Although the Bank of England has continued raising its base rate this year, most recently increasing it to a 15-year high of 5.25%, markets are looking ahead and focusing more on the prospect of an end to the tightening cycle in the coming months. Investors remain on the lookout for signs of weakness given the speed and size of the increase in interest rates, but for now economic data is, by and large, coming in better than expected as the UK has avoided recession thus far and continues to demonstrate strength in the labour market.

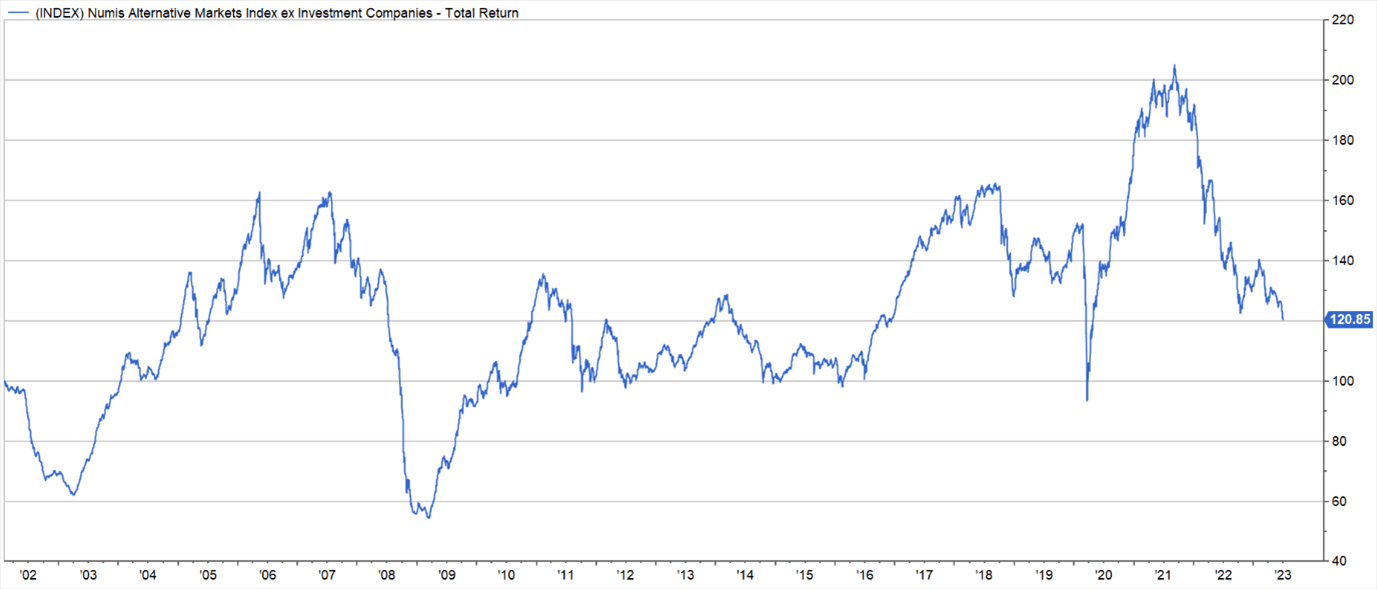

Looking back at previous market lows, two main things stand out:

- It is often not abundantly clear in real time that the market has reached a bottom. If it were that obvious then more investors would time the markets perfectly.

- By the time the fundamentals have improved enough to know that the outlook is significantly better, markets have often bounced strongly from the lows. This is true of most stock markets, but perhaps even accentuated for small-cap stocks due to their greater volatility.

Looking back at two previous significant lows, 2008 and 2020 we can see just how quickly the market snapped back.

|

Drawdown Date

|

Price Decline (%)

|

1-month return post bottom

|

6-month return post bottom

|

12-month return post bottom

|

|

2008

|

-59.95%

|

9.06%

|

52.88%

|

82.06%

|

|

2020

|

-35.28%

|

20.26%

|

53.67%

|

89.22%

|

|

2022

|

-39.81%

|

9.78%

|

6.06%

|

N/A

|

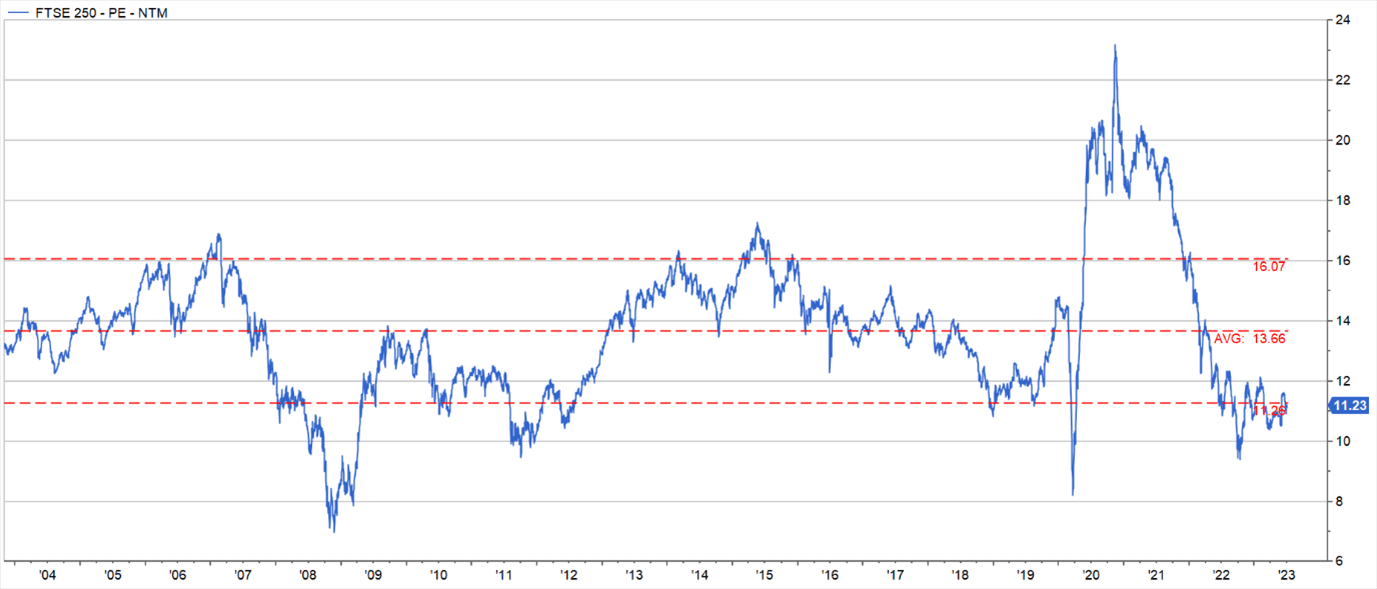

Given the size of the moves and heightened volatility around market lows, it can be prudent to position yourself in advance. No one knows the exact time when a market will make a major low, but the lower valuations have fallen, the more compelling the case is to invest as the probabilities become more skewed in your favour.

Looking at individual stocks, the following three on the AIM market look attractive at current valuations and have the potential to perform strongly going forward:

- Young’s – One of the premium pub operators in London and the South that has suffered a bit of contagion from competitors’ recent woes. Unlike peers Young’s has good margins and strong pricing power, providing greater protection against any sort of profit warning. Consumer confidence has held up better than expected over the last 12 months and tailwinds are emerging for the business.

- CVS Group – CVS is one of UK’s leading provider of veterinary services. It is well positioned to benefit from two key structural tailwinds - increased pet ownership and the “humanisation of pets”. We believe the group is a relatively defensive, high quality veterinary care business, with structural tailwinds and pricing power.

- Ashtead Technology is a leading subsea integrated solutions and equipment rental provider. The transition to renewable, energy security, and a structural shift to rental, are all supportive to the industry and the company's growth profile. The market outlook remains strong, with customer backlogs at record levels. The group has a successful track record of acquisitions, and we expect them to further consolidate the market.