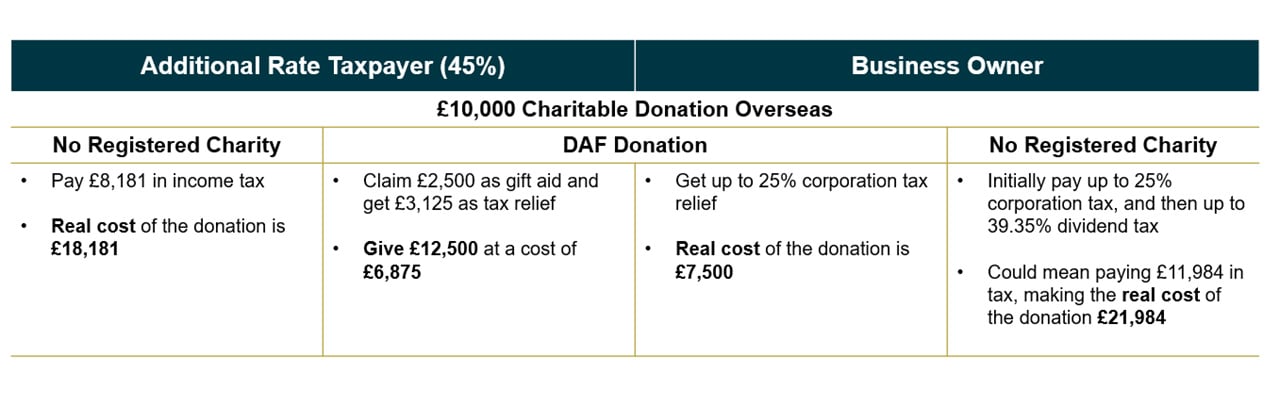

At present, many high-net-worth (HNW) Muslims in the UK face high tax charges for their generous donations, paying £1 in tax for every £1 they donate. Donor Advised Funds (DAFs) offer a way to make these charitable donations in a tax-efficient manner.

During the month of Ramadan, Muslims around the world engage in fasting.

In the UK, this period also sees a notable increase in charitable donations. Many Muslims take this opportunity to fulfil their Zakat obligations. Zakat is a mandatory act of charity for Muslims who meet a certain financial threshold, requiring them to donate a portion of their wealth to those in need. There are nearly 4 million Muslims in the UK, who donate an estimated combined £1bn to charity each year.

DAFs allow donations to grow tax-free and be distributed at the donor's discretion. This is especially beneficial for those donating to overseas charities, as it enables them to benefit from tax reliefs usually reserved for donations made through UK registered charities.

Charitable giving in the UK is encouraged by providing tax incentives. Donations to charity can effectively be tax-free through gift aid, income tax relief, and corporation tax relief for businesses. Donations made through a UK-registered charitable organisation qualify for these tax reliefs, while those made outside of such organisations do not. For HNW Muslims, these tax reliefs can accumulate to substantial amounts, making it expensive to miss out on them.

Many UK Muslims feel a connection with their countries of origin and a desire to give back. They donate millions of pounds annually to overseas charitable causes, both during Ramadan through Zakat and additional donations throughout the year.

HNW Muslims often prefer to have more personal control over how their donated funds are used than independent charities can usually accommodate. Every year, thousands of schools, clinics, orphanages, and homes for the poor are directly established overseas by HNW Muslims, without the involvement of a UK-registered charity. Often, these are built in honour of parents or departed loved ones to serve as a lasting legacy. However, this form of philanthropy misses out on valuable tax reliefs.

A few HNW Muslims have their own registered charities, allowing them to take advantage of available tax reliefs. However, the expense, oversight and reporting requirements often make setting up and running a personal charity too costly and onerous for most. In such cases, DAFs can offer an ideal solution.

A Donor Advised Fund (DAF) is an account sponsored by a UK-registered charity. It allows donors, to receive all the tax benefits associated with registered charities while supporting their favourite charitable causes. Contributions to the account not only receive tax benefits upon deposit but also grow tax-free. Donors can choose the amount and frequency of distributions from the fund, as well as their preferred charitable causes. For donors who wish to suggest grants to overseas charities, the DAF provider will follow HMRC’s overseas donations guidance to ensure proper due diligence is adhered to when verifying and paying the charitable cause.

Setting up a DAF is relatively simple and quick. The parent charity manages all regulatory requirements and due diligence. This convenience also applies to claiming tax benefits, which the donor can easily do. Additionally, funds in a DAF do not need to be immediately distributed and can accumulate over time.

Crucially, as there is no deadline for funds in a DAF to be spent, they can be used as an investment account to grow, tax efficiently, donations for a future project.

£10,000 donated each year for 10 years, with 6% annualised return, would yield £131,808. For an additional rate taxpayer, that’s a cost of £55,000 and for a company benefiting from 25% tax relief, a cost of £75,000.

For those looking to leave behind a legacy of their own, the above rate of saving/return over 30 years would yield £790,000. This could be used as a ‘Waqf’, an Islamic form of endowment, for future generations to make donations from the income whilst preserving the capital in perpetuity. For example, donating 3% each year would mean charitable spendings of over £23,700. The funds can be invested in shariah-compliant portfolios to achieve both long-term growth and sufficient income for regular disbursements.

For HNW Muslims in the UK, DAFs offer a potentially attractive opportunity. Specifically, for those who donate to charitable causes located overseas, DAFs can provide a more tax-efficient method of giving.

Approver Quilter Financial Services Limited & Quilter Mortgage Planning Limited 19/03/2024.

Tax treatment varies according to individual circumstances and is subject to change.

The value of investments and the income they produce can fall as well as rise. You may get back less than you invested.

Donor Advised Funds are not regulated by the Financial Conduct Authority.