Investment confidence levels

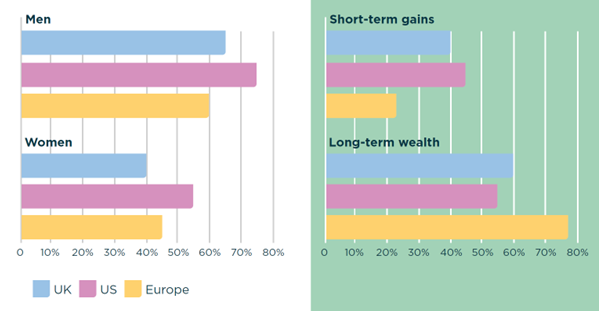

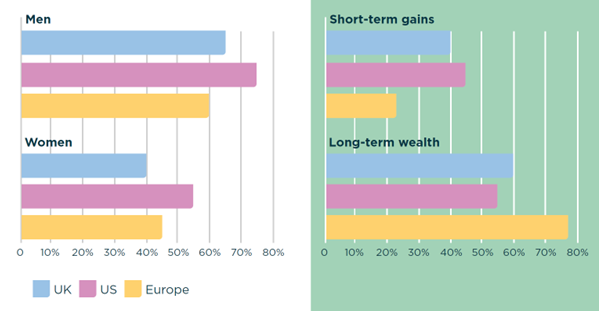

Confidence levels in investing are higher among men than women across all regions. In the US, 75% of men feel confident in their investing abilities compared to 55% of women.

The UK and Europe show similar trends, with men being more confident than women, albeit at lower overall levels of confidence. Here’s what influences confidence levels:

- Societal norms: Societal expectations and norms play a significant role in shaping confidence levels. In the US, there’s a greater cultural acceptance of risk-taking, which boosts confidence among investors.

- Financial education: Higher levels of financial education in the US contribute to greater confidence in investing abilities. Knowledge and understanding of financial markets empower individuals to make informed investment decisions.

- Gender dynamics: Across all regions, men tend to be more confident in their investing abilities than women. This confidence gap can be linked to historical underrepresentation of women in the financial sector and differences in financial education and societal expectations.

Investment goals

Continental European investors – particularly women – are the long-term planners, with 77% focusing on long-term wealth compared to 23% on short-term gains. This contrasts with the UK and US, where the focus is more balanced between short-term and long-term goals. Here’s why the focus varies:

- Economic stability: European investors, particularly women, are more focused on long-term wealth due to a more conservative investment culture and a stronger social safety net. This reduces the need for immediate financial returns and encourages a focus on long-term financial security.

- Cultural values: In the UK and US, there’s a more balanced focus between short-term gains and long-term goals. This balance reflects a blend of cultural values that prioritise both immediate financial success and long-term stability.