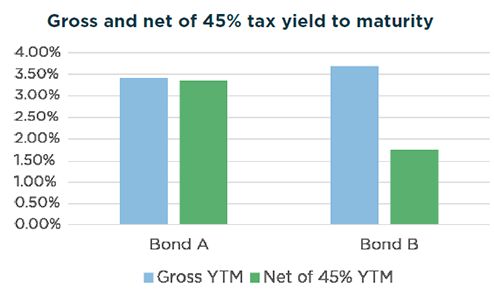

At Quilter Cheviot we have launched a model within our short-term fixed income strategy that invests based on the different tax treatment of gilts. The model is especially attractive for higher rate or additional rate taxpayers. It is based on a number of short-term, low coupon gilts that mature within the next few years. On current prices this is an opportunity for investors to lock in an attractive yield, net of tax, if they hold the bonds until maturity.

Short-term bond strategy

* Gross yield to maturity calculations are annual and accurate as of 21 January 2026. Forecasts and past performance are not a reliable indicator of future performance.