My home is my pension

When it comes to retirement, many people are tempted to simply rely on their house. After all, a house is often your most valuable single asset, with property accounting for 35% of total household wealth in the UK.

Relying on your home for your pension can come with significant downsides though. When you reach retirement age, there are two options to realise the value of your home: equity release or moving to a smaller property.

Equity release either involves mortgaging or selling part of your home and receiving the cash back as a lump sum or in regular instalments. Although you do not need to repay the mortgage while you live in the property, interest is charged on the money given to you. Even at a low interest rate of 3.5%, the money you owe can double in size, potentially eating into any inheritance you wish to pass on.

The alternative is to downsize. Unless you are prepared to move to an area where house prices are lower, or to significantly reduce the size of your living accommodation, the amount of money you release may not be significant enough to provide a good ongoing income stream.

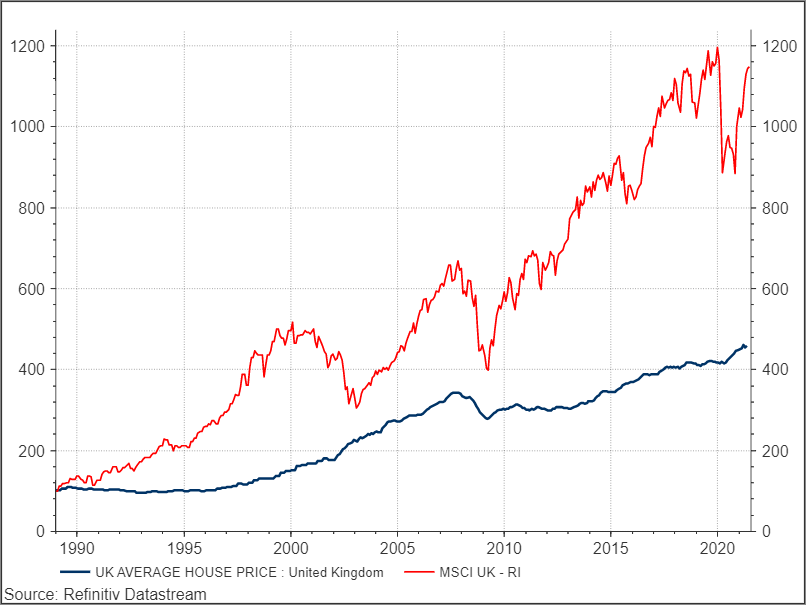

Property does not always offer the best returns

From an investment point of view, the main problem with relying on your house to fund retirement is the risk of poor investment performance. Since the beginning of 1989, UK equities have returned almost three times more than UK house prices, as measured by MSCI UK and HM Land Registry data.