- Can equity markets continue to move higher?

- Will US events dominate markets again this year?

- Is the AI rally going to continue? / Is tech in a bubble?

- What is the European outlook?

- Are central banks finished with rate cuts?

- What does diversification mean today?

We identify six key questions for 2026:

However, before looking ahead to this year, it’s worthwhile setting the scene for where we currently are, from an investing perspective, with a brief review of 2025.

- 2025 was another strong year for equities, with the MSCI All Country World Index returning 14.4% in sterling terms (all data from LSEG Datastream unless specified otherwise). The gains came despite a number of negative news headlines including trade tariffs, the longest US government shutdown on record, heightened geopolitical tensions in the Middle East and the ongoing Russia/Ukraine war.

- After two years of US exceptionalism, it was the UK (25.8%) and Europe (27.2%) that stood out last year, with Emerging Markets (25.1%) not far behind. The gains in Europe were driven by the announcement of large-scale German fiscal stimulus and countries in the bloc ramping up defence spending to meet their NATO commitments. This has yet to come through to the bottom line with European earnings falling 1.1% on the year, due to some drag from the weakening dollar. However, 2026 consensus expects to see a 13% rise in European earnings.

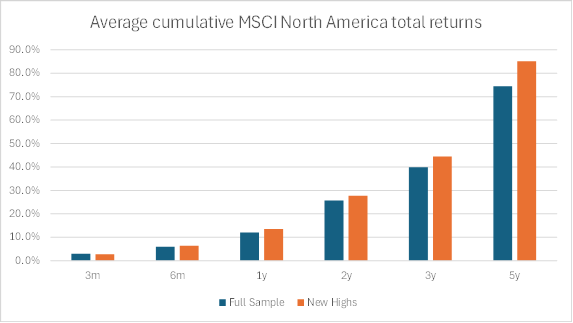

- 2025 saw the best relative performance for international stocks versus the US since 1993, with MSCI All Country World Index excluding the US outperforming MSCI North America by 13.5% in sterling terms. MSCI North America returned 10.4% but 17.7% in local US dollar currency terms marking only the third time on record the market has posted three consecutive 15%+ annual returns (1997-1999 and 2019-21). Strong corporate earnings supported US stocks despite threats from higher trade tariffs, and concerns about tech valuations, with earnings per share rising 12%.

- Currency moves played a larger than usual role in 2025, with sterling rising 7.7% against the US dollar. Gold had a very strong year, rising 64.6%. Heightened geopolitical tensions and the expectation of more aggressive Federal Reserve (Fed) rate cuts supported the gold price, but over time it was clear there was increased retail speculation and elevated volatility. The relationship between gold and interest rates had broken down and it was not clear whether that was temporary or not. Meanwhile the current price is in the region of 2x-3x the cost of production, which is a large historical disconnect. Since 1990, gold posted an annual return of 7.5% with 16.1% volatility, which is lower return and higher volatility than global equities, so 2025 was a truly exceptional year for gold.

- Treasuries and gilts had their best return in five years despite all the worries about budgets and government debt. Short-dated gilts made their best returns since 2008 so good news for lower-risk investors. Gilts on average returned 0%. The best gilt returns came in the 5-15yr (5.9%) part of the curve, with the short end also outperforming (0-5yr: 5.1%) while the longer end (gilts 15yr+: 3.7%) lagged due to higher UK inflation and a global rise in long-dated yields due to debt sustainability concerns. Index-linked bonds returned 1.4%. UK investment grade corporates 7.3%.

After very volatile but very strong financial market returns in 2025, looking forward we anticipate continued positive returns in risk assets, although more moderate than last year. The six key questions we see for 2026 include:

Conclusion

As we move into 2026, the investment landscape remains promising but nuanced. While equity markets appear poised for further gains, supported by solid fundamentals and earnings growth, investors must navigate uncertainties around US policy shifts, central bank actions, and geopolitical developments. The AI-driven tech sector continues to offer opportunities, albeit with a need for selectivity, and Europe stands out with improving growth prospects and attractive valuations, as do Emerging Markets. Diversification across geographies and asset classes remains essential, particularly given evolving macroeconomic dynamics and structural changes. We see an interesting evolving opportunity set with increased diversification in the private equity space versus the listed equity space.

Overall, a disciplined, balanced approach will be key to capturing opportunities while managing risks in the year ahead.

Approver: Quilter Cheviot, 12 January 2026

Important Information: This document is a marketing communication. It is not independent investment research and should not be considered investment advice or a recommendation to buy or sell any security. Past performance is not a reliable indicator of future results. The value of investments can go down as well as up, and you may not get back the amount invested.

Quilter Cheviot and Quilter Cheviot Investment Management are trading names of Quilter Cheviot Limited, Quilter Cheviot International Limited and Quilter Cheviot Europe Limited. Quilter Cheviot International is a trading name of Quilter Cheviot International Limited.

Quilter Cheviot Limited is registered in England and Wales with number 01923571, registered office at Senator House, 85 Queen Victoria Street, London, EC4V 4AB. Quilter Cheviot Limited is a member of the London Stock Exchange, authorised and regulated by the UK Financial Conduct Authority and as an approved Financial Services Provider by the Financial Sector Conduct Authority in South Africa.

Quilter Cheviot International Limited is registered in Jersey with number 128676, registered office at 3rd Floor, Windward House, La Route de la Liberation, St Helier, JE1 1QJ, Jersey and is regulated by the Jersey Financial Services Commission and as an approved Financial Services Provider by the Financial Sector Conduct Authority in South Africa.

Quilter Cheviot International Limited has established a branch in the Dubai International Financial Centre (DIFC) with number 2084, registered office at 4th Floor, Office 415, Index Tower, Al Mustaqbal Street, DIFC, PO Box 122180, Dubai, UAE which is regulated by the Dubai Financial Services Authority. Promotions of financial information made by Quilter Cheviot DIFC may be carried out on behalf of its group entities. Quilter Cheviot Europe Limited is regulated by the Central Bank of Ireland, and is registered in Ireland with number 643307, registered office at Hambleden House, 19-26 Lower Pembroke Street, Dublin D02 WV96.

Would you like to speak to one of our experts?

You can contact us by phone, email or simply complete the online form and our team will be in touch with you soon.