional’ MPS managers to have as much as 50% invested in passive investments in a bid to reduce client costs. Due to the high weighting of a handful of tech stocks in many passive investments, this results in a high concentration in a small number of companies that have not been selected for their investing credentials, but for the low cost of exposure.

Furthermore, operational challenges with onboarding new holdings and implementing service-wide changes can limit a manager’s options. Should market conditions change, managers and ultimately clients, can be stuck with unwanted exposures for longer than necessary.

At Quilter Cheviot, we believe our offering is the most active proposition in the MPS market and our unique approach tackles these challenges.

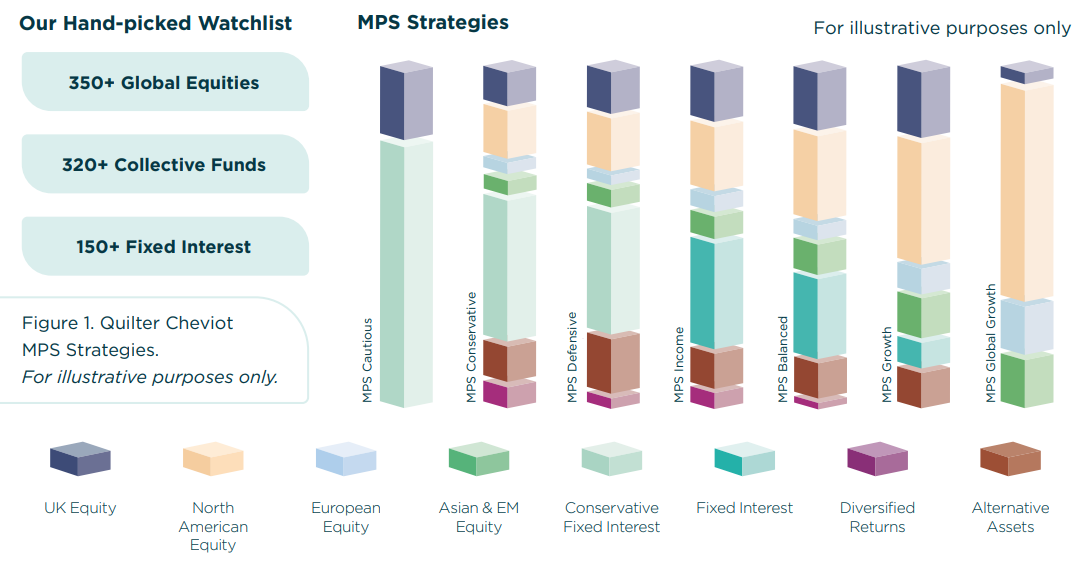

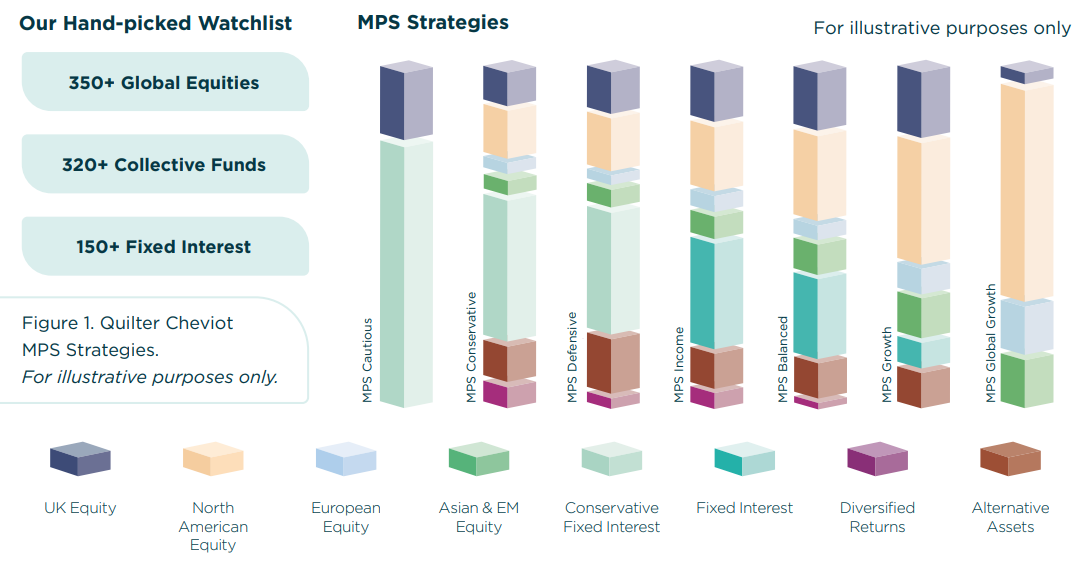

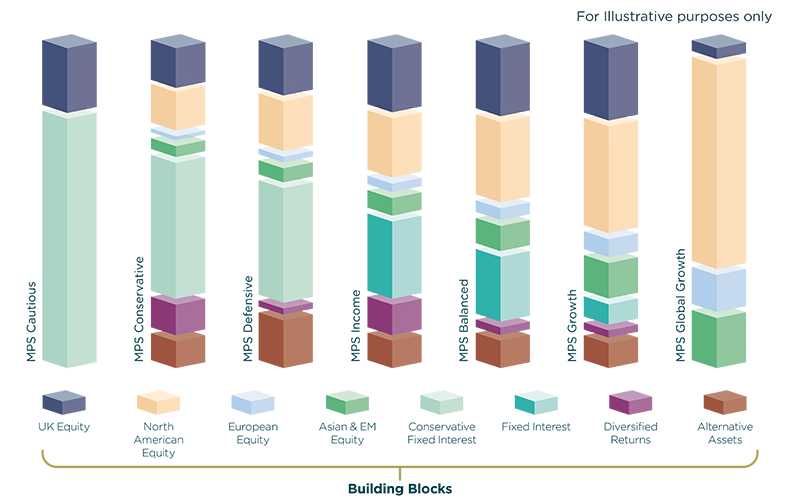

- The strategies are constructed solely using our ‘Building Blocks’ — eight purpose-built funds designed for use within Quilter Cheviot’s MPS. This allows a far greater degree of active management without burdensome costs, as we can select individual securities and fine tune holdings to our desired exposure.

- Quilter Cheviot is both the MPS model manager and underlying manager to the funds. This means changes to the holdings within each Building Block can be implemented at the fund level in a dynamic manner. Changes are immediately reflected across all holders, preventing the need for a portfolio rebalance and the accompanying operational complexity required by a ‘traditional’ MPS. Quilter Cheviot does not charge a management fee for the running of the Building Block funds, removing any conflict of interest - the funds are solely to enhance the investment proposition.

- The Building Blocks reflect our highest conviction investment views and they go beyond open-ended funds. They can invest in direct equities, direct bond holdings, exchange-traded commodities (ETCs), and closed-ended or exchange-traded funds (ETFs), irrespective of the wrapper in which your client’s portfolio is held.

Passive funds are only considered as a temporary home for flows or exposure to a specific index, instead of being relied on to lower costs. This avoids diluting active exposures and alpha-generating potential.

See Figure 1 below for an illustration of how the Building Block funds are used across our MPS strategies.