A new chapter, new obligations

Becoming a partner at a Big Four (Deloitte, EY, KPMG and PwC) firm is a significant career milestone. It reflects years of dedication, expertise, and leadership. With this achievement comes not only greater influence and prestige, but also a new set of financial responsibilities that can feel both exciting and, at times, a little overwhelming.

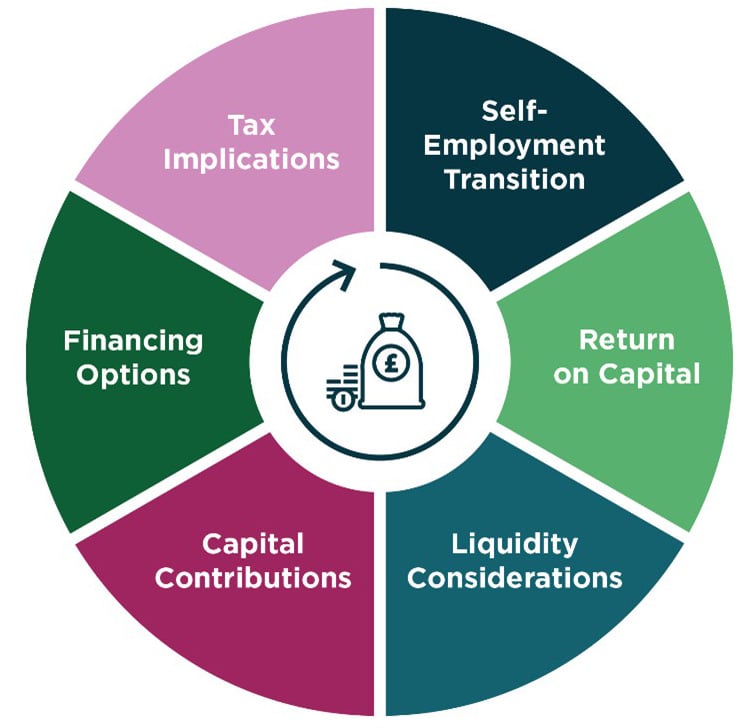

One of the first things to recognise is that your financial obligations as a partner are different from those you faced as an employee. The decisions you make now will have a lasting impact on your long-term financial wellbeing. Keep in mind that personal independence requirements extend beyond you as an individual. Your immediate family members, such as your spouse, partner, or dependent children, will be subject to the same compliance rules. Ensuring that your family’s financial arrangements remain within your firm’s independence framework is a key part of your planning.