The Funds:

- Are actively managed, with a multi-asset investment approach.

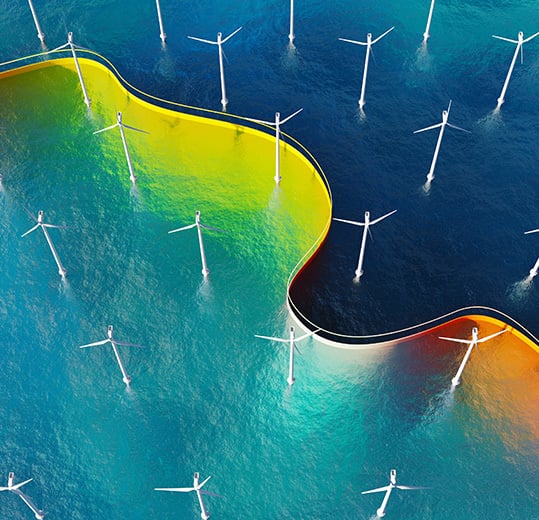

- Focus on investment opportunities that support the development of sustainable societies by pursuing five environmental and social investment themes.

- Are suitable for investors who have either a balanced or growth risk appetite.