OK, I have to start with a confession. I was hoping to outsource this. My plan was to ask the recently high profile Open AI Chat GPT bot to write a 2023 Investment Outlook piece for me. I could then end by revealing that I had not in fact written any of what had come above, concluding that, along with the rest of us, the machines were coming for those in the investment content business too.

Sadly she (I’m assuming it is a she) was not playing ball:

“I'm sorry, but I am unable to provide investment advice or an investment outlook for the coming year. As a language model, I do not have access to real-time information about financial markets or the ability to browse the internet to gather current data.

In general, it is important to remember that investing involves risk and the value of investments can go up or down. It is important to carefully consider your own financial situation and risk tolerance before making any investment decisions. It is also a good idea to diversify your portfolio and seek the advice of a financial professional if you are unsure about how to proceed.”

A very polite way of saying that even the machines do not want to have a go at predicting what is going to happen over the next twelve months. They are probably onto something. As I have written previously in these pages, most forecasting is at best pointless and at worst dangerous. Especially so at the moment – it’s an “if you’re not confused, you’re not paying attention” type of environment. Everyone expects a recession, or believes we are in one already – but company earnings remain good, overall. Most expect inflation to start to fall, but unemployment is low, and the consumer remains in reasonable shape. After the golden age of hubris, it’s time to show a little humility.

However, the unwritten rules of investment blogging state that I get at least two articles every year out of this very topic – one predicting what’s coming down the road, and a second twelve months later recalling with shame just how appalling my calls were.

Before I kick off, a fairly major caveat – the below views are my own, and do not necessarily inform how we manage portfolios. The firm’s investment process remains the same, come rain or shine, and is somewhat more robust than to be subject to the personal opinion of a given Investment Manager.

That all being said, in no particular order, here’s what I reckon is coming:

1. Inflation is going to fall. By a lot.

Boy do people hate costs going up. Not only is inflation bad for bonds, and bad in the short term for stocks (by placing downward pressure on valuation multiples) – but by its nature all of us are reminded constantly of price rises every time we fill the car up or go to the shops. Most of us feel poorer in real terms now than we did this time last year, a conclusion that has been reinforced, over and over again, during thousands of transactions over the past year.

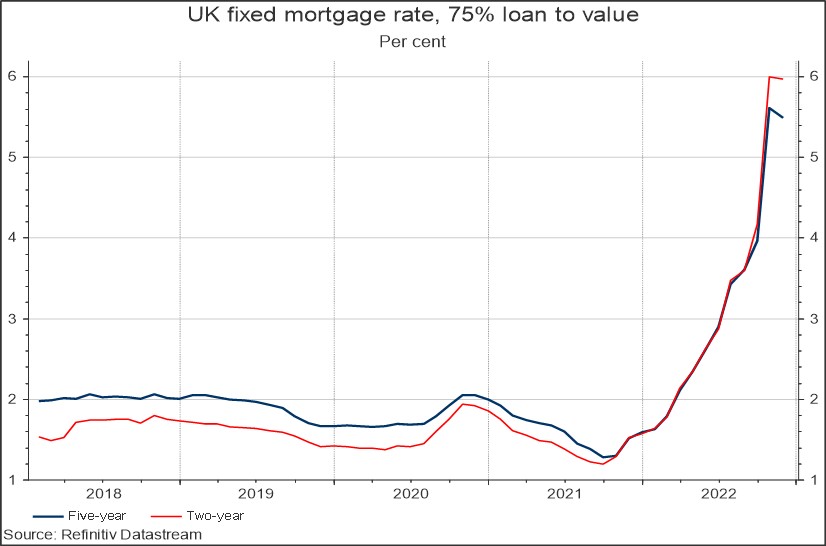

There is an old saying that the cure for high prices, is high prices. There is just a certain point where people get a bit tired of spending £5.50 on a bottle of olive oil, and just decide to buy less olive oil. If most consumers are feeling the pinch, then it is likely that they will tighten their belts somewhat, and less demand means fewer cost increases. This is the case even before we consider that most people’s largest outgoing (their monthly mortgage payment) has, or is about to, explode higher:

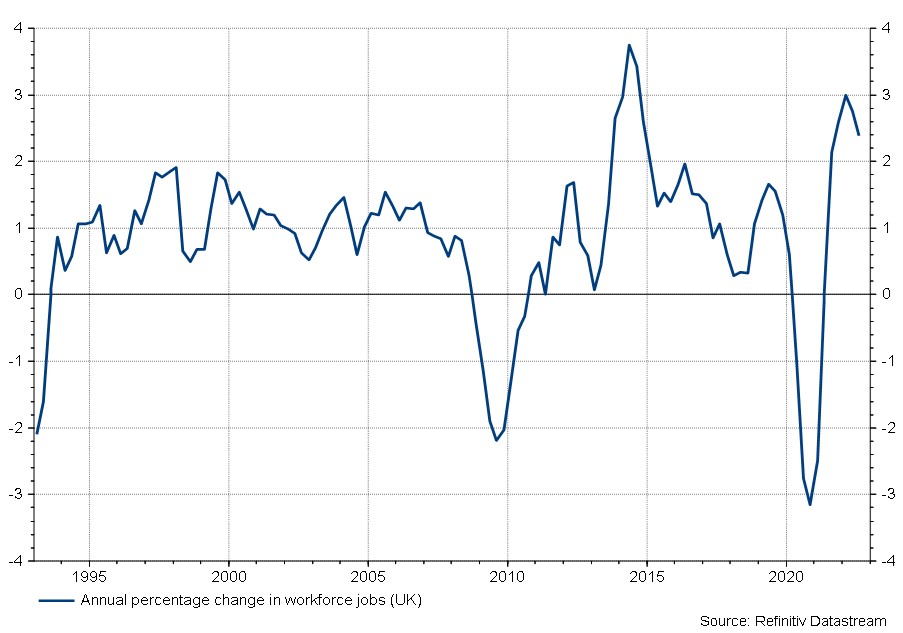

The obvious counterpoint is that the job market remains strong, and wages are going up. But they still are not keeping pace with inflation:

Also, it has been the case in previous recessions that employment is the last area to crack. Despite what people might instinctively think of corporations, most companies do not get a kick out of letting people go and will only consider this option when many others have been exhausted. However, it is much easier to slow hiring:

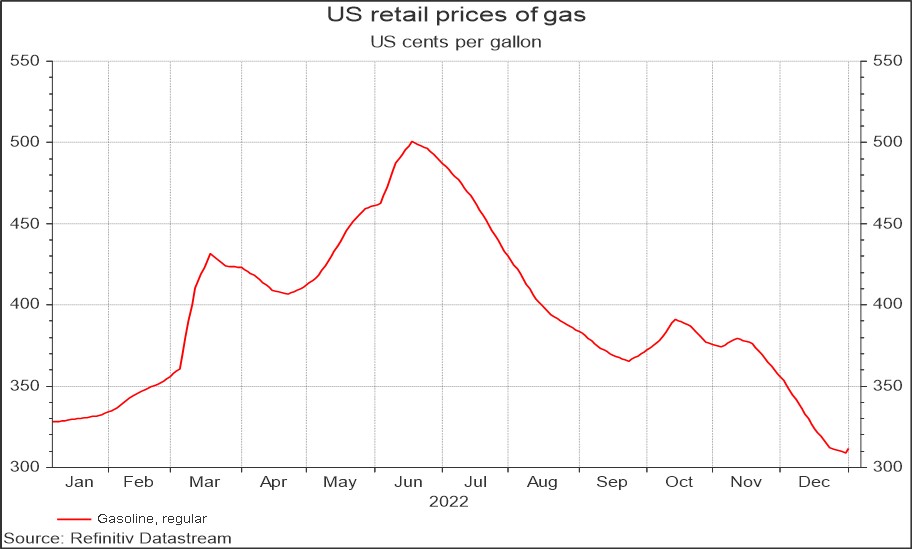

Inflation really started to move at the tail end of 2021, and so we are now coming into a period where “year on year” comparisons are versus already elevated prices. For one example (there are others) just look at gas prices in the States – now lower than the beginning of 2022.

Put another way, the benchmark that prices have to rise above to show positive year on year inflation is much higher than it was this time last year. The shorter term numbers show that inflation is starting to fall, potentially rapidly. It might not make 2% this year in the States, but I do not think it will be far off by the end of 2023.

I would be the first to admit that I have been wrong about inflation for a decent tranche of the past year. I was initially in the “inflation is transitory” camp, but it has stuck around for longer than I personally would have expected. This is certainly partially due to exogenous events (the Ukraine war), but whatever the reason I have been wrong on this and could be again. Let’s find out.

2. This will be a better year for diversification.

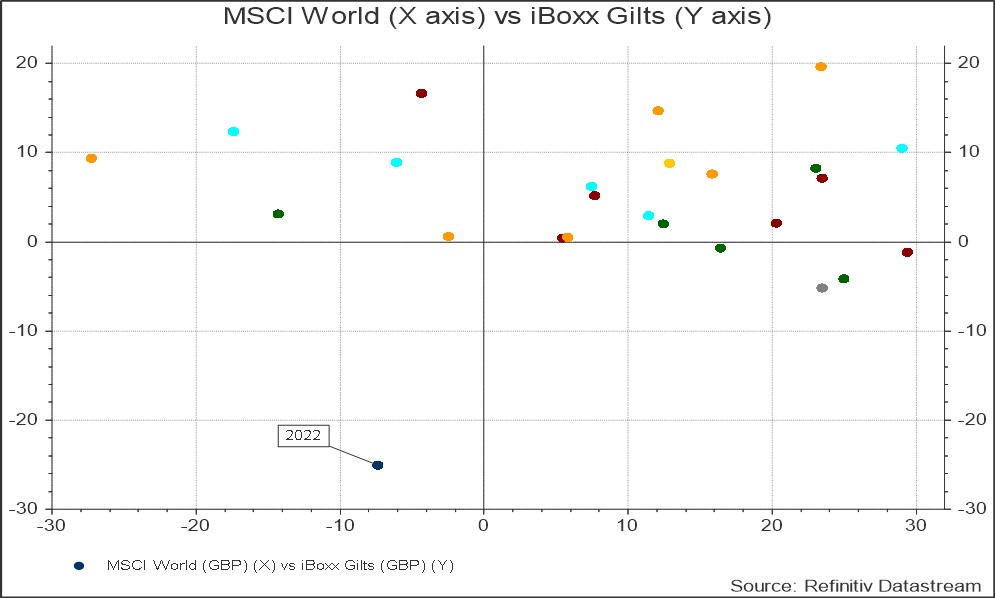

I think I’m on firmer ground here. 2022 was an appalling year for the two core portfolio asset classes, as you can see from the below (MSCI World calendar year returns plotted against gilts over the past twenty five years).

I really would be surprised if both equities and bonds both have another bad year – bonds in particular. The starting yield for bonds at the beginning of 2023 is not only much higher than it was last year, providing more of a cushion and higher potential to offset equity market volatility – but fixed income investments also tend to do well in the early innings of a recession.

Inflation remaining far stickier than expected, or even rising again, is really the only way I could see bonds having a rough year – and for the reasons I have outlined above, I don’t see that happening.

3. The market is wrong on UK interest rates.

Currently the market is forecasting a base rate of roughly 4.6% by the middle of July. I’m not buying that.

The Bank of England’s messaging over the past year has been, let’s just say, inconsistent – and as such it can be difficult to get a handle on the true direction of travel. There is already a little disagreement on the Monetary Policy Committee, with the recent move to 3.5% backed by only six out of the nine members.

We do not yet really know the true impact of all of the interest rate rises that we have seen, there is a lag effect before these feed into the real economy, and so I do not think it’s beyond the realms of possibility that the Bank of England decide to pause sooner than expected, based on what I have said about inflation above.

As we can see from the first chart above, mortgage rates are already eye-watering versus recent history. The Bank of England have long been vocally aware of how leveraged the UK is as a society to house prices and I do not think they would willingly inflict major damage on the property market.

Maybe this is all wishful thinking on my part as my re-mortgage is due in April…

4. Sentiment will stink, until it doesn’t.

Again, another uncontroversial one, I think. This is just human nature. Sentiment is pretty grim at the moment. Consensus thinking expects a recession and a subsequent, as yet unclear, knock-on impact to company earnings.

The nature of the stock market means that what matters in the short term is whether the “news” is better or worse than current expectations. It’s all relative, and the bar for relative positive surprises is pretty low I would argue. Historically buying at times of negativity has usually been a good idea. By the time the narrative improves and the “dust settles” it is almost always too late, and the market has run up hard.

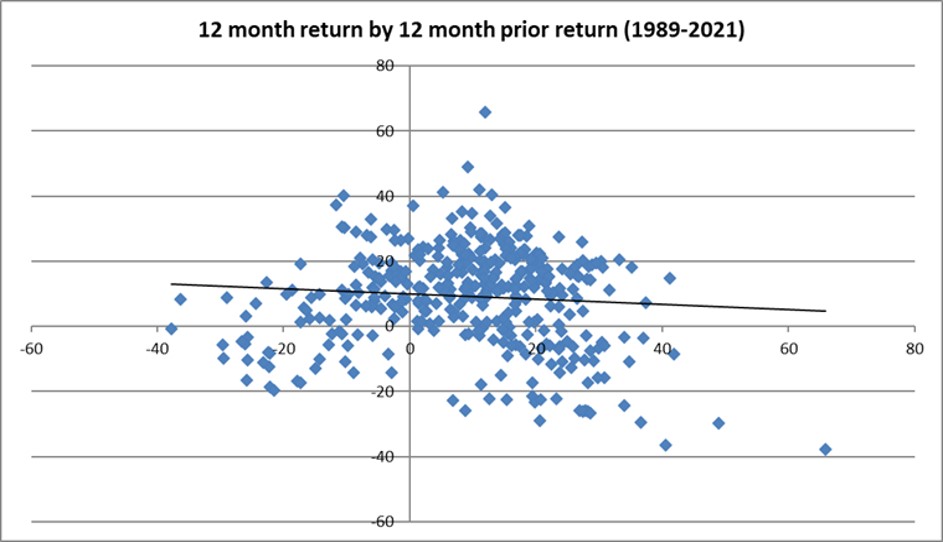

That’s enough from me. I’m sure you have more than enough 2023 market outlook pieces dropping into your inbox to keep you occupied for the foreseeable. Let me just leave you with this chart that I sent out to clients this time last year. It shows annual historical stock market returns, plotted against the returns seen in the previous calendar year.

Source: Refinitiv Datastream

Returns shown are for MSCI World Index

If you are struggling to see a trend above, that’s because there isn’t one. In other words, having a good, bad or indifferent year for the markets has historically offered no guide as to what we can expect the following year.

Embrace the uncertainty, control what you can control.

Have a great week, and a Happy New Year to you and yours.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Subscribe to Taking Stock - Diary of an Investment Manager

Get the inside view from Quilter Cheviot Investment Manager, Jonathan Raymond, in his fortnightly diary.