Water scarcity has long been thought of as an issue facing the developing world. Yet with the increasing impact of climate change coupled with a huge rise in the global population, water shortages are becoming a crisis near and far.

UK water demand is far outstripping supply, with the Environment Agency predicting that London and the Southeast could run out of water in 25 years. Water shortages bring an array of negative impacts and Thames Water estimate the cost of severe drought to London’s economy to be £330m per day.

Supply and demand challenges are not being solved quickly enough and the complex regulatory environment for water companies means they are often not sufficiently incentivised to invest in the necessary infrastructure to both reduce water leakage and ensure the appropriate treatment of wastewater. As a result, we have become accustomed to losing incredible quantities of water through leaky pipes, and sewage discharges polluting our coastlines and waterways, including precious chalk streams. There are thought to be only 200 of these streams globally with 85% in England.

2030 targets

On a global scale, the picture is even more troubling. Sadly, UN Sustainable Development Goal Six – “clean water and sanitation for all” – and its underlying targets are not on track to be achieved by the 2030 deadline. To give perspective on the pace of progress needed, compared to current levels, to meet the respective targets, it would require a:

- Six-fold increase for drinking water

- Five-fold increase for sanitation

- Three-fold increase for hygiene

In the UK, infrastructure is dated and low water quality can be reflected in several different measures. One which is particularly prominent right now is bathing water quality, given the discharge of sewage that is happening into the rivers. Other European countries, such as Germany and Croatia have seen a significant improvement in bathing water quality, as they have invested in their infrastructure and constructed new wastewater plants and sewage networks.

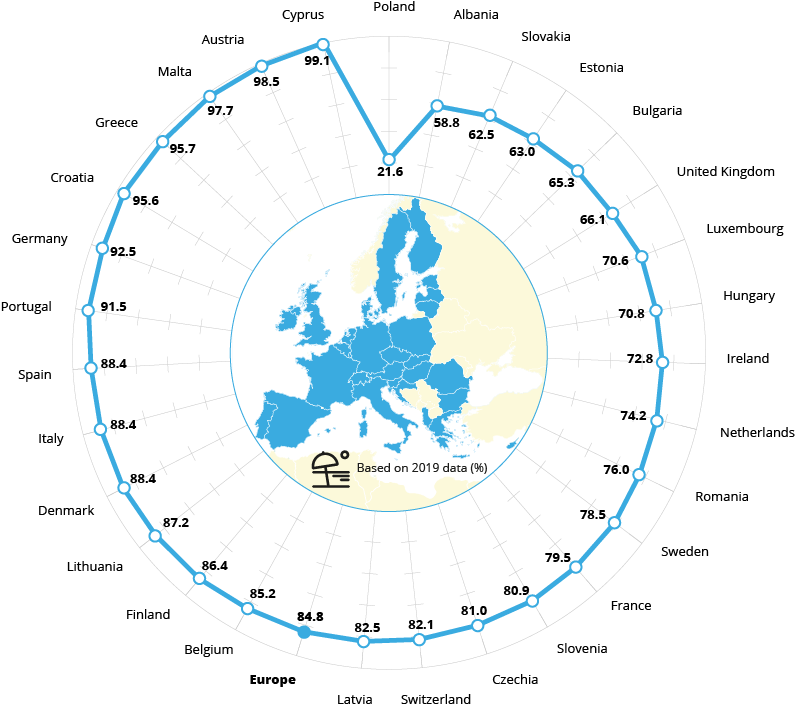

Proportion of bathing waters with excellent quality in European countries in 2019

Source: WISE bathing water quality database (data from 2019 annual reports by EU Member States 1, Albania and Switzerland).

While these stats and predictions are alarming, there is a glimmer of hope. Thanks to tireless campaigners such as Feargal Sharkey OBE, the issue of water quality and scarcity is now firmly on the public agenda. We were delighted to recently welcome Feargal Sharkey OBE to share his thoughts on the latest and most pressing issues on water during our webinar “The ‘undertone’ of investing in water”, which can be viewed on demand here.

For investment managers, engagement is one way to influence and public interest can help determine the engagement priorities.

But it is at the political and regulatory level that the greatest change is likely to be delivered. Regulation is not currently being enforced rigorously enough on the UK water companies. We think a tightening of the regulation, and importantly, better enforcement would likely underpin progress along with providing opportunities for investors.

Should water providers be mandated to upgrade their infrastructure and manage water in a more efficient and responsible way, or face fines, other companies that supply the equipment for this will be big beneficiaries.

Signs of encouragement

The three listed UK water companies have recently released their business plans for the next regulatory period where they have announced a substantial step-up in investments. The regulator is likely to provide an update on these plans in 2024. Whilst the water sector has come under much criticism, it is pleasing to see that the water companies are now being proactive and investing record amounts. Asset growth for the sector is expected to be close to 30% over the period, compared to 6-7% over the current period.

Thames Water fell into problems due to rising inflation and higher payments on its ever-growing debt pile. Their CEO abruptly left after two years in the job, where she was aiming to improve the environmental performance of the company from under investment. This highlights why leadership, and a long-term mindset is so important. These problems are a result of underinvestment due to a focus on the short-term. Companies need to be investing for the long-term, both for environmental and financial outperformance, or their short-termism will catch up with them and performance will deteriorate. The listed peers are at least showing signs of moving in the right direction, albeit it remains unclear whether this will be enough to return our water systems to their former glory.

Opportunities

The water-related opportunity extends far beyond bringing water companies into the 21st century. Pretty much every company and industry need water, and some need it in far greater quantities. As we see demand for water, and water solutions, increase, there are different ways for investors to potentially benefit.

Water technology businesses such as the North American company Xylem provide innovative solutions across the end-to-end water cycle. Water utility companies that are recognised as sustainability leaders in their sector are also worth consideration, such as American Water Works which has invested significantly in its infrastructure to maximise its water efficiency. In addition to established companies, new companies are also emerging such as Veralto which was until recently part of the Danaher Group. We like the company’s focus on innovating to improve water quality and its use of IT infrastructure and data to maximise water efficiencies.

In summary, significant progress is required if we are to achieve UN Sustainable Development Goal Six – “clean water and sanitation for all”. The global water supply crisis poses significant challenges, exacerbated by climate change, population growth and urbanisation trends. We think the scale of the challenge presents attractive opportunities for investment and we will continue to monitor this thematic area closely.

Written by Caroline Langley, Deputy Manager of the Climate Assets Funds, co-authored by Tom Gilbey, Global Equity Research Analyst at Quilter Cheviot covering Commercial and Professional Services, Transport and Utilities. These funds are managed with a thematic approach using five sustainability themes, of which one is Water.

Climate Assets Funds

The Climate Asset Funds invests in companies that make a positive contribution to the world, with a strong underpinning of ethical values.