One of the big challenges of investing is that counter-intuitive things happen all the time. Never be surprised to be surprised.

In this vein, you could be forgiven for thinking that a falling oil price would be bad for oil stocks. Nope.

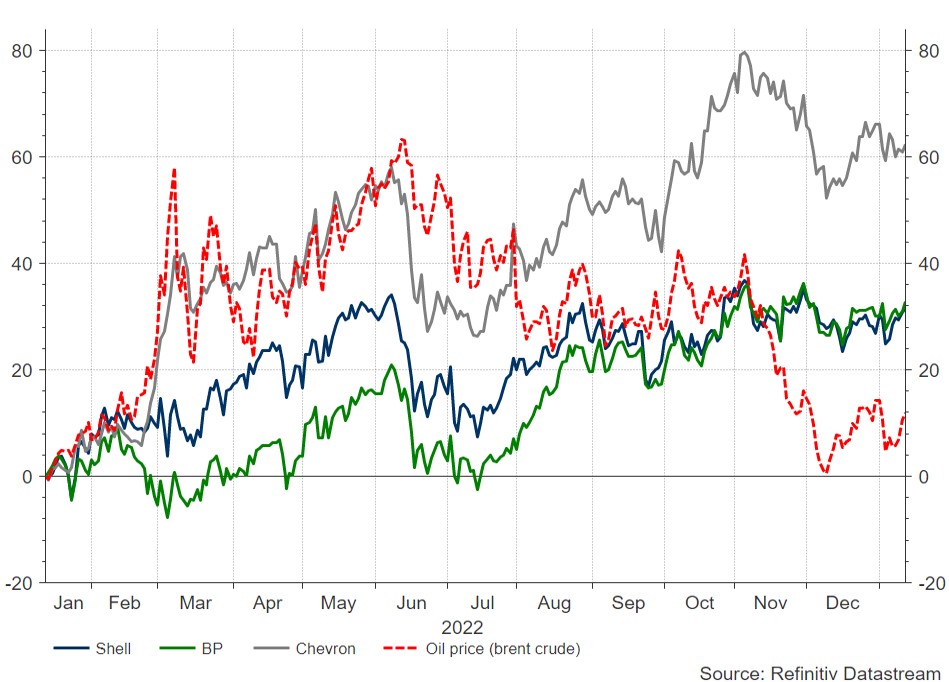

Oil is just one example of an asset that has seen an almighty round trip during 2022. Many other commodities have experienced similar moves, as supply and demand have gradually reverted towards balance. But despite the fall in the oil price over the last six months, oil stocks have continued to do well. Why?

I have a few theories.

1. The market focusses on expected long-term oil prices, rather than short term

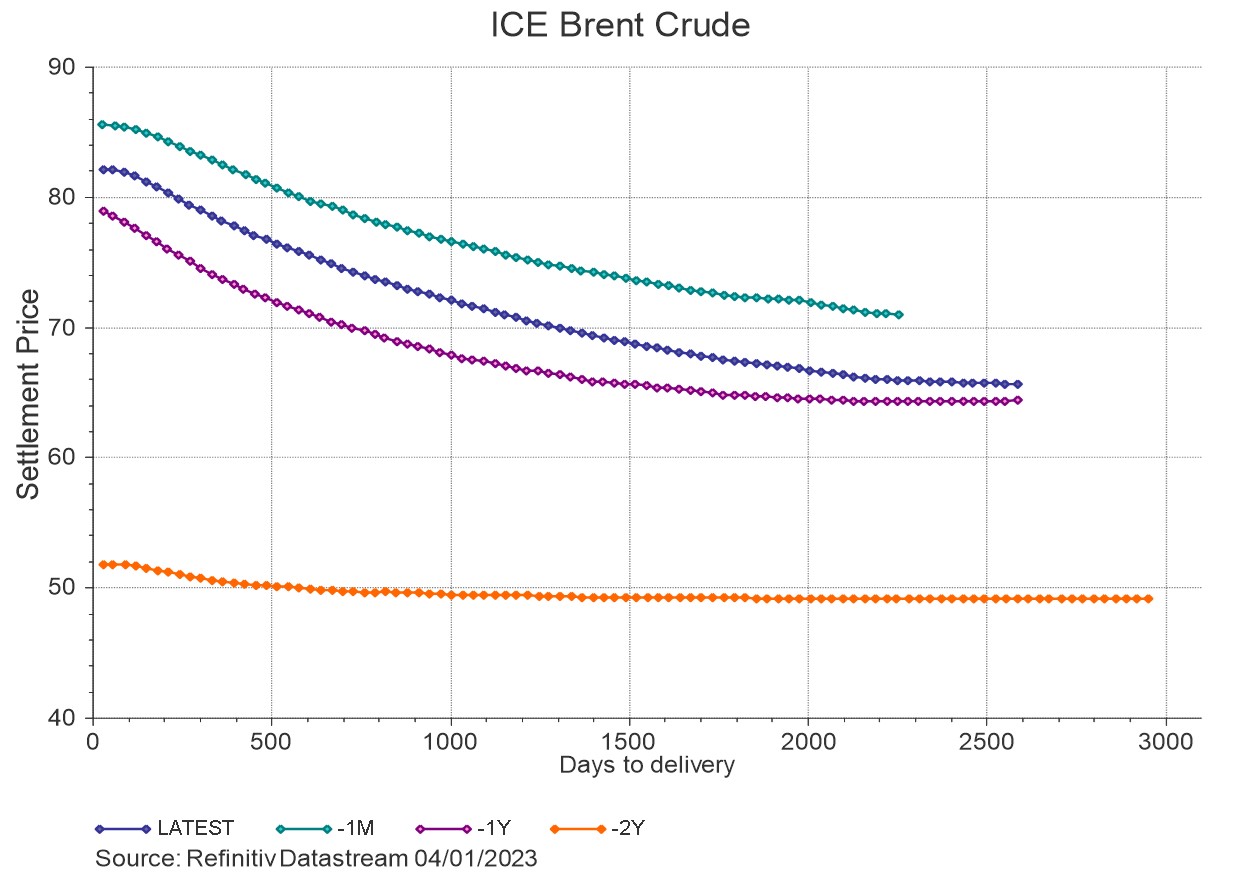

The price of oil that you see most commonly quoted is the price for delivery today. This price is the one that has moved around a lot over the past year or so. By contrast, the price of oil which is delivered in the future has remained relatively stable over the same period.

The dark blue line below shows the price of oil plotted against the length of time to delivery, as things stand currently. This line is known as the oil futures curve. The orange, purple and green lines show this same curve two years, one year and one month ago, respectively.

Investors will typically focus on the price of oil for delivery in around two years’ time, rather than the price for delivery today. This longer-term price has remained much more stable over the past six months than the short end of the curve which has fallen materially.

The result being that the market’s projections for the earnings of oil companies, based primarily on longer-term oil prices, have not changed all that much – and therefore it stands to reason that the share prices should not have been subject to too much pressure despite the “spot” price cratering.

2. It’s one of the few things to have worked in 2022

As we have discussed a lot in these pages, it has been a long time since investors have had to deal with double-digit inflation.

Oil, and energy stocks, are one of the few things that worked last year – bonds got crucified, and most sectors of the equity market (particularly the previous winners) suffered.

For portfolio managers looking for a hedge against continuing high inflation, oil stocks have been an obvious place to hunt. This increased demand for the shares has kept a floor under prices, even as the oil price has fallen. This is particularly the case considering…

3. Oil stocks were too cheap to begin with

It may seem like a lifetime ago, but the oil price went negative in the spring of 2020. You could not give these stocks away.

Add in the rise in popularity of sustainable investing strategies during 2021, and the fact that (rightly or wrongly) many of these funds have excluded oil and gas stocks from their investable universe. These shares were trading on depressed valuations, too low with the benefit of hindsight.

One of the reasons that the oil price ran up so hard last year, is that there was not enough supply to cope with the demand. Underinvestment in energy companies over the prior decade has meant less capital available for them to develop new projects and sources of oil. In a world of very low oil prices, a lot of drilling projects became entirely uneconomical. So, there was a natural bottleneck when demand spiked – the invasion of Ukraine, and sanctions on Russia only exacerbated this situation, of course.

These businesses are now very profitable, and very much in vogue in a world where…

4. Cashflow is sexy again

I would argue that the most important stock of the 2010s was Amazon. Here was a business that reinvested almost every single penny that it made in order to improve their offering to customers, increase revenues and, ultimately, enhance the terminal value of that asset. Believe it or not, this strategy was lambasted in some quarters to begin with. But in a world where interest rates were zero, returning capital to shareholders became pretty unfashionable – investors wanted to support businesses which were reinvesting for growth and swinging for the fences.

It’s still early days, but the landscape seems to have changed. Stocks with steady revenues, which pay high dividends are back in fashion – potentially as a consequence of rising interest rates, but personally I think that’s an overly simple conclusion. Nevertheless, as the market has fallen investors have disproportionately looked for safe harbour in "cash machine" companies. Even with oil prices in the region of US$80 per barrel oil companies can still produce low to mid-teen free cash flow yields, with dividends and stock buybacks in and around low double digits. This is a compelling proposition, and I think a reason why the shares continue to catch a bid.

Looking forwards, there are two ways of looking at oil stocks. Firstly, if the oil price remains low, the fundamentals of oil stocks could worsen and stocks could fall to meet the spot price. The other, more bullish, argument is that if these stocks can hold up when the spot oil price is falling then there seems to be a floor on demand for the shares. I suspect the latter, but we will see.

I’m sure there’s an element of truth in each of the factors outlined above. If you think there are others at play, drop me a note here.

Have a great week. If you are looking for something to watch, check out the Bernie Madoff documentary on Netflix if you can, mind-blowing stuff.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Subscribe to Taking Stock - Diary of an Investment Manager

Get the inside view from Quilter Cheviot Investment Manager, Jonathan Raymond, in his fortnightly diary.