Spending needs

Cash flow modelling and regular reviews can play an important role when considering spending needs, but what is the reality?

The individual nature of our clients means that any decumulation strategy is unique to them. By their very nature, unforeseen events are impossible to model, and whilst ‘what if’ scenarios that demonstrate what could happen can be deployed, can you factor these into the client’s plan with any degree of accuracy?

Also factor in the multi-layered approach to spending needs. Compare, for example, the more active parts of spending that may occur early in a decumulation strategy, with the less active and even care needs towards the later stages. Health, longevity and investment influences will also play a big part in the timing of such events and may end up baring little resemblance to the client’s reality.

The silent dangers in retirement: portfolio risk & volatility drag

When clients generally think about risks in retirement and managing their assets, it is through the lens of potential expenditure and needing money for pressure points that may arise, such as home repairs or care costs, and then planning accordingly. The silent dangers in retirement that need to be considered centre around portfolio risk in withdrawals and volatility drag.

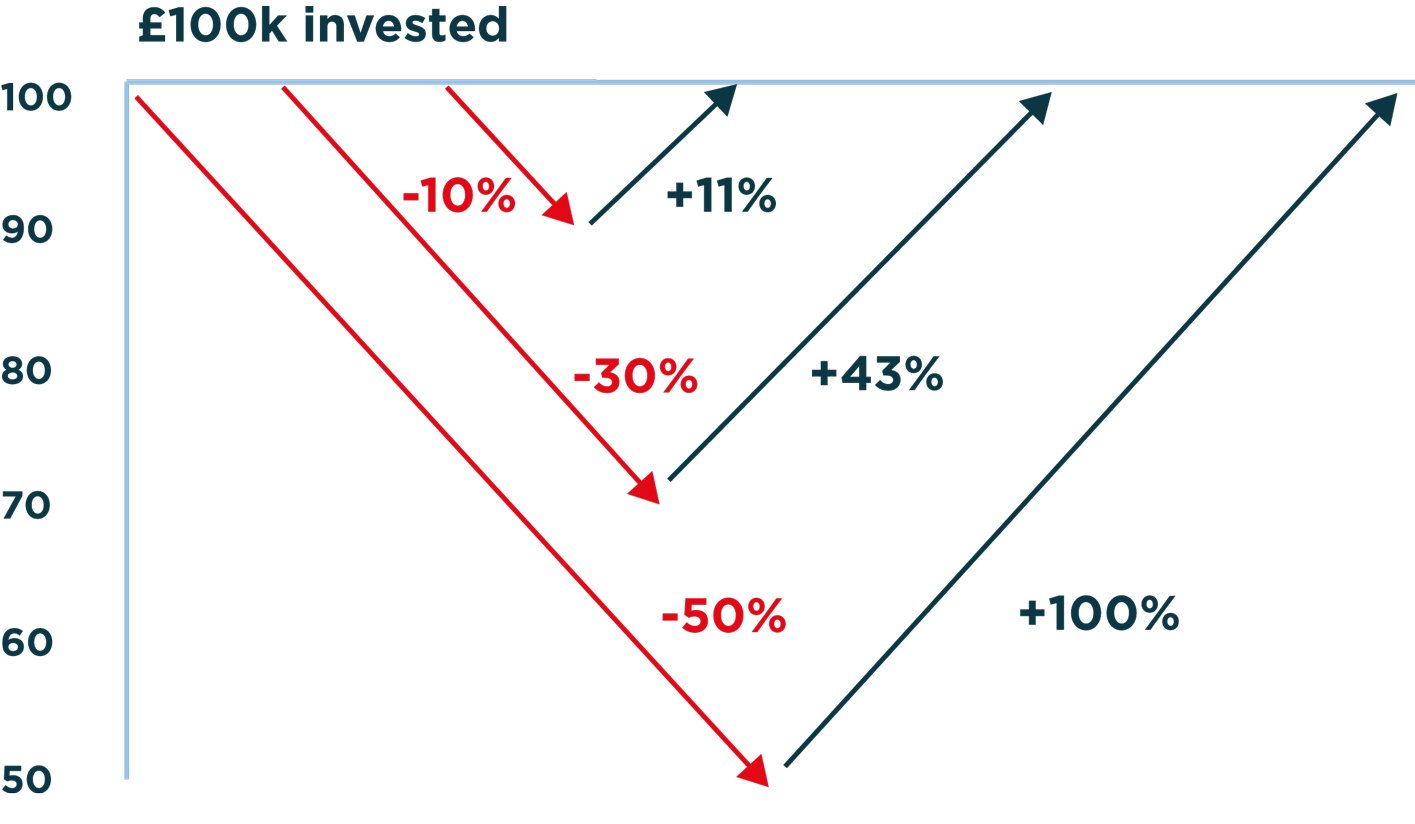

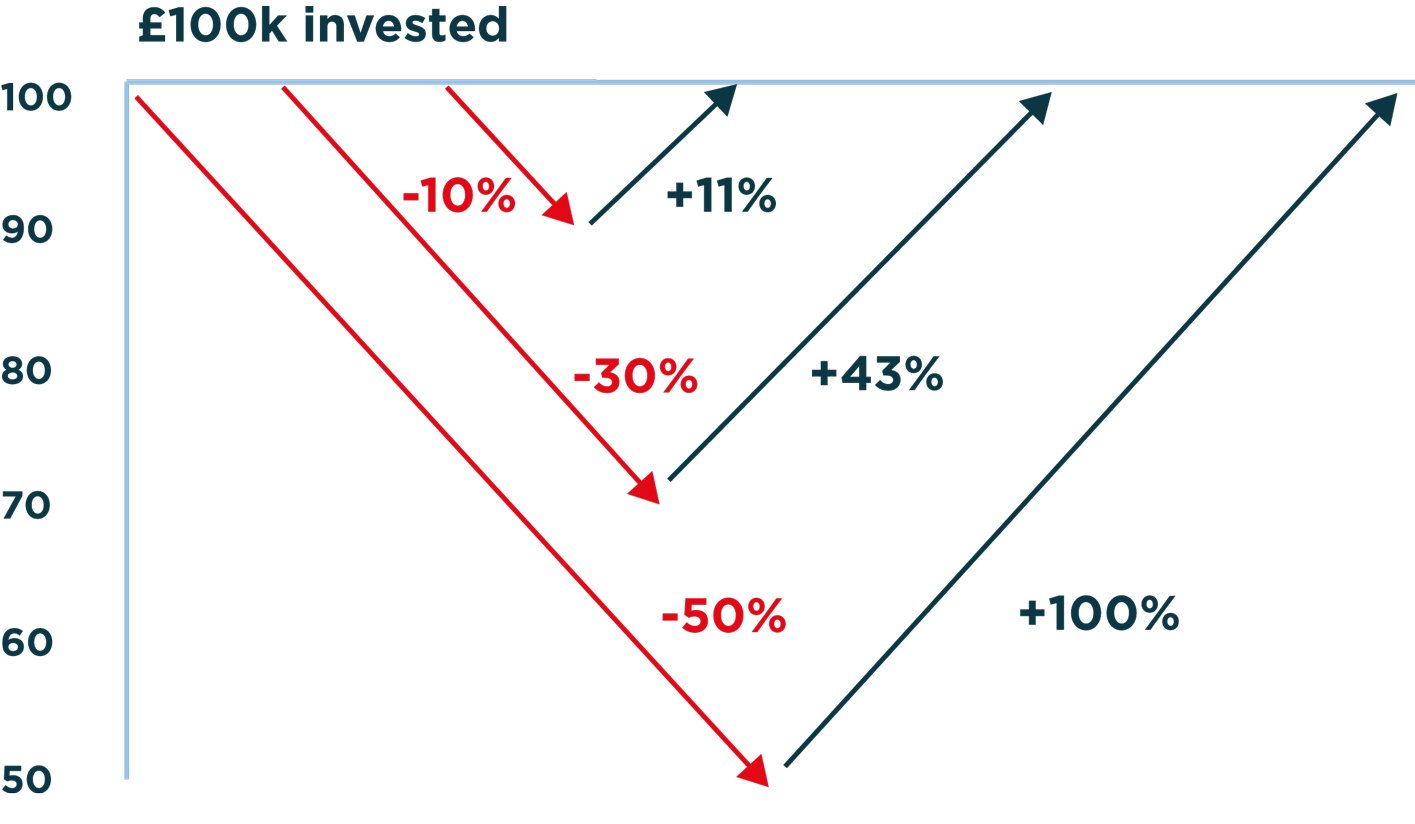

With regards to volatility drag, it is very simple. When investments fall in value, they have to work harder than the fall to return to their original value - the larger the fall, the bigger the performance has to be to recover.

In the example below, a client has investments totalling £100k and experiences a fall of 10% to £90k. To recover the lost ground fully, the investments must now perform at 11% just to return to their pre-fall state. This is further compounded as the size of the fall increases as evidenced below.

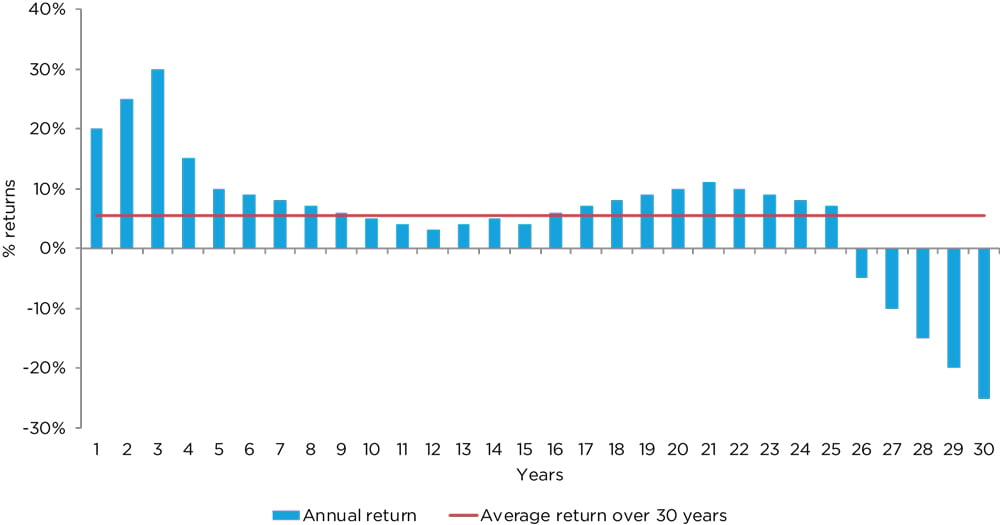

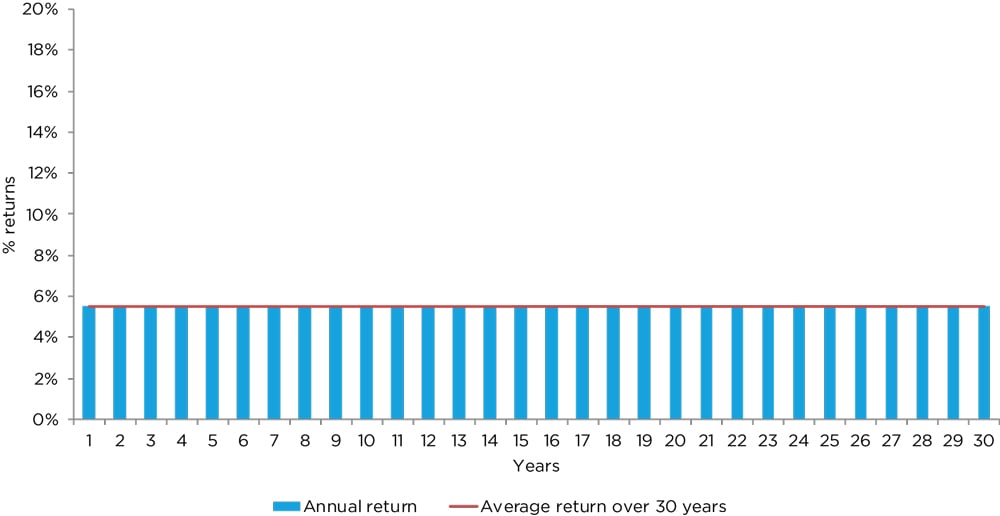

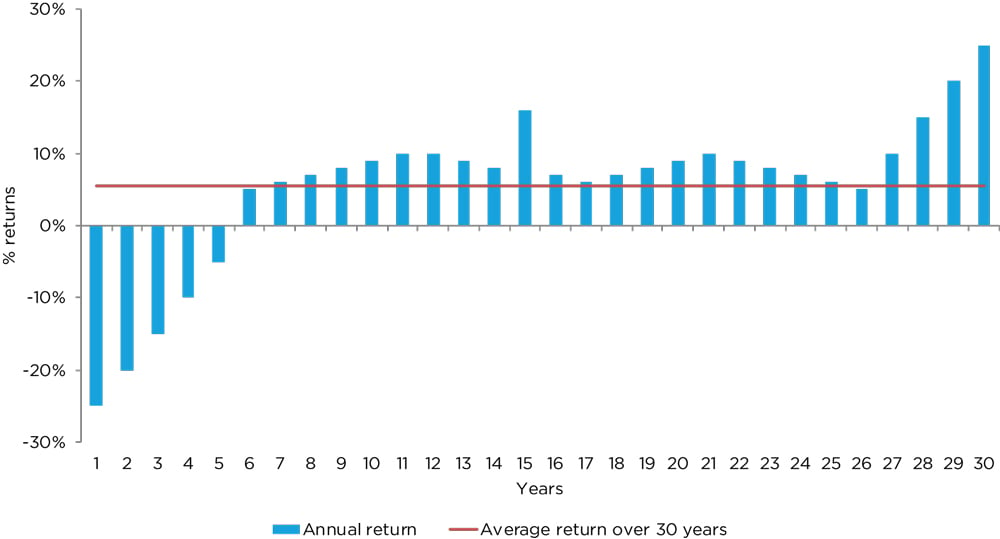

We then must consider the sequencing and negative pound cost averaging risk of withdrawals during periods of volatility.