Over a quarter of total capex spend (US$2.3bn) is currently going on AI infrastructure (US$600m) and while free cash flow was positive in the second quarter, for the first half it remained in negative territory due to the major inventory build being only partially reversed and accounts payable drawn down.

Given these challenges we remain cautious and although the stock performed fairly well in the first six months of the year on bullish AI sentiment, the year-to-date return is back in the red after the latest results. We believe the underlying pressure on Tesla’s auto business cannot be ignored, which is particularly concerning for the company’s growth prospects. Therefore, we favour remaining on the sidelines for now.

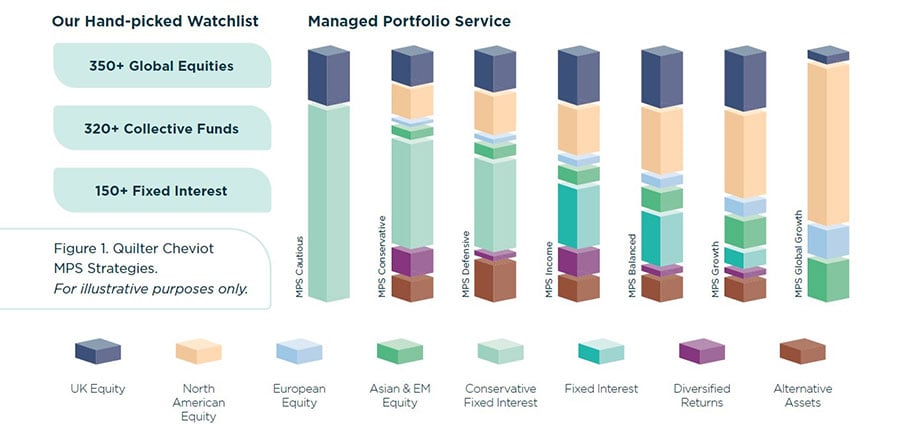

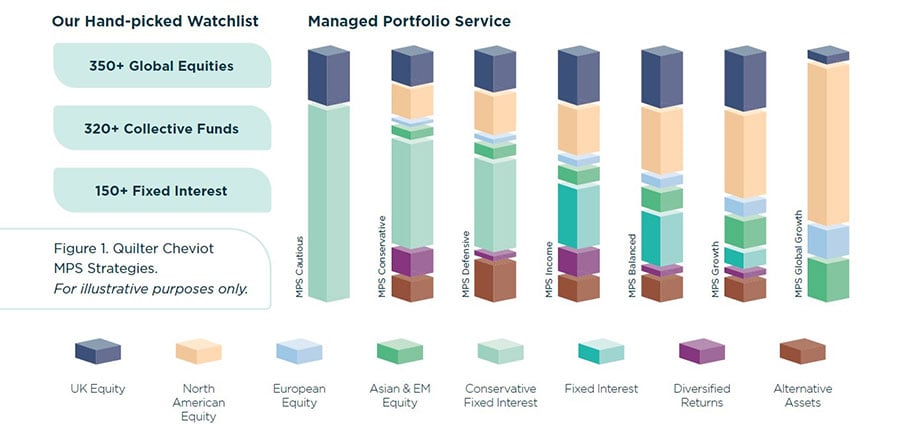

Our MPS active management

Access to active management is a key attraction of a model portfolio service (MPS), offering several potential advantages in terms of flexibility, returns and risk management. Tesla has not been a holding in our MPS strategies since 2022, despite being one of the largest components of US equity benchmarks and a member of the so-called “Magnificent Seven” tech stocks. The rationale for this is outlined above, with the decision to not include the stock taken by our portfolio managers after consultation with our in-house stock selection committee and Mamta Valechha, our equity analyst specifically covering the stock. This is not to say that we think Tesla is a poor company, we just believe that at present there are more attractive opportunities elsewhere and our “Building Blocks” structure allows us the flexibility to make these decisions precisely and swiftly.

About our “Building Blocks”:

- Our strategies are constructed solely using our ‘Building Blocks’ — eight purpose-built funds specifically designed for use within Quilter Cheviot’s MPS. This allows a far greater degree of active management without burdensome costs, as we can select individual securities and fine tune holdings to our desired exposure.

- Quilter Cheviot is both the MPS model manager and underlying manager to these funds. This means changes to the underlying holdings within each Building Block can be implemented at the fund level in a dynamic manner. Changes are immediately reflected across all holders, preventing the need for a portfolio rebalance and all the accompanying operational complexity created by a ‘traditional’ MPS. Quilter Cheviot does not charge a management fee for the running of the Building Block funds, removing any conflict of interest - the funds are solely to enhance the investment proposition.

- The Building Blocks reflect our highest conviction investment views and they go beyond open-ended funds. They can invest in direct equities, direct bond holdings, exchange-traded commodities (ETCs), and closed-ended or exchange-traded funds (ETFs), irrespective of the wrapper in which a client’s portfolio is held.

Passive funds are only considered judiciously, for instance as a temporary home for flows or a targeted exposure to a specific index, instead of being relied on as a tool to lower costs. This avoids the pitfall of diluting active exposures and alpha-generating potential.

See Figure 1 below for an illustration of how these funds are used across our MPS strategies

Figure 1. Quilter Cheviot MPS Strategies.

For illustrative purposes only.