Trusts are pivotal in strategic financial planning, providing a secure method for managing assets according to one’s wishes. They are integral for estate planning, retirement planning, and are instrumental in business succession strategies. Use trusts appropriately, and you can gain a greater degree of certainty about the handling of your financial affairs, both for now and in the future.

What is a Trust?

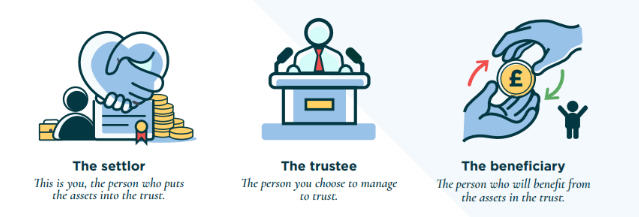

A trust acts like a legally binding safety deposit box for your assets. A trust acts like a legally binding safety deposit box for your assets; be it money, property, or other investments. You give these assets to someone you trust, who takes care of them for the individual or organisation you want to pass on your assets to. This setup is especially useful for making sure your assets are passed on conveniently to loved ones after you pass away. The trust system comprises of three key individuals:

Think of it as a way to give gifts to your loved ones after you’re no longer here, with instructions you’ve set on how and when they receive them. It’s a smart way to keep things organised and make sure your wishes are followed.