Volatility is the rate at which the price of a financial asset (e.g. a stock) increases or decreases over a particular period. When there is higher stock price volatility, this can often mean higher risk.

Selecting your investment strategy

Once we have established your objectives, we will determine the investment fund or strategy that is most closely aligned to your risk profile ensuring that you have a risk and reward balance that works for you.

Our recommended models typically include a mix of equities, fixed interest, commercial property, and alternative investments, along with a portion of cash designed to meet different objectives and risk profiles.

Our recommended models typically include a mix of equities, fixed interest, commercial property, and alternative investments, along with a portion of cash designed to meet different objectives and risk profiles.

The up and down movement of the markets is one measure of risk. Investors tend to worry most about volatility when shares are falling. However, losses or gains are only realised when you sell your holdings. Investments are for the long-term, so short-term volatility is not necessarily a reason to make drastic changes to your investment portfolio

This is where experts like Quilter Cheviot can help to maximise your chance of success.

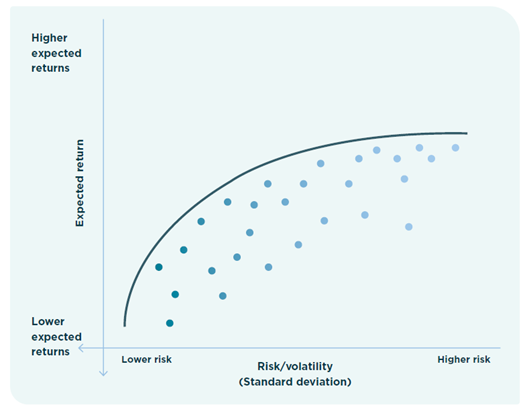

The line represents the efficient frontier: the optimal combination of volatility and return. Each dot represents a possible portfolio. The closer a dot sits in relation to the efficient frontier, the more return that portfolio is generating for its level of volatility. The frontier represents the set of portfolios that generate the highest possible return for the risk they are taking.