1. Investing for the long term

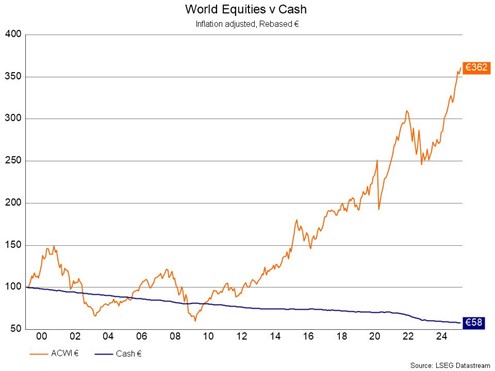

It’s important to think about managing your investments for the long-term, rather than any short-term movements, because history shows us that in the long run returns have heavily outweighed any short-term declines. This means any switch to hold more short-term, conservative investments like cash or other assets means your money may not grow at a faster rate than inflation (we call this ‘inflationary risk’). Our Investment Managers are focused on the long-term direction of the market and what that means for your investments.

2. Why having an investment expert as your guide is important.

As a firm, we believe that investment expertise really shows its worth when markets are in decline. With an investment expert as your guide, you gain access to:

- Active management - They will steer you through market volatility and explain the risks that affect your portfolio. This means that they can help you take advantage of the opportunities available as some asset prices become cheaper.

- Support in meeting your goals - They will suggest the right solutions to better match your financial goals. This means you can take full account of the current market environment in pursuing your long-term investment objectives. The value of investments can fall as well as rise.

Time is of the essence...

Did you know that someone who starts saving regularly at the age of 21 and stops at 30, leaving the money invested, could see their money grow more than a saver who starts at 30 and puts money aside for the next 40 years, retiring at 70?

This surprising fact is explained by the power of compound interest. The principle behind compounding is that each year, you earn interest on the original amount invested; as well as on the interest earned in previous years.

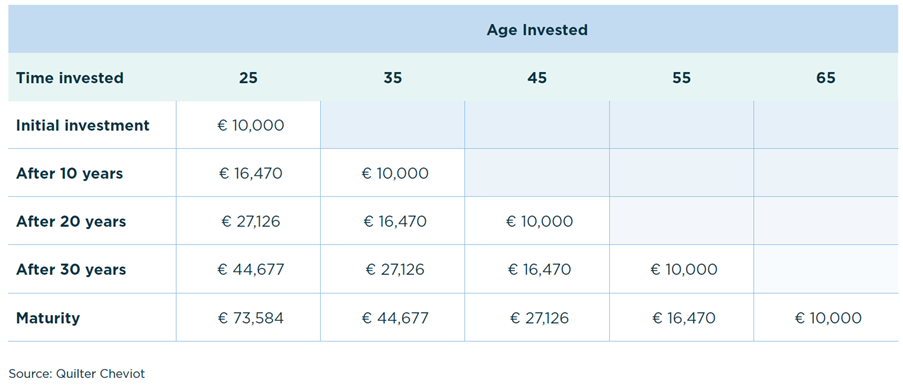

What difference do a few years make?

Imagine you have €10,000 to invest, you would like to retire at 65 and investment returns are fixed at 5%. The table below shows the difference investing early could make to this amount of money, when it is invested at different stages.

Investing in the stock market can be one of the most effective strategies to tackle inflation. Many companies are able to pass on some, or all, of rising Input costs onto customers and end users, meaning that in many cases the full impact of inflation Is not felt in corporate balance sheets.

Source: https://www.cso.ie/en/releasesandpublications/ep/p-cpi/consumerpriceindex