‘What am I going to do with all this free time?', 'How much can I afford to spend each year?’, ‘How do pensions work?’ These are the challenging questions for many approaching retirement. And for business owners, the situation is even more complex.

‘How will I move on from the business which has been my life’s work?’, ‘What will happen to the business and its employees once I’m gone?’, ‘Is there an identifiable successor within the business?’

Corporate finance specialists can give structure to these problems. They help you find buyers/lenders so you can smoothly exit your business, passing it on to successors. But there is one burning question which perhaps supersedes all: ‘How much can I sell the business for?’

Rationalise your position

Whether your valuation or ultimate sale price exceeds or falls short of expectations, there are likely to be emotional hurdles to overcome.

As a hard-won asset that you are looking to sell, your business is not just a monetary figure, it is a culmination of your life’s work. If you receive a valuation that falls short of what you think the business is worth, it may be difficult to not take personally.

Many factors determine a business’s value, most of which will change over time (production costs, buyers in the market, interest rates etc.). This variability can provide a reason to decline an offer and wait for more favourable conditions. However, turning down an offer now comes with the cost of waiting for another, with no guarantee that the next offer will be better, and may even be worse.

Of course, every situation is unique. But for those hovering between accepting or declining an offer, the following may be useful.

Beyond the sale

On the other side of a sale, you need to tackle the next big question: “What do you want to do with your retirement?”

During my career in financial advice, I have heard a plethora of retirement plans. From fixing an old Volkswagen Kombi and taking a couple of months touring it around the British coastline, to contributing to the costs of grandchildren’s school fees or spending a year in India.

But most often, clients have told me that their retirement plans are not fully developed. An unexpected element of my job involves establishing what it is that clients actually want from their lives beyond their careers.

Organise your objectives

Take the time to reflect and seek guidance as you refine your retirement plans. Remember, this is potentially decades of your future we're planning, so it deserves thoughtful consideration and care.

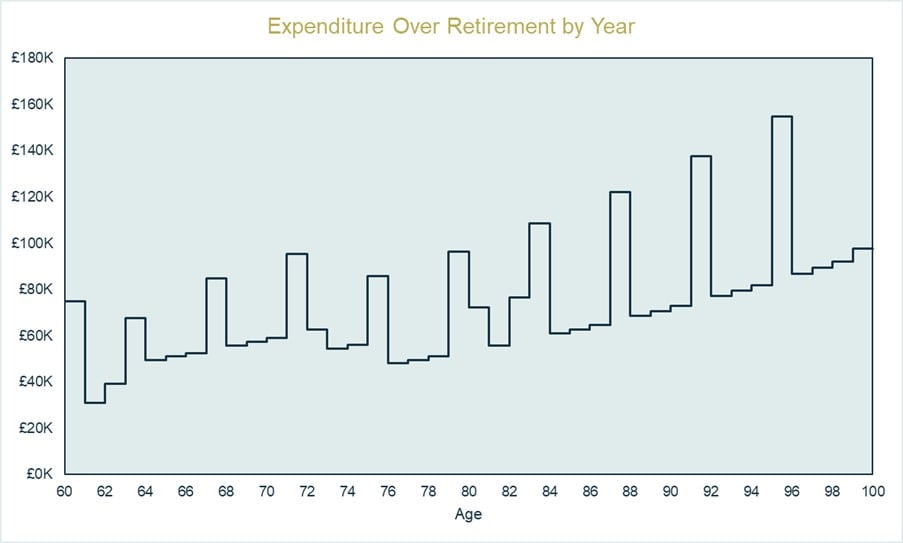

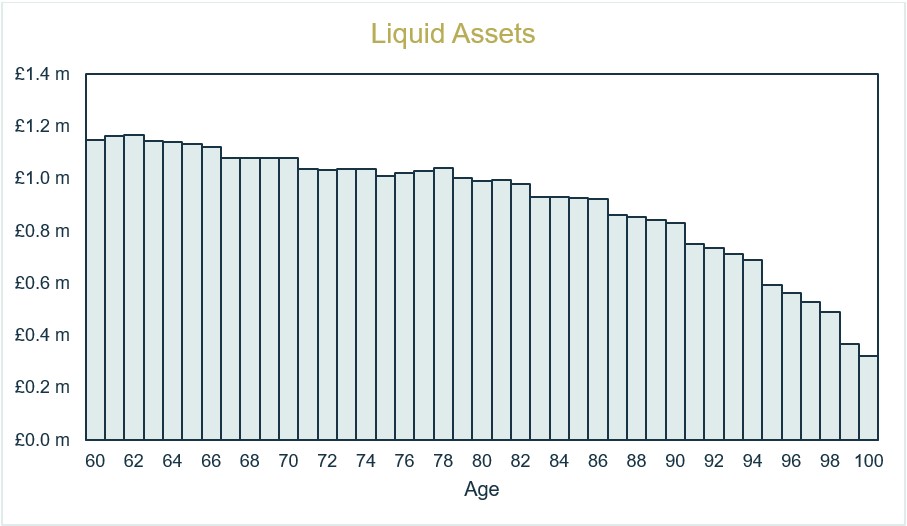

To develop a comprehensive plan, we work off these objectives to agree on their monetary values in today’s terms. These may look something like: