My home is my pension

When it comes to retirement, many people are tempted to simply rely on their house. After all, a house is often your most valuable single asset, with property accounting for 35% of total household wealth in the UK.

Relying on your home for your pension can come with significant downsides though. When you reach retirement age, there are two options to realise the value of your home: equity release or moving to a smaller property.

Equity release either involves mortgaging or selling part of your home and receiving the cash back as a lump sum or in regular instalments. Although you do not need to repay the mortgage while you live in the property, interest is charged on the money given to you. Even at a low interest rate of 3.5%, the money you owe can double in size, potentially eating into any inheritance you wish to pass on.

The alternative is to downsize. Unless you are prepared to move to an area where house prices are lower, or to significantly reduce the size of your living accommodation, the amount of money you release may not be significant enough to provide a good ongoing income stream.

Property does not always offer the best returns

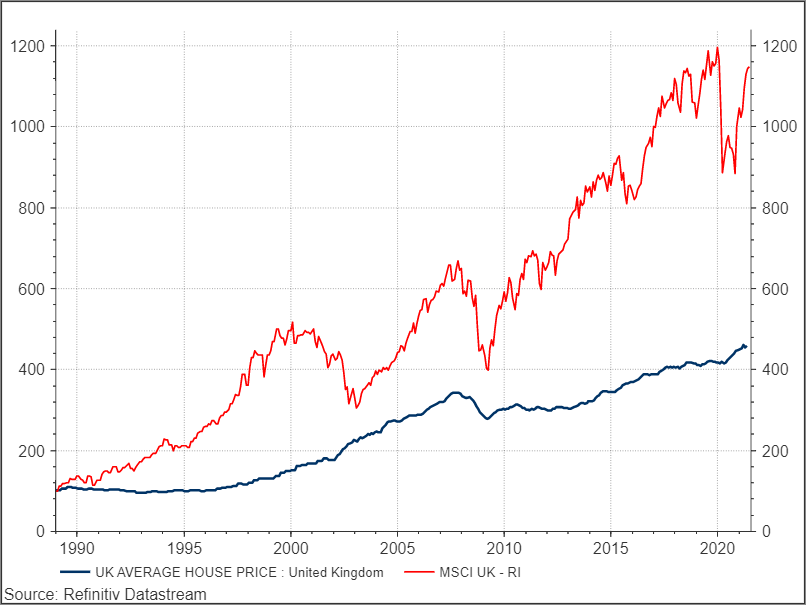

From an investment point of view, the main problem with relying on your house to fund retirement is the risk of poor investment performance. Since the beginning of 1989, UK equities have returned almost three times more than UK house prices, as measured by MSCI UK and HM Land Registry data.

What do you offer that I cannot do myself?

Aside from our wealth management expertise, you are also paying for our time managing your portfolio. Staying on top of markets – and thinking about the implications of investment decisions to buy and sell – is often a full-time job in itself. And on top of thinking about what you invest in, you also need to make sure you fully utilise your tax allowances each year.

With the amount of information online, it is possible to manage your wealth yourself and do a good job of it. But you need to be careful to avoid common behavioural errors, such as failing to apply a proper investment strategy or not diversifying properly. The most commonly bought shares on Hargreaves Lansdown, for example, all feature UK companies, suggesting that some DIY investors are failing to diversify their portfolios sufficiently, or to take advantage of other asset classes and geographical areas.

Over-reliance on a single asset class

Another significant risk of a property-based pension is over-reliance on a single asset class. UK house prices fell by close to 20% during the financial crisis, and took almost seven years to recover to their previous highs. In the case of UK equities, the fall was greater, but they took less than half the time to recover to their previous highs.

Investing also provides an opportunity to diversify away from the fortunes of the UK economy, on which domestic house prices will be highly reliant. It is relatively simple to invest in a portfolio of global assets which will be less affected by developments in the UK such as Brexit or any potential change in government. It is important not to take more risk than you can afford to, however. Our investment managers can help you with this, and help you work out issues like your investment time horizon.

Conclusion

If you do rely on your home for your pension, you also need to think about how exactly you will use your home to fund your retirement. You may want to invest the money in order to receive a higher income than that available from a bank account. But if you are prepared to invest your money in retirement, you may want to think about investing ahead of retirement too.

Beyond the relatively poor investment performance of property in recent years, it is clear that the two main options for unlocking the value of your home, equity release and down-sizing, come with significant downsides. The shorter term concerns around the UK property market show how ‘investing’ is not the only financial activity that can carry risk. Those thinking about how to save for retirement should think carefully before taking the property plunge and always seek professional financial advice.

For more information on our bespoke investment management service, download our ‘Why you deserve bespoke’ brochure today, or fill in your details to arrange to speak to one of our investment managers.

Author

Busting the myths that stop you from investing in your future

Quilter Cheviot is cutting through the many myths that surround investing to help you take a fresh look at your finances, evaluate whether they’re robust enough to support your plans and prepare properly for the future you deserve.