Spreading risk is one of the most important principles of investing, not only between several different investment types (also known as asset classes), but also between the stocks and shares (equities) of different companies. Diversifying your investments stops you taking too much undesirable risk, whilst also allowing you access to a range of investment areas so you do not miss out on opportunities as they arise.

Taking a diversified approach means that, even if a particular asset class or single investment goes through a bad patch, the rest of your investments need not be affected. In other words, we will help you select a strategy which avoids putting all your eggs in one basket.

The selection of asset classes in a portfolio is known as asset allocation, and is one of the primary ways to manage investment risk whilst also seeking to maximise the chance of healthy investment returns. The strategic allocation to different types of investment is the basis for the selection of the individual securities used to construct a portfolio or fund.

Different types of asset classes have different performance characteristics. When two asset classes move in the same direction at the same time, they are considered to be highly correlated. When one asset tends to move up when the other goes down, the two assets are considered to be negatively correlated. By allocating the right mixture of correlated and uncorrelated asset types to a portfolio, investment managers aim to ensure that the peaks and troughs of their performance will generally balance each other out in a way that is optimised for each risk profile.

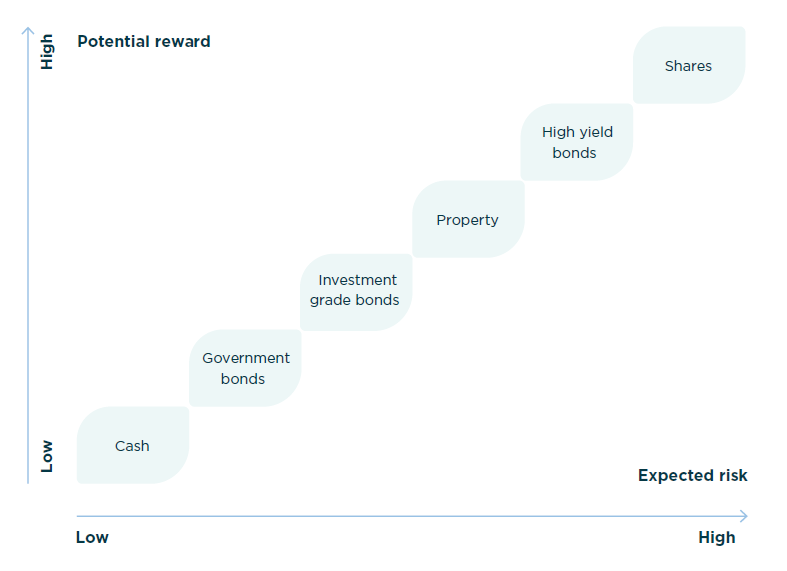

One of the best ways to spread risk is to invest across several different asset classes. The main choice is between shares, bonds, cash, and perhaps other ‘alternative investments’ such as property.