Bed and ISA – the practice of selling investments held outside an ISA and then buying them back under the ISA tax wrapper – is a familiar concept, but for high-net-worth individuals bed and pension can make a lot more sense. The essence of either of these moves is to increase the tax efficiency on existing investments and recent changes to tax allowances have added to the attraction of moving investments into a SIPP (self-invested personal pension), a process known as bed and pension.

The reduction in capital gains tax (CGT) allowance - from £12,300 in the 2022/23 tax year to £6,000 in the 2023/24 tax year and only £3,000 from April 2024 onwards – has increased the tax burden on investments held outside of tax wrappers. Bed and ISA is one of the most popular solutions to improve tax efficiency and shield investment gains from HMRC, but for those with sizable investment portfolios the £20,000 annual limit is restrictive.

Increased pension allowance

In contrast recent changes have increased the pension annual allowance to £60,000 and, unlike the ISA allowance, this can be carried forward unused for up to three years. The simplest way to demonstrate this is with a worked example.

The potential savings vary and depend on a number of factors, but at their maximum an individual utilising the past three years of pension allowance, along with their partners, could stand to benefit far more. If we assume no pension contributions have been made for either the individual or the partner then there is £40,000 each, £80,000 combined for each of these three years that can be used, plus £60,000 for the current tax year.

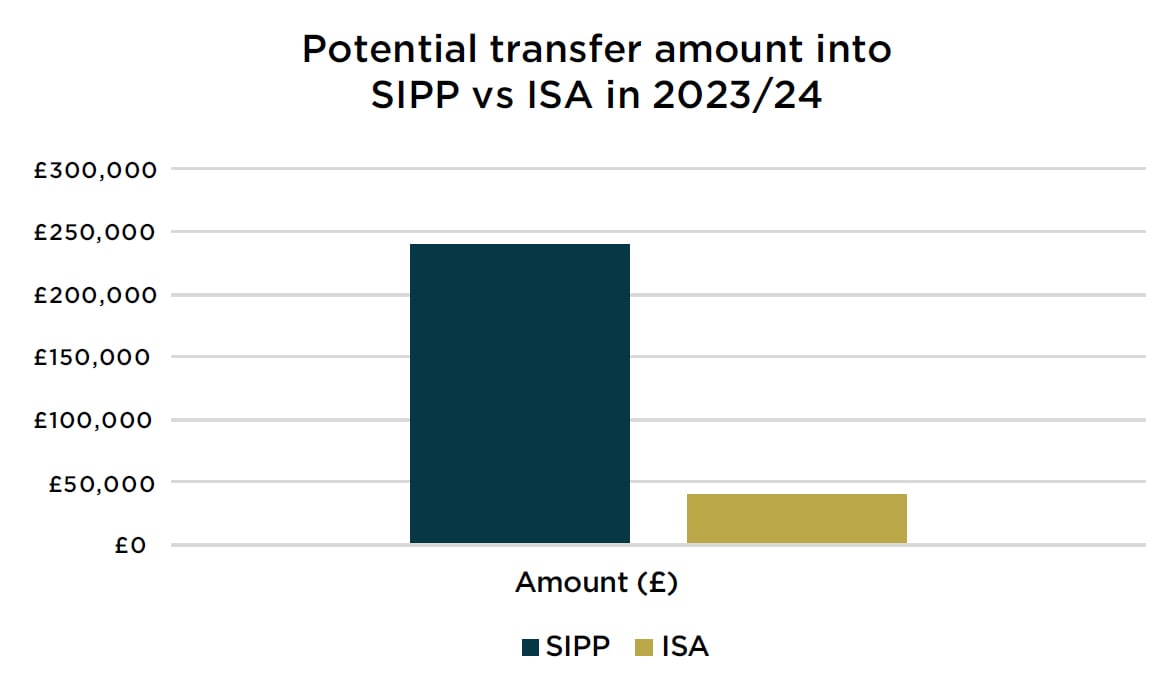

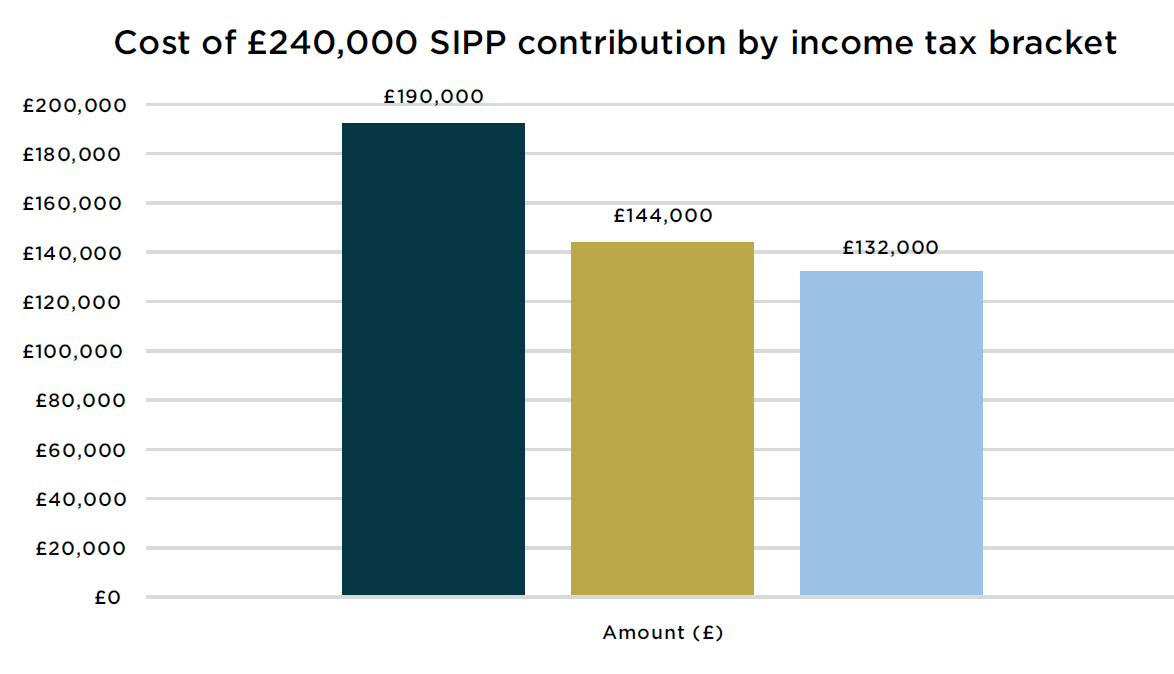

£240,000 could be moved into a SIPP in the current tax year, compared to £40,000 in an ISA – that’s six times as much! Due to the additional benefit of tax relief being applied to pension contributions at the investor’s highest marginal income tax rate is also means to make a £240,000 contribution it would cost only a basic rate taxpayer (20%) £192,000. The cost to a higher rate taxpayer (40%) would be further reduced to £144,000, a £240,000 contribution would cost a basic rate taxpayer (20%) £192,000. The cost to a higher rate taxpayer (40%) would be £144,000.

The window could be shortened

The window to make these changes could potentially be shortened, should the UK election bring about a new government that takes a less generous position on pension allowances. It should be noted that you cannot usually access money in a SIPP until the age of 55 (57 from 2028) whereas ISA withdrawals are allowed at any time. However, for a high-net-worth individual with little expected need for the money in the near-term future, the tax benefits of bed and pension heavily outweigh those on offer in an ISA.

Author

Approver Quilter Financial Services Limited & Quilter Mortgage Planning Limited 12/02/2024

The value of pensions & investments and the income they produce can fall as well as rise. You may get back less than you invested.

For ISA’s Investors do not pay any personal tax on income or gains but ISAs do pay unrecoverable tax on income from stocks and shares received by the ISA manager.

All references to clients’ examples in this article are fictitious.

Tax treatment varies according to individual circumstances and is subject to change.

Quilter Cheviot Financial Planning is a trading name of Quilter Private Client Advisers Limited which is an appointed representative of Quilter Financial Services Limited and Quilter Mortgage Planning Limited, which are authorised and regulated by the Financial Conduct Authority.

Registered in England and Wales. Registered number: 06201261, registered address: Senator House, 85 Queen Victoria Street, London, EC4V 4AB.

Quilter Financial Services Limited and Quilter Mortgage Planning Limited is entered on the FCA register (https://register.fca.org.uk/s/) under reference 440703 and 440718. Trusts, Estate planning, some Buy to Let Mortgage, Taxation and Inheritance Tax Advice are not regulated by the Financial Conduct Authority.

The representative member of the VAT group is Quilter Business Services Limited. VAT registration number: 386 1301 59.