The UK stock market recently hit a new all-time high, with the blue-chip index rising into unchartered territory thanks to attractive valuations underpinned by strong earnings growth, a relatively low threat from US trade tariffs and a favourable sectoral weighting for the current environment.

Stock markets

While other stock markets, such as the US, have enjoyed large returns in recent years, UK stocks have lagged.

However, recent evidence suggests that the tide could be turning and that increased uncertainty regarding US economic policy has left investors questioning whether they are willing to pay the premium valuations associated with American stocks.

UK stocks outperform

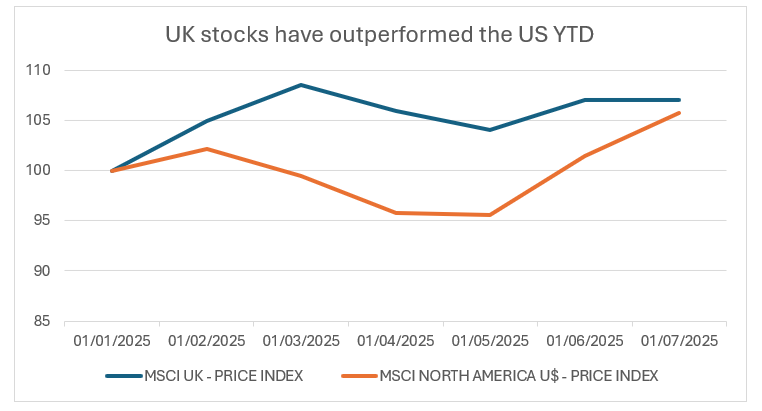

Sentiment is the largest driver of near-term returns for financial markets, and there has been a clear shift in favour of the UK thus far in 2025.

Source: LSEG Datastream, Quilter Cheviot Limited 01/07/2025. These figures refer to the past and past performance is not a reliable indicator of future results.

However, in the long run corporate earnings and valuations play a far bigger role in returns.

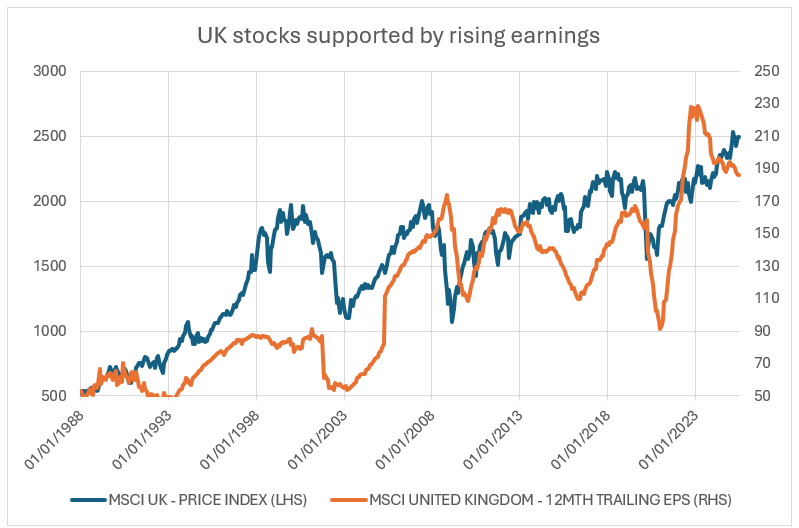

Fundamentals matter long term

Source: LSEG Datastream, Quilter Cheviot Limited 01/07/2025. These figures refer to the past and past performance is not a reliable indicator of future results.

New all-time highs for stock markets can be seen as a sign of overexuberance but history has shown that when moves higher are supported by sound fundamentals then there is a far greater chance that more upside lies ahead. The chart above shows UK stocks (blue line) and earnings per share (orange line) dating back to the 1980s. The recent advance in the blue line to new highs has been supported by rising earnings, suggesting that there is a solid economic reason underpinning the gains, rather than simply improving sentiment.

There does appear to be a dip in earnings over the last year or so, but this is largely due to the lagging nature of the data. The 12-month trailing earnings per share looks at the past year. In the short term, price anticipates earnings and the continued rise in price suggests investors expect earnings to pick up. However, the main takeaway remains that in the long term the relationship that matters is that earnings drive price.

Contrast the current situation with that around the turn of the millennium, when the dotcom bubble caused stocks to

rally without an accompanying rise in earnings. This was based on the hope of future earnings from technology stocks that failed to transpire, leaving the price at an elevated level relative to earnings. Put another way, valuations were lofty and stretched.

Trade deal benefits

The UK acted swiftly to secure the first major trade deal with the US after Donald Trump announced punitive trade tariffs. While the agreement leaves Britain with less favourable terms than before the dramatic tariff increases were announced, the trading relationship is favourable compared to what a number of peers currently face. Furthermore, and perhaps most importantly, it represents an end to the heightened uncertainty that is providing a headwind for much of the globe.

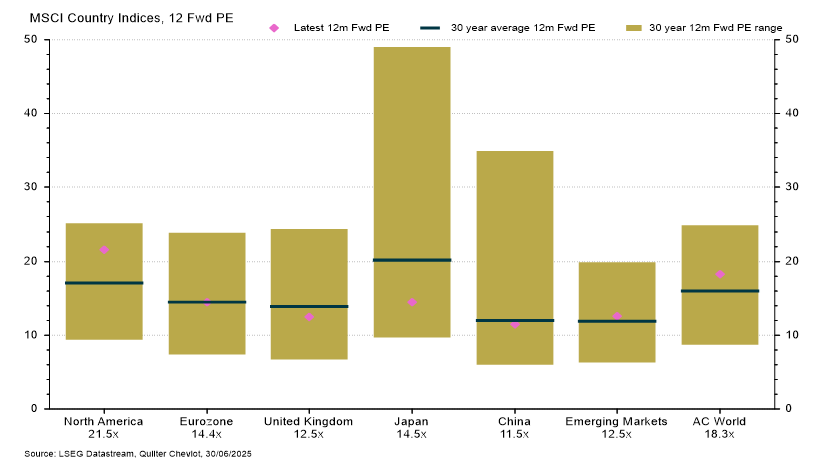

Valuations matter long term

Sentiment for UK stocks is still fairly modest, with valuations based on consensus forecasts for the next 12 months earnings at a lower level than the 30-year average. The UK trades on a 12.5X forward P/E compared to 21.5X for North America. There is some justification for a US premium — earnings for US large-cap tech stocks have been among the fastest growing in recent years — but investors are starting to question whether the premium is too large.

The composition of benchmarks plays an important role in performance, as we’ve seen with the stellar run in US stocks in recent years. However, recent developments have been in favour of the UK, with its mix of mining, telecoms, financial and utilities. Defence stocks have been some of the best performers so far this year, on pledges for a sizable increase in defence spending across Europe.

The UK index has a significant amount of international exposure and in recent years has been more sensitive to global developments than domestic. One way this can impact returns is through exposure to foreign currency earnings, with around 40% in US dollar terms, 30% in sterling and 20% in euros. In the first six months of 2025 sterling appreciated almost 10% against the US dollar, making the outperformance of UK equities over US all the more impressive.

Summary

Stock markets hitting new highs can cause investors to feel the urge to bank profits and take some money off the table, but we believe it is important to maintain a clear focus on the underlying fundamentals. New highs should in themselves be viewed as a positive development and history has shown that buying markets at all-time highs can be a rewarding strategy.

Corporate earnings can be viewed as being driven by revenue growth, costs and operating leverage. Broadly speaking, revenue growth is mainly linked to GDP and inflation while costs and operating leverage are a reflection of company performance. Therefore, if GDP and inflation are expected to be positive over time, then unless companies are performing badly and destroying value, earnings should increase and correspond to rising equity markets.

The rise in earnings alongside price has left valuations at modest levels and UK stocks arguably still look cheap compared to peers. Utilising the expertise of our in-house equity research team, we will continue to monitor developments closely but for the time being, we believe the rally in 2025 is justified and reflective of an improving fundamental backdrop.