The trouble with bank deposits 2 – Poor returns

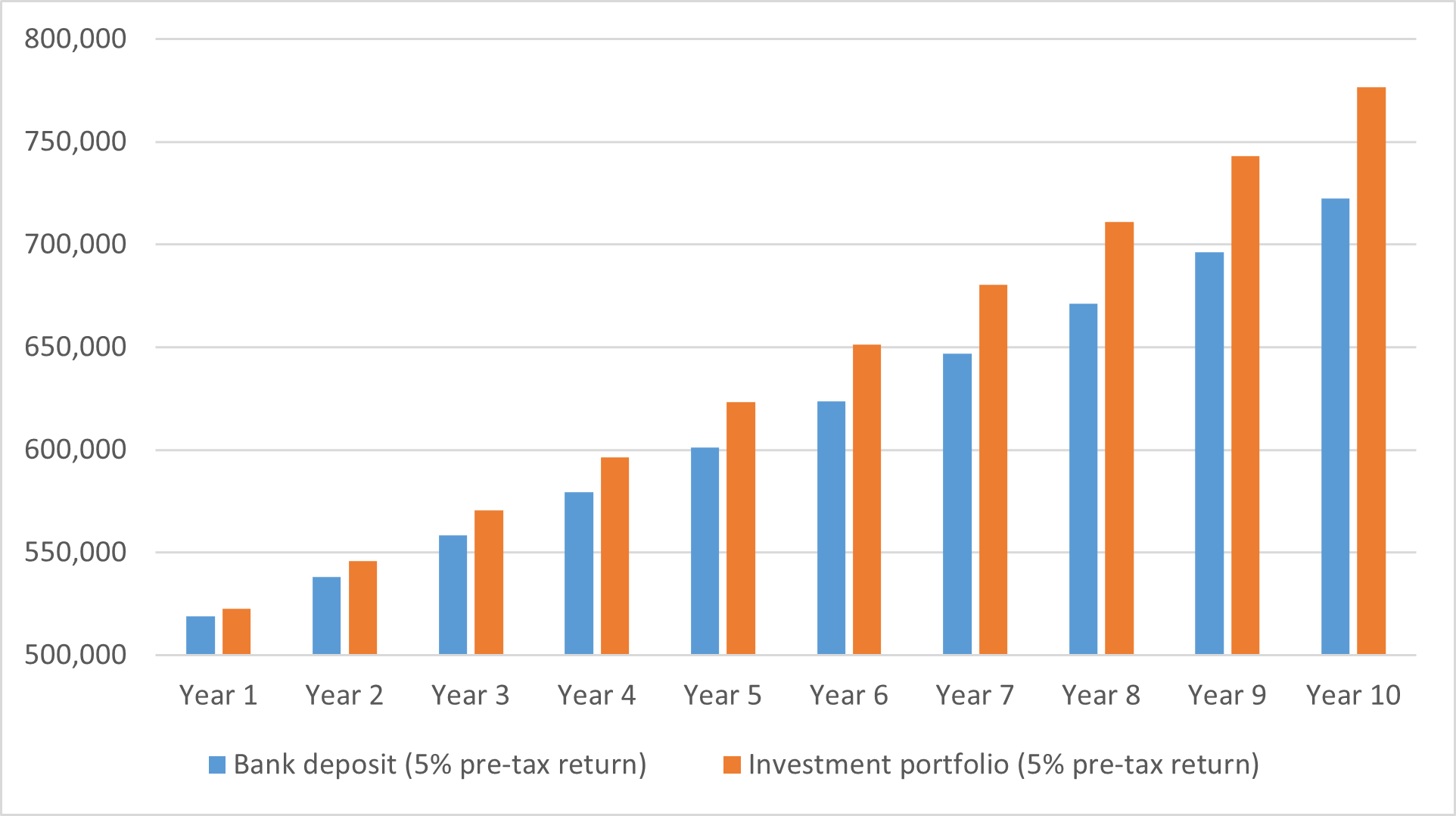

The above example assumes the same return from cash and investment. In practice, they’re not comparable.

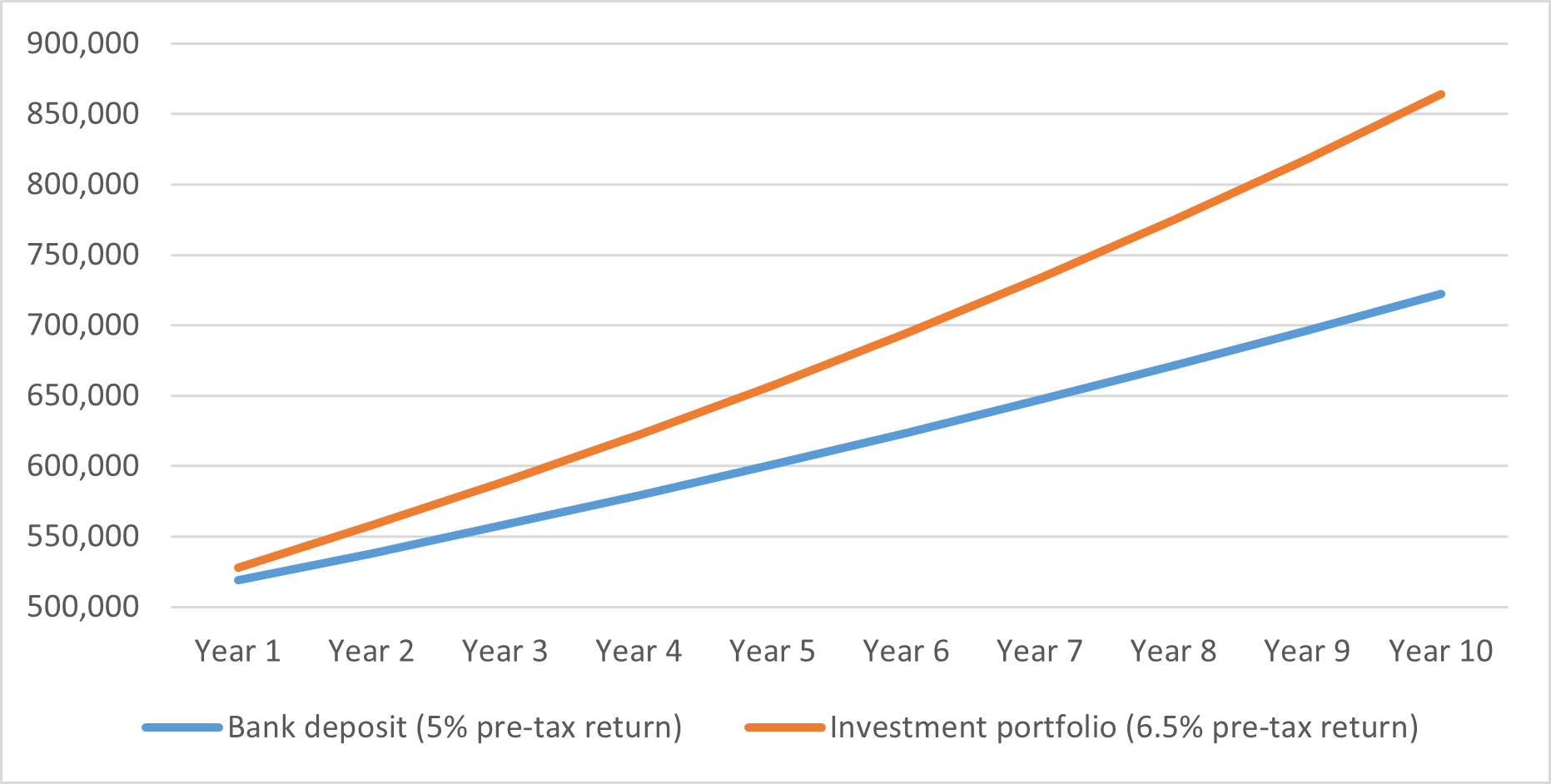

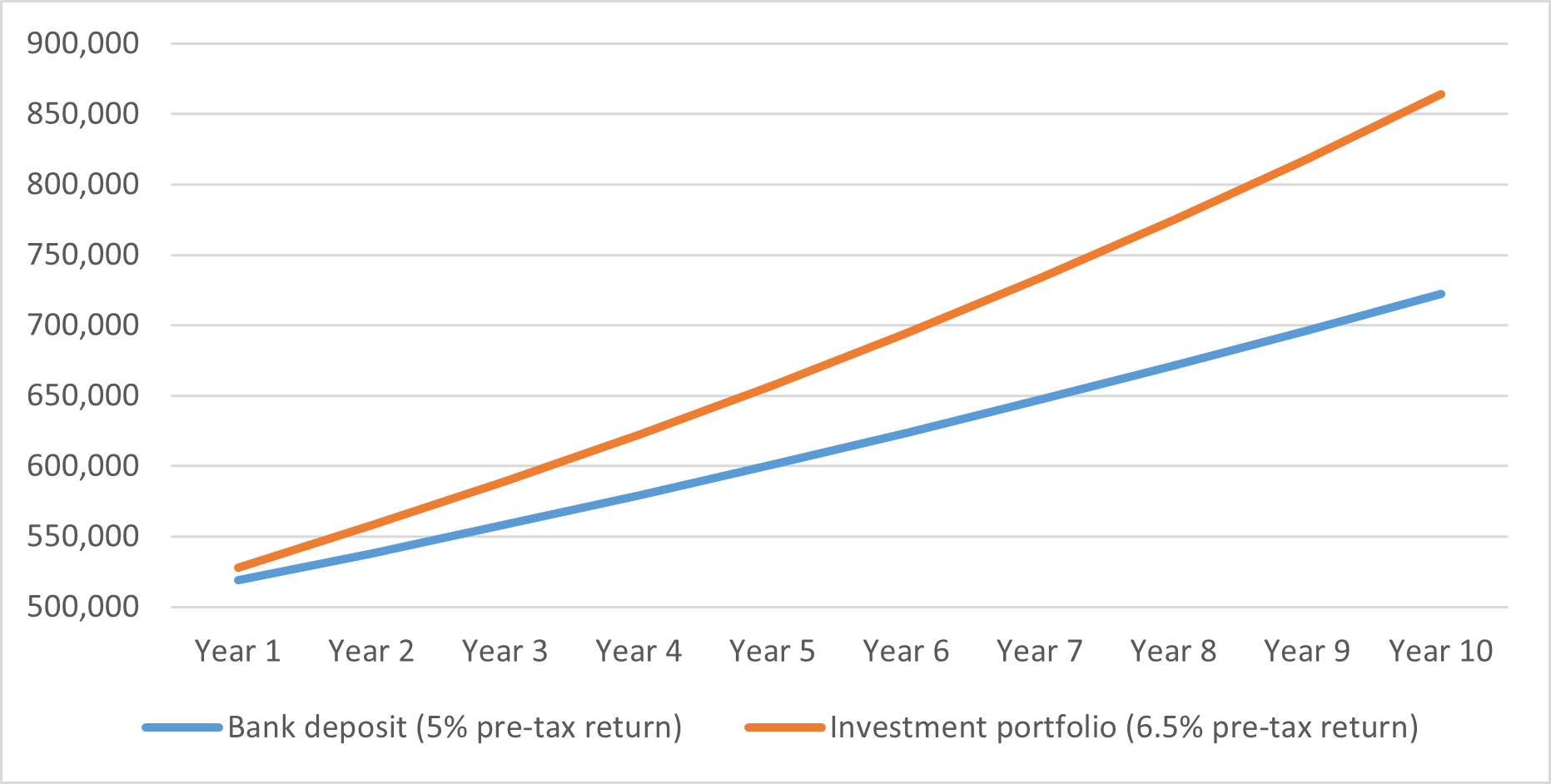

The returns on an initial £500,000 investment are still notably larger for an invested portfolio than a bank deposit, even after management fees. As seen in the previous graph, a £500,000 investment would return £722,522 after 10 years if placed in a bank deposit yielding 5%. At Quilter Cheviot, the Balanced Strategy has an estimated annual return of 6.5% over the longer term. For example, if the composition of this 6.5% is 3% from dividends (no corporation tax), 1.5% capital return (25% corporation tax) and 2% interest (25% corporation tax) then the after tax return is 5.625%. This would mean after 10 years the initial £500,000 would grow to £864,246, an additional 141,724, or 28%, compared to a bank deposit.

The trouble with bank deposits 3 – The cost of inflation

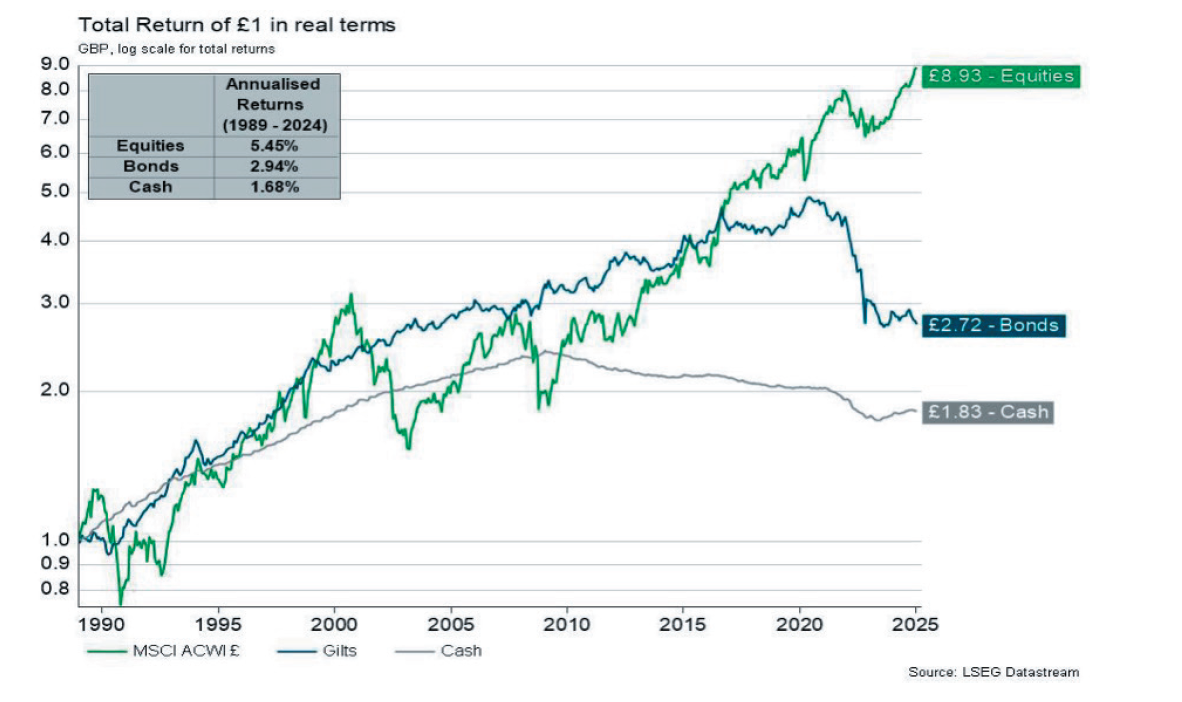

Investment carries risk, most notably to capital in the short term. In the medium and longer term, however, it significantly reduces the risk of inflation reducing the value of capital.

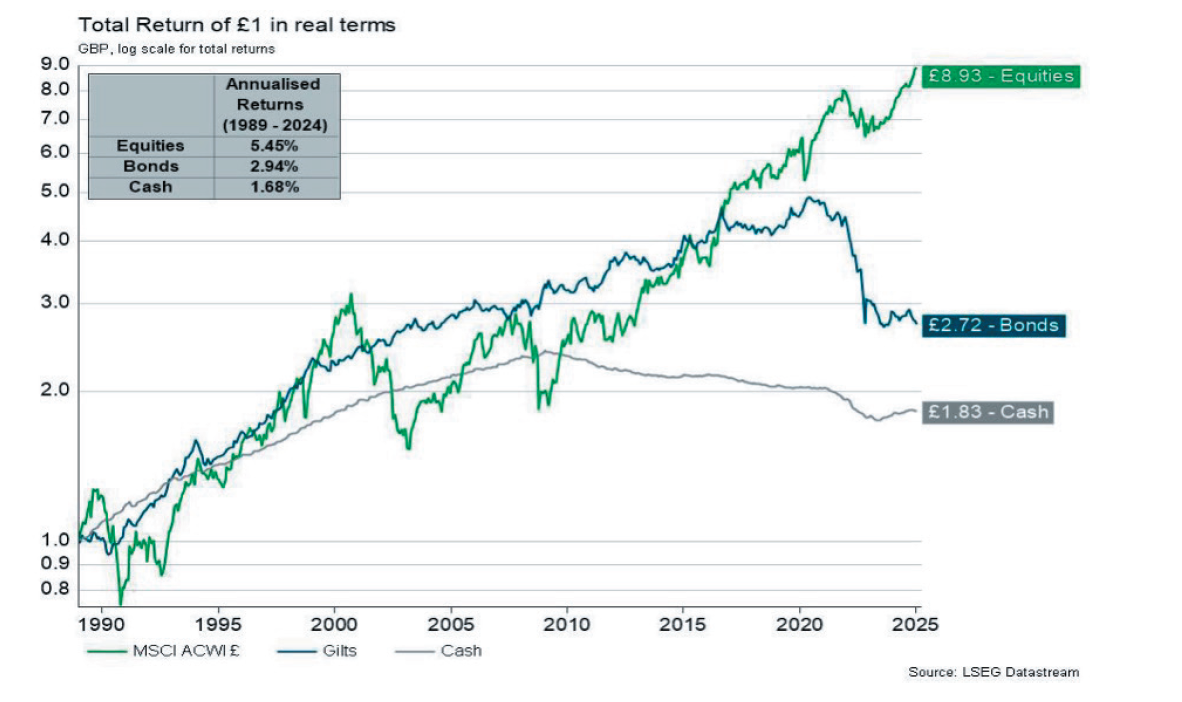

More than that, historically equity and bond investments have comfortably outperformed returns on cash and inflation.

Investing via a bond ladder

Access to bank deposits is usually determined by cash maturity dates, restricting flexibility.

We can help. For clients like you we invest business cash in a series of bonds that mature at appropriate future dates. This allows you to plan when the business needs access to liquidity. These investments will be in government or investment grade bonds, meaning a low risk of default.

The benefits of a diversified portfolio

Including stocks in your investments offers the chance of greater returns over the medium- to long-term. Not only have equities traditionally outperformed bonds and cash over longer timeframes, but they benefit from preferential tax treatment too.