Pros of active management

There are three main reasons why people choose active management; performance, flexibility and risk management.

1. Performance

- Investors going alone can often lead to worse outcomes as there is not an experienced investment professional there to help prevent you making costly errors. This is demonstrated by the consistent underperformance of retail investors. For example, investors in US mutual funds and exchange traded funds (ETFs) earned returns of 6.3% per year over the 10 years to 31 December 2023, 1.1% per year less than the funds’ total return over the same period. Why the gap? The poor timing of investors.1

- An investment manager does not only add value by skilfully selecting optimal portfolios, they also act as a safeguard against investors’ behavioural biases that have proven to be financially damaging.

Concentration risks of passive investing

- 2024 was an unusually concentrated year for stock market returns, making it especially hard for active management to outperform. Around half of the 27% annual return for the MSCI North America index came from just seven stocks (the so-called Magnificent Seven”) — Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

- The top 10 members of the index now account for around one third of its market value, the highest level on record, and only 26 stocks account for half the entire benchmark’s value (there are 673 stocks in the MSCI North America)2.

1 Mind_the_Gap_2024.pdf

2 The US stock market has never been more concentrated. Does it matter?

2. Risk management

Investors often choose an active management approach for performance reasons. This does not simply mean beating a passive benchmark however, although that can be an aim. For investors returns should be judged on a risk-adjusted basis.

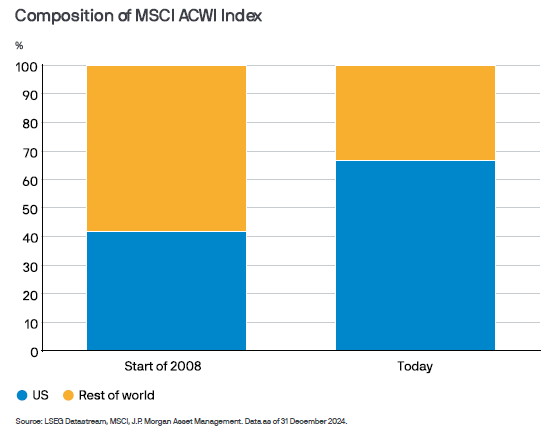

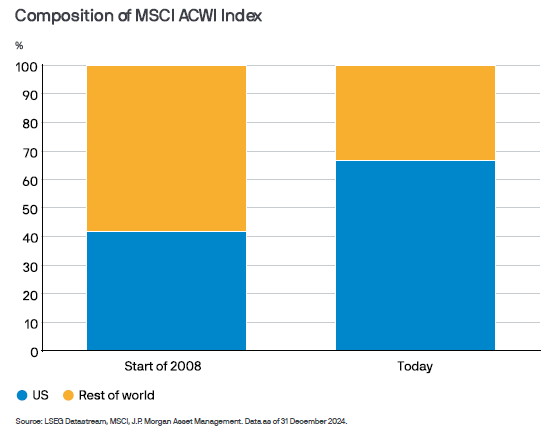

- The US also has a substantial and growing position in the MSCI All Country World index, accounting for around two-thirds of the benchmark.

- The strong outperformance of US stocks since the 2008 global financial crisis has seen a large increase to their weighting in global benchmarks, rising from just over 40% to a little under 70%.

- Just three companies — Apple, Nvidia and Microsoft — make up 13% of the US$78tn index! With expectations so high on the Magnificent Seven stocks, there is plenty of room to disappoint. Looking at the seven largest stocks during the dotcom boom around 2000 reveals an underwhelming level of future performance.

Largest seven dot com stocks

| Dot com stock |

Status |

P/E at dot com peak |

Return since dot com peak |

| Microsoft |

Survived |

50.9x |

1124% |

| Cisco |

Survived |

105.4x |

12% |

| Intel |

Survived |

39.6x |

-49% |

| Oracle |

Survived |

103.9x |

373% |

| IBM |

Survived |

23.9x |

257% |

| Lucent Technologies |

Merged |

43.9x |

-94% |

| Nortel Networks |

Bankrupt |

87.6x |

N/A |

Past performance is not a reliable indicator of future returns. Source: LSEG Datastream, S&P Global, J.P. Morgan Asset Management. Largest seven dot com stocks are the largest seven Tech or Tech-related firms in the S&P 500 by market cap, as of March 2000. Data as of 31 December 2024.

- What this means is that the composition of global benchmarks over time has changed dramatically, meaning they no longer offer the levels of diversification they once did. Less diversification means an increase in risk, leaving these benchmarks susceptible to specific events, such as the release of a generative Artificial Intelligence (AI) chatbot from Deepseek, a Chinese start-up, in January 2025.

3. Flexibility

- Active management allows for a more flexible approach, with investment managers able to carefully craft specific portfolios for individual clients.

- Risk tolerance is a key element here. An investment manager can help ensure that a client’s portfolio reflects both their ability and willingness to take risk. This prevents clients from positioning their portfolio in a way that could work against their investment goals.

- Investment managers can incorporate a client’s personal preferences into their investment rather than broadly buying a passive tracker. Filters can be applied based on individual preferences, values or ethics or even screening out entire sectors.

Fixed income

Two potential problems from following a passive investing approach relate to fixed income;

Passive investments often look only at equity trackers, missing other opportunities

Choosing passive investments is an active decision in itself, and requires a consideration of asset allocation. The strong performance of equity markets in recent years may have drawn some advisers into believing that an all-equity approach is optimal, but investors should be careful to extrapolate the recent past into the future.

Active management can often perform better during market downturns, but specific factors relating to the last two significant equity market declines, in 2020 and 2022, have meant that equity holdings have not materially underperformed.

2020: During the Covid-19 pandemic decline in 2020 the swift and decisive reaction from central banks and governments caused equity markets to recover rapidly, insulating long-term investors from realising sizable losses.

2022: The equity decline was caused in part by the pandemic response, as inflation soared following Russia’s invasion of Ukraine. High inflation caused central banks to pursue a rapid interest rate hiking cycle, causing bonds to fall alongside equities. This is an unusual occurrence as equities have typically fallen during times of economic slowdowns or recessions — like the 2008 financial crisis — causing central banks to cut rates, sending bond prices higher.

Unusual bear markets undermine case for asset class diversification

Taking a longer-term view on past equity market downturns shows the last couple to be anomalies. Furthermore, now that government bond yields have returned to historically “normal” levels following a prolonged period of very low, and in some case negative, interest rates there is plenty of dry powder for central banks to use.

Central bank base rates in the UK and US are in the region of 4%-5%, meaning there is plenty of room for reductions should economies deteriorate. While the path getting here through 2022 was painful, the current environment is far more conducive to fixed income investing than the prevailing set of conditions since the 2008 financial crisis, when extraordinary central bank policies greatly reduced bond yields.

Fixed income funds have historically performed pretty well versus benchmarks

Active fixed income funds have typically fared well against their benchmarks.

Fixed income investments have a well-proven track record of providing portfolio diversification that can help dampen volatility, preserve capital, reduce risk and generate income.

Diversification, often considered the cornerstone of investing, is the closest thing to a free lunch you can get. Effective diversification improves risk-adjusted returns, meaning that either for a given level of risk your return will be higher or for a given level of return your risk will be lower.

Ability to tailor portfolios for specific client needs or ethical restrictions

Another problem with passives is their inability to incorporate specific clients needs. For instance, if the client is interested in responsible investment, then it has been shown that it is preferable to follow an active approach. While it is possible to choose passive options, the low-cost and light touch management of these means that they can be found to provide a less robust process to responsible investment.

At Quilter Cheviot, we have a duty to make sure that we are considering environmental, social and governance issues throughout our investment process and through our engagement with the companies and funds we invest in on behalf of our clients. We believe that being a responsible investor is an important element in working towards a sustainable future for the next generation. As a business that tailors its services to the specific needs of our clients, we strive to meet their responsible investment objectives. Where we do invest in passive funds, we have assessed their approach to responsible investment and specifically, stewardship activity. Typically passive funds are unable to implement ESG integration or exclude certain investments.