Technological advancements have done much to improve the world of investing, with digital services such as client portals and mobile apps providing investors greater accessibility for monitoring their portfolios - but they can also lead to behaviour which could cause less obvious investment outcomes, and not always for the better.

To be clear, checking a portfolio will obviously have no impact in itself on returns, but if you check it too often your perception of performance may be different to reality, which could lead to poor investment decisions.

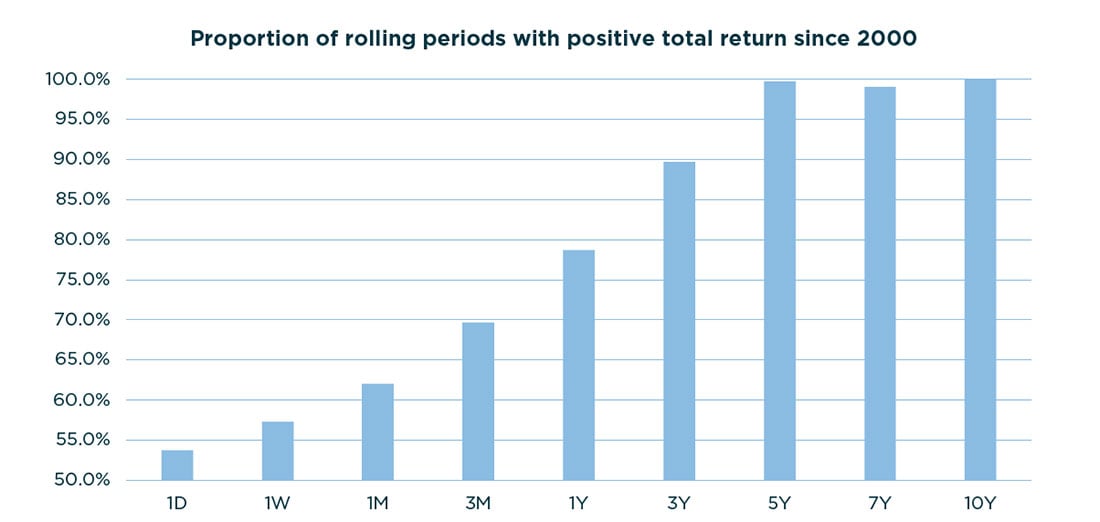

This is because, on any given day, the market may be up or down (53.7% probability of positive return for the MSCI All Country World Index total return over the past 25 years, as you can see from the chart). But over a 5-year time frame you have had a 100% probability of the markets being up.

Source: LSEG Datastream, Quilter Cheviot Limited. 31/07/2025.

These figures refer to the past and past performance is not a reliable indicator of future results.