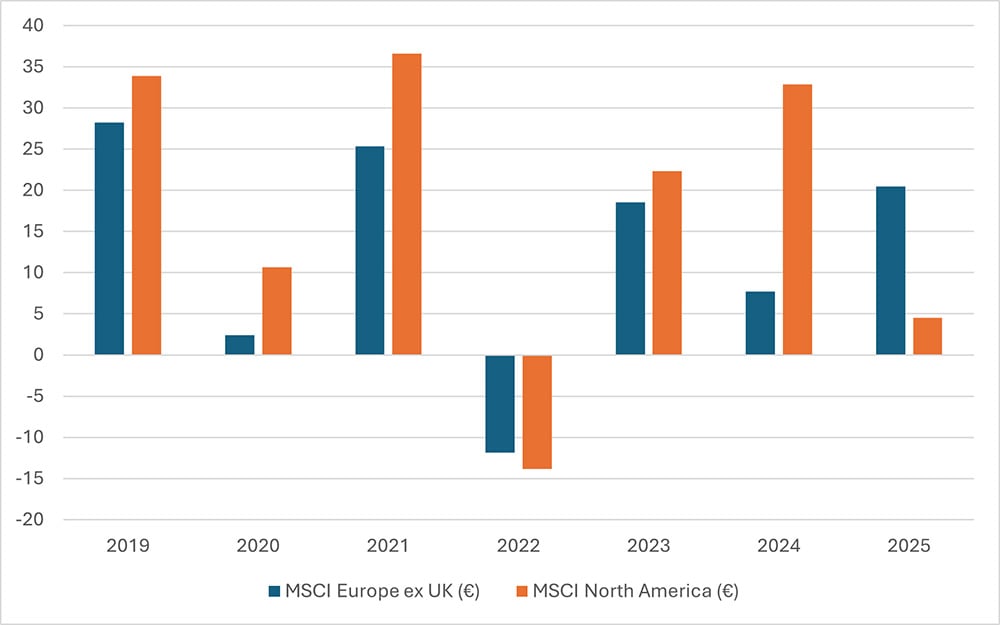

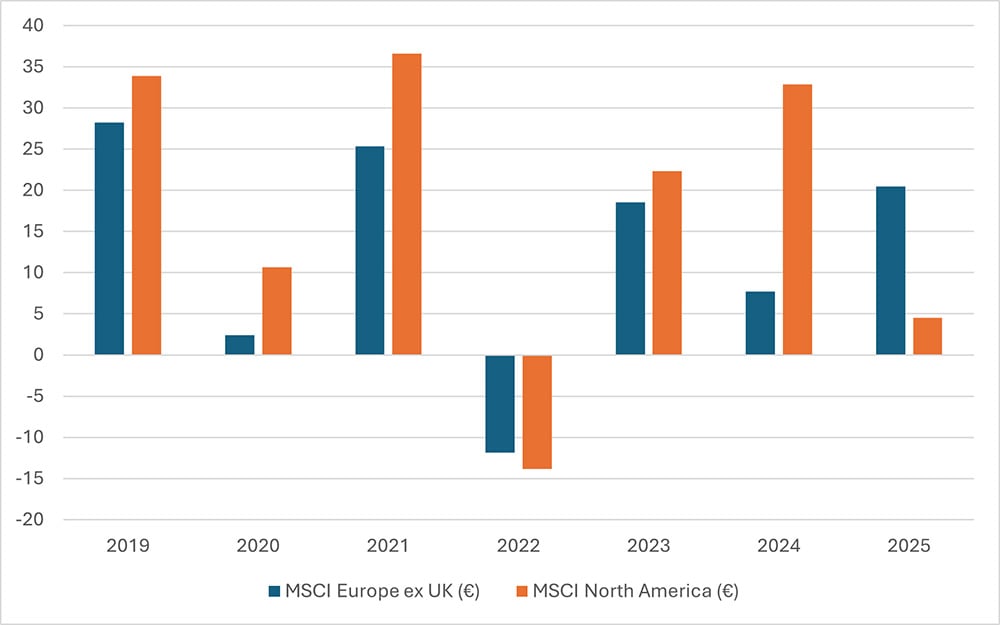

Chart 2: European stocks bucked the trend of US outperformance last year, rising 20.4% compared to a 4.5% return from US stocks

Source: LSEG Datastream, Quilter Cheviot Limited 17/02/2026

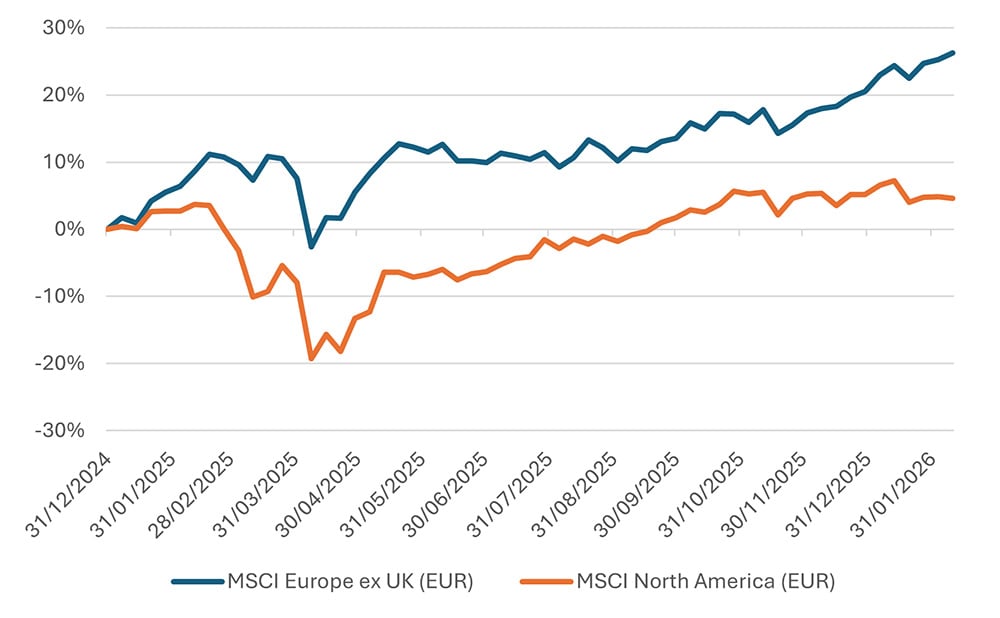

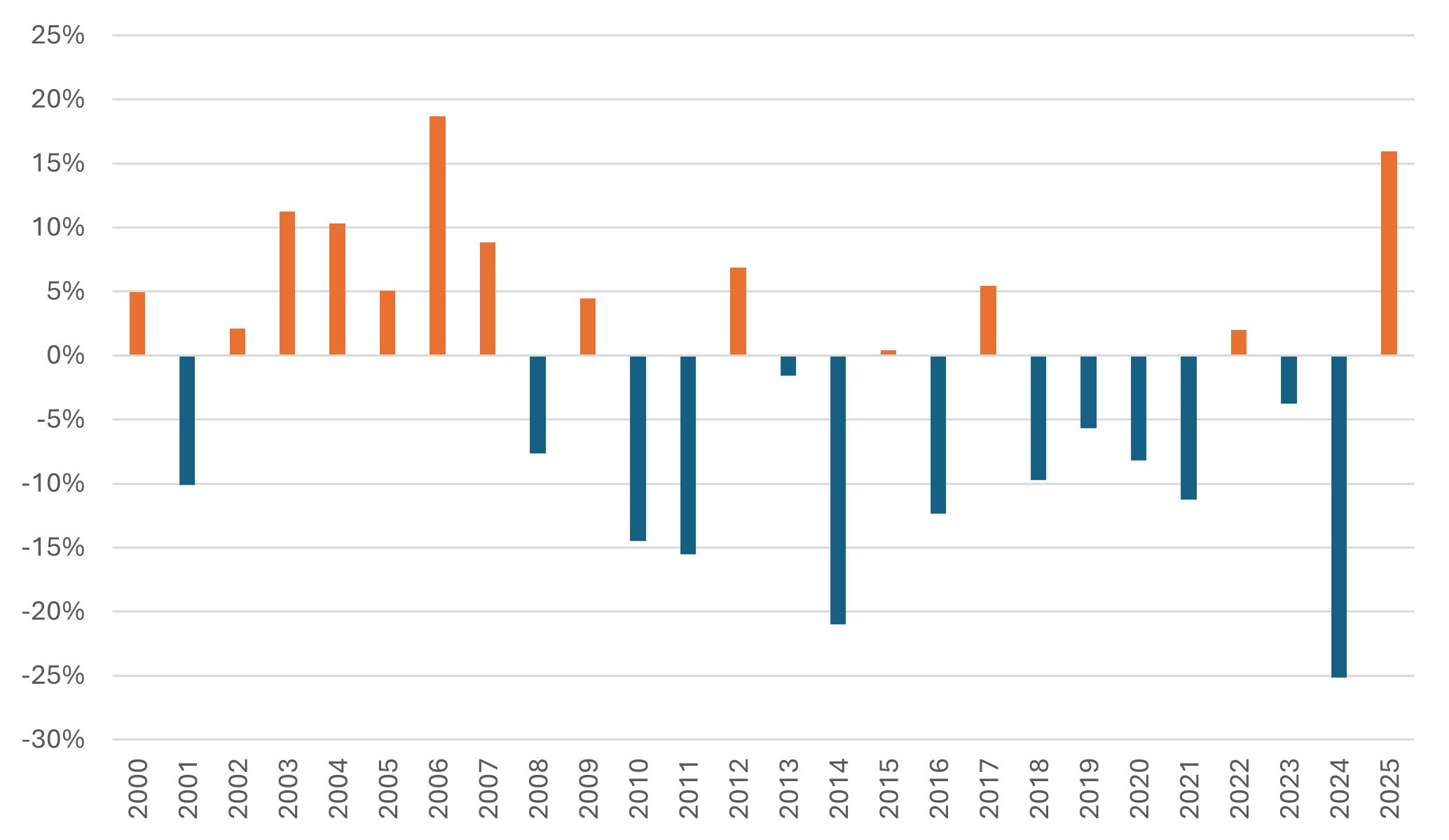

The strong relative performance of European stocks since the start of 2025 marks a notable change from the preceding years when US exceptionalism was very much in vogue. The rise of US big tech stocks — in particular the Mag 7 (Alphabet (Google), Amazon, Apple, Meta, Microsoft, Nvidia and Tesla) — led to a number of years of strong US outperformance with many investors starting to believe that these stocks were the only game in town. After the 2022 drawdown, the launch of ChatGPT sparked a growing hype around the possibilities of AI (Artificial Intelligence) causing a wave of investor enthusiasm which seemingly culminated with the large 2024 outperformance (US stocks returned 33% vs 8% for European stocks).