March has been the most tumultuous month for the banking sector since the height of the 2007-08 financial crisis with the collapse of Silicon Valley Bank and UBS swooping for an emergency takeover to prevent Credit Suisse befalling a similar fate.

Although recent headlines have led to panic and turmoil in financial markets, it is important to keep things in the correct perspective and thus far the issues appear to be specific to Silicon Valley Bank and Credit Suisse, rather than reflective of a systemic crisis due to widescale irresponsible lending, inadequate capital and opaque interdependencies like we had 15 years ago.

In the case of Silicon Valley Bank (SVB) its downfall can be traced back to the investment boom fuelled by easy money following the outbreak of the Covid-19 pandemic and is essentially a prime example of interest rate risk mismanagement. Compared to traditional banks SVB’s deposits were lumpy, greater in size and lower in number, often coming from corporate treasurers in the tech sector as opposed to retail savers. This meant the bank’s liabilities were flighty and when fledgling tech companies ran into difficulties, as many would have last year due to the changing macroeconomic environment, deposits were withdrawn.

With the economy so awash with money SVB received more deposits that it could lend out, taking in almost US$130bn in new deposits in 2020 and 2021. This led to much of the money being invested in long-term US government-backed bonds, seen as practically risk free and still offering a positive interest rate spread due to the deposits costing next to nothing. This changed dramatically after the Federal Reserve embarked on rapidly increasing interest rates following the return of the spectre of inflation early last year, leading to sharp moves lower in bond prices and substantial paper losses on SVB’s holdings.

Higher interest rates also damaged the bank’s depositors with the tech sector one of the hardest hit last year. The bank increased the rate it paid on deposits in an attempt to prevent the withdrawal of funds and to attract fresh deposits, but this was not enough to prevent money going out the door. Once word of SVBs troubles began to spread the well-known dynamics of a bank run began the vicious circle was set in motion.

A last-ditch attempt to save itself failed as SVB’s plan to raise US$2.25bn in a deal led by Goldman Sachs did not work. The planned amount, to be raised via common and convertible preferred stock, was only 25% larger than the US$1.8bn loss from selling much of its bond portfolio, meaning there was not that great margin for error. This proved critical given that the offering was not underwritten or already subscribed-for, a key reason why businesses hire global investment banks to verse these deals as they are able to tap into their vast network of potential investors.

Ultimately, the best they could muster was a US$500m commitment from General Athletic that was neither irrevocable nor unconditional and came without a fixed purchase price. When the deal was launched and came up well short of the required amount, SVB’s fate was sealed. Shares of the bank tumbled 60% the following day and a day later, Friday 10th March, the stock was halted and never reopened, with the collapse announced over the weekend.

It's a similar story, albeit on a smaller scale for Signature Bank, the failed cryptocurrency-focused lender. The Federal Deposit Insurance Corporation (FDIC) stepped in to support both SVB and Signature Bank in the wake of their failures to guarantee deposits and reassure customers that their money is safe. The US Treasury has also lent some support, although its messaging has been far from clear with Janet Yellen, Treasury Secretary first seeming to hint that all US deposits would be covered before walking back and playing down a blanket deposit guarantee at a Senate hearing.

US regional banks play a key role in commercial real estate lending and the recent issues in the sector, coupled with the expected increase in regulation, will likely mean higher costs of capital going forward, which, if it occurs, could well have knock-on effects to the real estate sector.

In the case of Credit Suisse its problems can be traced back further, as shown by the 99% decline in its share price from the 2007 peak to the Sfr0.76 (Swiss francs) level which UBS have agreed to pay for the acquisition in their stock. Though these troubles have intensified of late with several observers of the belief that had UBS, or another bank, not stepped into the Swiss government-brokered deal, then Credit Suisse would have required a full-scale bailout. The fact the agreed upon price was 60% lower than the level the stock closed at the trading day before the deal was confirmed speaks volumes about Credit Suisse’s financial health.

The business practices of Credit Suisse have less than scrupulous for many years, with a series of scandals since the 2007-08 financial crisis culminating in its handling of the Greensill Capital and Archegos crises in recent years. These have resulted in billions of dollars of losses and caused lasting damage to its risk management reputation. Last year the bank reported a US$7.9bn loss, effectively wiping out a decade’s worth of earnings. In contrast many banks posted sizable profits for 2022, with UBS for instance declaring earnings of US$7.6bn.

Chart one: The performance of UBS and Credit Suisse shares have diverged sharply in recent years

The common factor across the troubles at both Credit Suisse and SVB was that which is typical of many bank failures – an accelerating outflow of deposits, due to a loss of confidence. Technological advancements in recent years, such as digital banking and social media both becoming ubiquitous, perhaps exacerbated the situation for the ailing banks, serving to accelerate the process.

Rising cost of capital

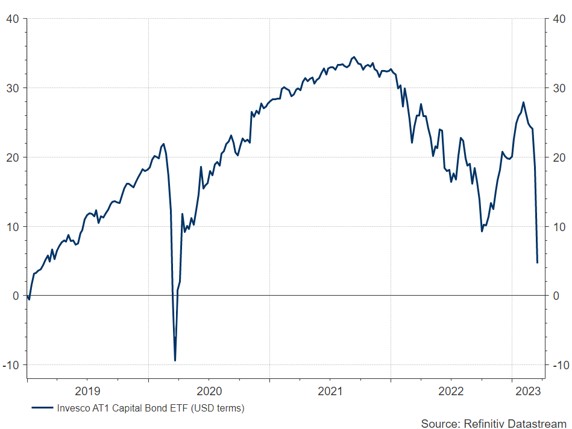

Although the preferred solution of a private takeover was found, there is still a risk to the public purse with the Swiss National Bank (SNB) providing a Sfr100bn liquidity line and a loss guarantee of up to Sfr9bn – this guarantee only comes into effect after the first Sfr5bn of losses has been taken by UBS. However, the outcome has caused some ructions in bond markets after US$17bn worth of Credit Suisse’s riskiest bonds, known as additional tier one (AT1), were declared worthless.

Conditions of these AT1 bonds state that they would either be written down or converted to equity once a certain trigger is hit and FINMA, the Swiss regulator, decided on the former, ultimately rendering them worth nothing. A legal battle will ensue as some AT1 bondholders believed their holdings would only face losses once equity capital was wiped out, following the traditional hierarchy whereby debt claims supersede those of equity.

While the outcome of the lawsuit will take some time to play out, the immediate reaction in the markets has seen AT1 holdings of other banks sold aggressively, with valuations dropping significantly on fears that these bonds would also become valued at zero should another bank find itself in the same predicament at Credit Suisse. Although equity holders in Credit Suisse will have taken a substantial loss, the fact they received some return (the total value of the deal is US$3.25bn) has irked AT1 investors.

Chart two: The market value of AT1 bonds has dropped sharply since the Credit Suisse acquisition

AT1 bonds, also known as contingent convertible (CoCo) bonds were introduced after the 2007-8 financial crisis and are typically written down when a 7% common equity tier one (CET1) threshold is breached. This is where the cause of the controversy lies as Credit Suisse’s CET1 ratio was substantially higher than this at 14.1%, but FINMA, used the non-viability clause to write down the bonds. The European Central Bank has muddied the picture by stating its view that AT1 bonds would only face losses after the full write down of equity.

Still cheap?

We had been positive on banks in general due to the move away from the zero-interest rate environment, with higher interest rates typically boosting margins as banks pass on more of the increase to borrowers than savers. However, we had not contended with material bank failures, even if SVB was due to its idiosyncratic features, and an emergency rescue of a global, systematically important, bank like Credit Suisse.

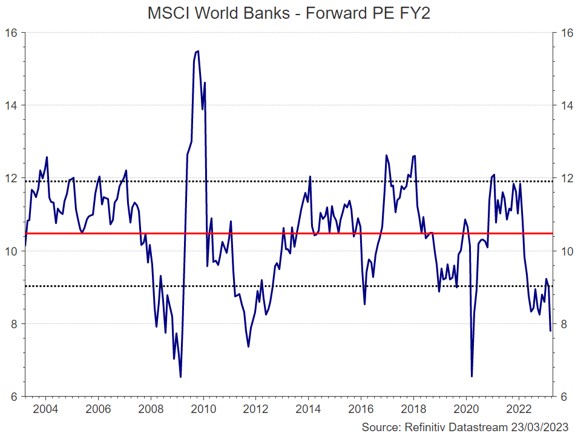

Valuations in the sector remain highly discounted compared to historic norms and it appears that there is a fair amount of bad news already in the price for many banks. The European banks sector trades at 0.8x tangible book value, offering returns on tangible equity of 12%-13% and implying a cost of equity of 15%-16%.

The price/earnings (P/E) ratio of global banks is around 6x, significantly below its long-term average of just over 10x and not far above the level it fell to during the 2007-08 banking crisis. These stocks also look cheap on a relative basis when comparing (P/E) levels with other sectors. Banks currently trade at roughly 50% of the broader market, on this metric.

Chart three: Bank valuations have fallen well below their long-term average and are currently not far from their lowest level in 20 years

Several of the prevailing headwinds for banks during the last decade have recently eased, with a number of them turning into tailwinds. After a long period of falling or near-zero interest rates, there has been considerable increases in the last 12 months, providing a catalyst for margin expansion. Constraints on capital and funding have largely been replaced by surpluses and besides changes on the US regional level, it appears that the prospects of further, more stringent, regulation is minimal. Sizable fines and, in the case of UK banks, PPI payments ate into profits during much of the 2010s but in recent years a greater proportion of profits have been returned to shareholders, via dividends and share buybacks.

As we have seen several times before* trouble in the banking sector can not only act as a symptom of an economic slowdown but also serve as a catalyst for one. While SVB was the second largest banking collapse in US history and Credit Suisse of global systemic importance, the contributory issues appear to be specific to these banks and not troubles that can be easily extrapolated to the wider banking system. In the case of Credit Suisse, the fact that a market-based solution could be found is also a positive and suggests a reduced need for governmental support in the sector compared to the 2007-08 financial crisis.

For UK banks, such as NatWest and Lloyds Bank, there are several important differences that decrease the chances of a recurrence occurring. Firstly, the investment of deposits is prohibited from taking the same kind of interest rate risk as SVB and, even if they were put to work in this manner, unrealised losses would be reflected immediately in the capital base. In other words, the accounting treatment is far more transparent and the regulatory environment more robust. Also, deposit bases are more diversified, with lower customer concentration meaning they are less lumpy. At the end of 2022, only 2.7% of SVB's deposits and 6.2% of Signature Bank's deposits were lower than US $250,0001, the threshold for FDIC protection. At the regional level in the US regulation will likely be heightened in the area as a result of SVB’s collapse, but large US banks and European peers are unlikely to face additional regulatory requirements given the already significant measures in place.

Dividends and buybacks set to continue

Capital return is a key part of the positive case for banks, and we expect that to continue. It seems unlikely that we will see a return to regulators preventing banks from conducting share buybacks and paying out dividends in Europe, as we saw during the height of the Covid-19 pandemic.

Sure, the impact of rising interest rates has clearly played a pivotal role in both SVB’s and Credit Suisse’s decline, but this is more due to clearly exposing poorly run businesses that could maybe have continued trudging along in an easy money era. Higher interest rates are, everything else equal, a good thing for banks as it increases their interest rate margins. This has been seen across most sets of bank results in the past 12 months with profits rising significantly.

In the US, regional bank lending has played a central role in funding small- and medium-sized enterprises (SMEs) in recent years and SVB’s collapse will likely mean a restriction on credit and slowdown in economic activity. On the face of this appears to be not good news for banks due to their high level of sensitivity to the economic cycle, but concerns around slowing activity could well lead to central banks changing tack.

Rapid interest rate increases have seen the Fed funds rate aggressively increased from 0.25% to 5.00% in little over a year while the Bank of England has lifted its base rate from 0.25% to 4.25% with 11 consecutive increases at policy meetings. However, recent troubles in the banking sector could well dissuade rate-setters from continuing to hike much further in a bid to curb inflation.

The situation is clearly very fluid and subject to a high degree of uncertainty, but we remain of the opinion that markets are already pricing-in a large amount of bad news for banks and the system, as a whole, appears to be on a far firmer footing than during the 2007-08 crisis. Like there is a tendency for generals to fight the last war, it is not uncommon for market fears to relate to the last crisis** even though it is extremely rare that occurs in the next one. In our view, the banking sector is not bulletproof and will face headwinds should economic activity slow down. However, for most banks the high current level of funding and degree of overcapitalisation, along with the expected ongoing return of capital to investors via dividends and share buybacks, as well as cheap valuations, on a historical and relative basis, means there is still a sound investment case to be made for the sector.

1Chart: SVIB and Signature Were Highly exposed to Risk of a Bank Run | Statista

*Bankrupt comes from the Italian banca rotta, meaning “broken bench”. Hundreds of years ago In Italy money dealers used to work from benches or tables and if they ran out of money, their bench or table was broken in half, and they were out of business.

**We are overlooking the pandemic crisis here, as it was relatively short-lived in terms of adverse economic impact.

This is a marketing communication and is not independent investment research. Financial Instruments referred to are not subject to a prohibition on dealing ahead of the dissemination of marketing communications. Any reference to any securities or instruments is not a personal recommendation and it should not be regarded as a solicitation or an offer to buy or sell any securities or instruments mentioned.

Author

Subscribe to one of our newsletters

Get the inside view from Quilter Cheviot delivered straight to your inbox.