European stocks have by no means been immune to the effects of both Trump’s tariffs and global conflicts. However, they have demonstrated more resilience thus far. It’s a similar situation for bonds as fixed income investments have held up far better than equities since the tariff announcement. While future developments and market returns are uncertain, recent events have served as a timely reminder of the benefits of following a diversified, long-term approach to investing.

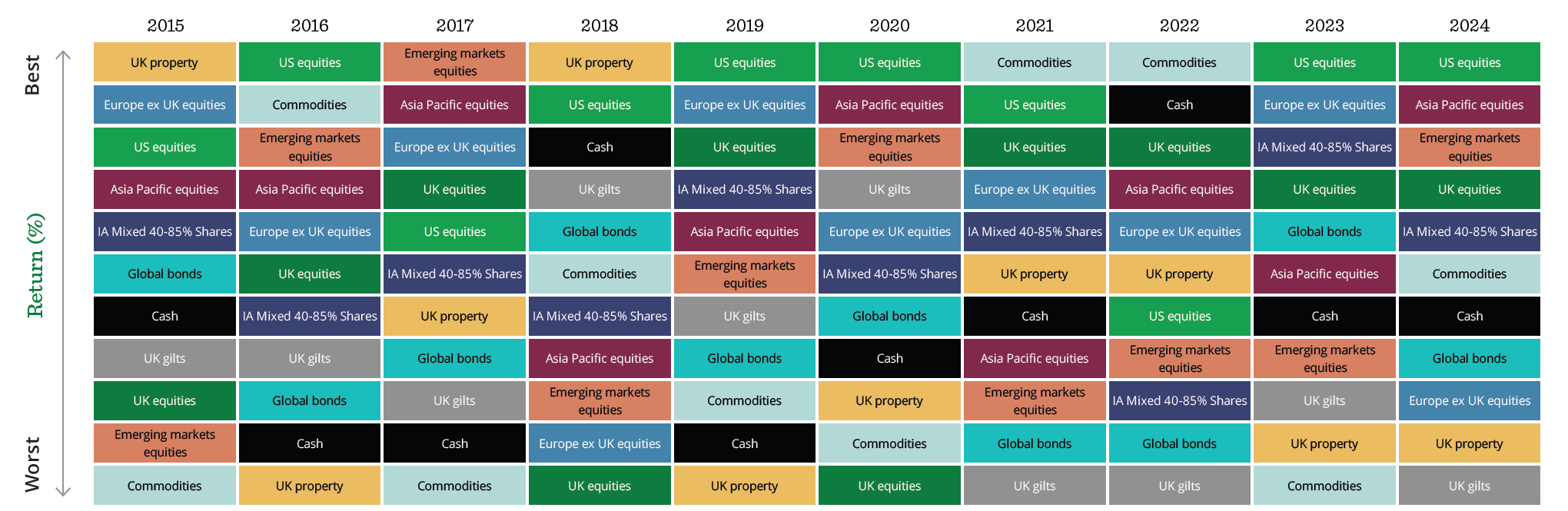

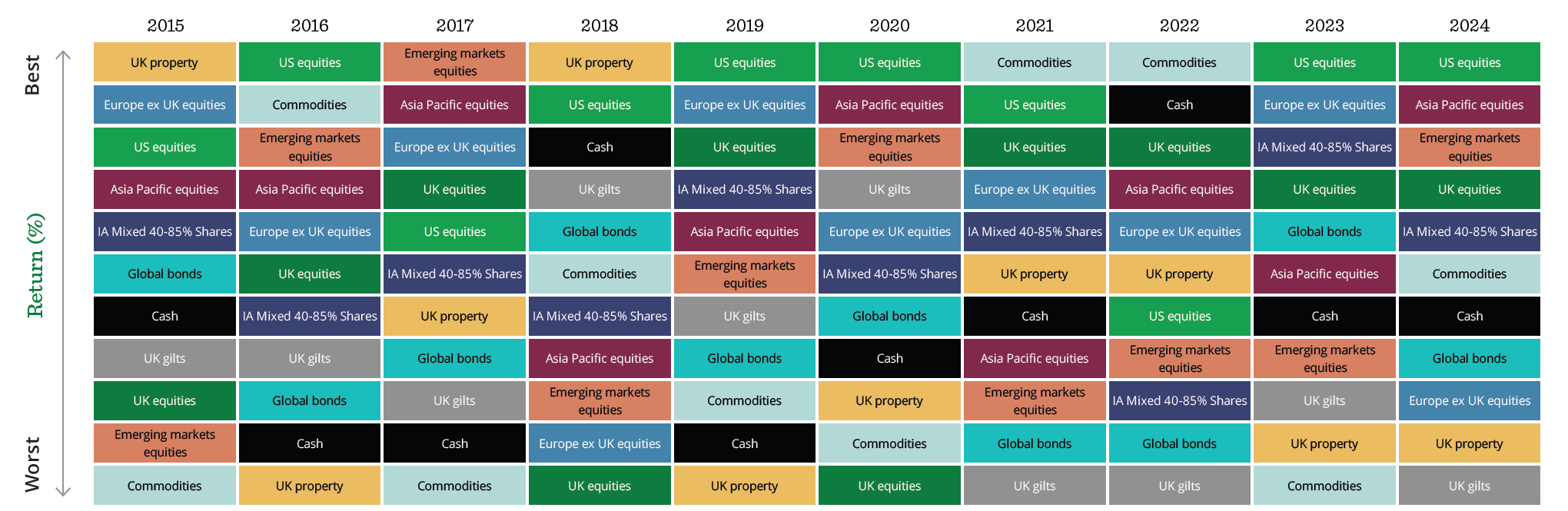

In late 2024, US exceptionalism was on the lips of many an investor as they proclaimed the factors supporting a continued outperformance for US equities. Six months later and the US was one of the worst performing stock markets. This demonstrates the folly of basing investment decisions too heavily on the short-term and why we believe that over time a long-term, diversified approach will deliver better results.

Source: Quilter Investors and Morningstar as at 31 December 2024. Discrete annual return, percentage growth over period 1 January 2015 to 31 December 2024. Asia Pacific equities is represented by the MSCI AC Asia Pacific Index; Cash by the Bank of England Base Rate; Commodities by the Bloomberg Commodity Index; Emerging markets equities by the MSCI EM (Emerging Markets) Index; Europe ex UK equities by the MSCI Europe Ex UK Index Global bonds by the Bloomberg Global Aggregate Index; IA Mixed 40-85% Shares by the IA Mixed 40-85% Shares sector average; UK equities d by the MSCI United Kingdom All Cap; UK gilts by the ICE BofA UK Gilt Index; UK property by the IA UK Direct Property sector average; and US equities by the MSCI North America Index. The information provided is for illustrative purposes only and doesn’t represent the past performance of any particular investment. It is not possible to invest directly into an index.

The case for diversification

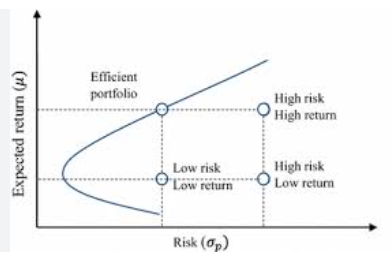

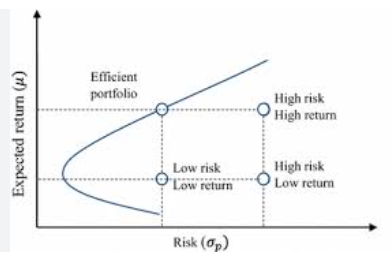

This divergence in performance underscores the critical importance of diversification. This strategy is essential for managing risk and optimising returns, especially in times of economic uncertainty and market volatility. By reducing systematic risk, diversification provides better risk-adjusted returns. There are two ways of looking at this.

A more diversified portfolio delivers:

- Higher returns for a given level of risk

- Lower risk for a given level of return

What diversification does

- Mitigate risk: By investing in a mix of assets, you can reduce the impact of poor performance in any single investment. For example, if US stocks are underperforming, gains in European stocks or bonds can balance the portfolio.

- Enhance returns: Diversification allows you to capitalise on opportunities across different markets. While one market may be experiencing a downturn, another may be thriving, providing a more stable overall return.

- Reduce volatility: A diversified portfolio is less susceptible to the swings of any one market. This stability is particularly valuable during periods of economic uncertainty, helping you maintain a more consistent performance.

- Be flexible: With diversification, you can adjust investments in response to changing market conditions. This adaptability ensures that portfolios remain aligned with goals, even as the market landscape evolves.

By incorporating a diversified approach, investors can better navigate periods of market stress and capitalise on opportunities wherever they arise. This strategy is not just about spreading risk; it's about positioning for long-term success in an ever-changing financial environment.