Building a portfolio tailored to you

Our Discretionary Portfolio Service is designed for professionals who want a bespoke, hands-on investment help that handles the specifics. You’ll be paired with a dedicated Investment Manager who builds and manages your portfolio based on your personal independence requirements, goals, risk appetite and personal independence requirements.

This isn’t a one-size-fits-all approach. Your holdings are selected from a broad universe of asset classes, including equities, fixed interest, commodities, hedge funds and cash. We also incorporate tax-efficient wrappers such as SIPPs and ISAs, and work with you to manage your capital gains and other tax considerations.

Our investment process is guided by one of the most experienced research teams in the industry. They analyse direct investments and third-party funds across global markets, ensuring investments are based on solid research and aligned with your firm’s compliance framework.

We also recognise that many professionals want their investments to reflect their values. Whether you’re focused on environmental impact, social responsibility or governance standards, we offer a range of responsible investment options. You can choose to apply ESG (Environmental, Social, and Governance) screens, exclude specific sectors or adopt a more thematic approach. These preferences are built into your investment strategy from the outset and reviewed regularly to ensure they continue to reflect your priorities.

Ultimately, this service is about giving you confidence. Confidence that your investments are being actively managed, that your compliance is being taken care of and that your investment objectives are being handled thoughtfully.

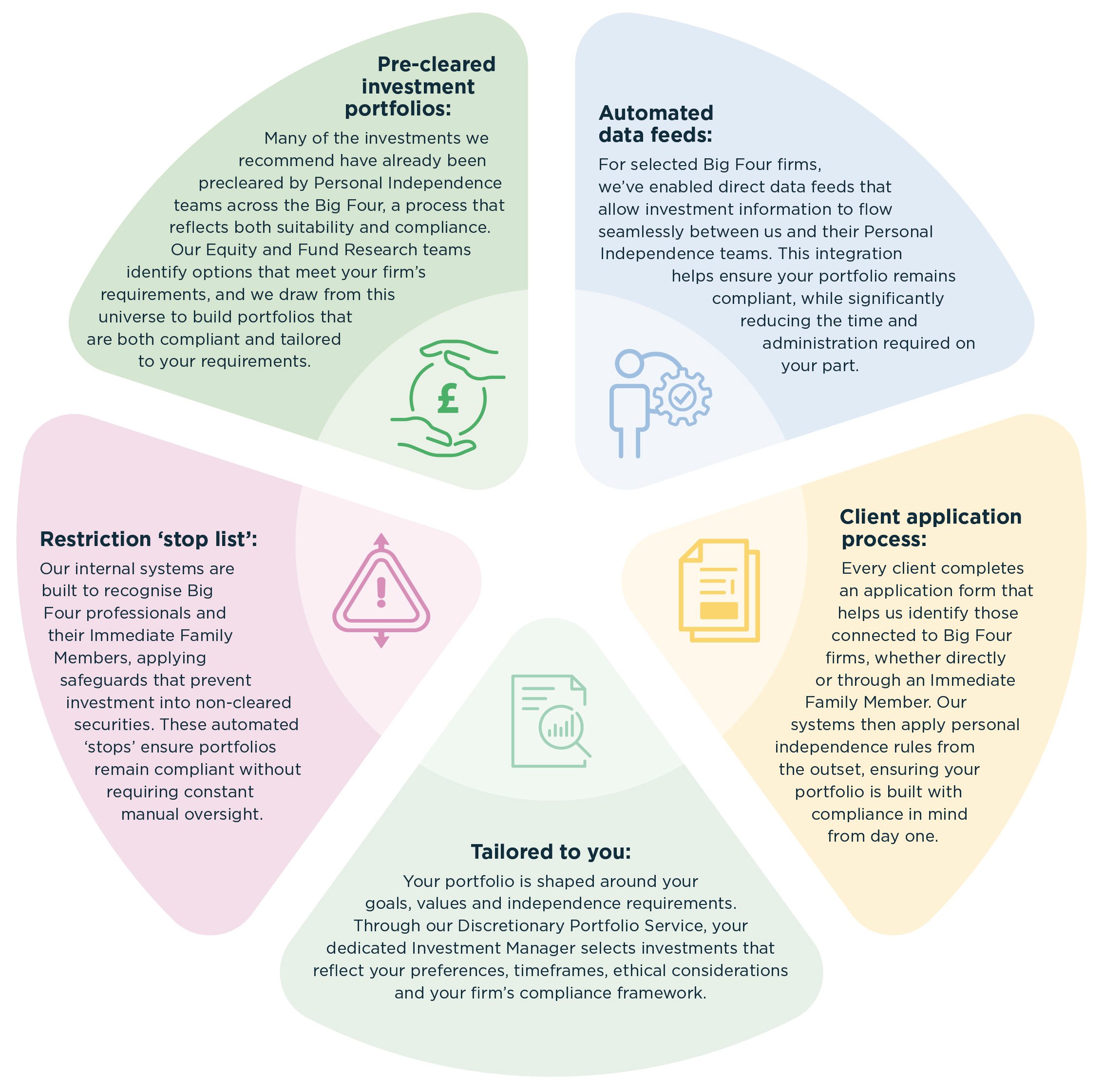

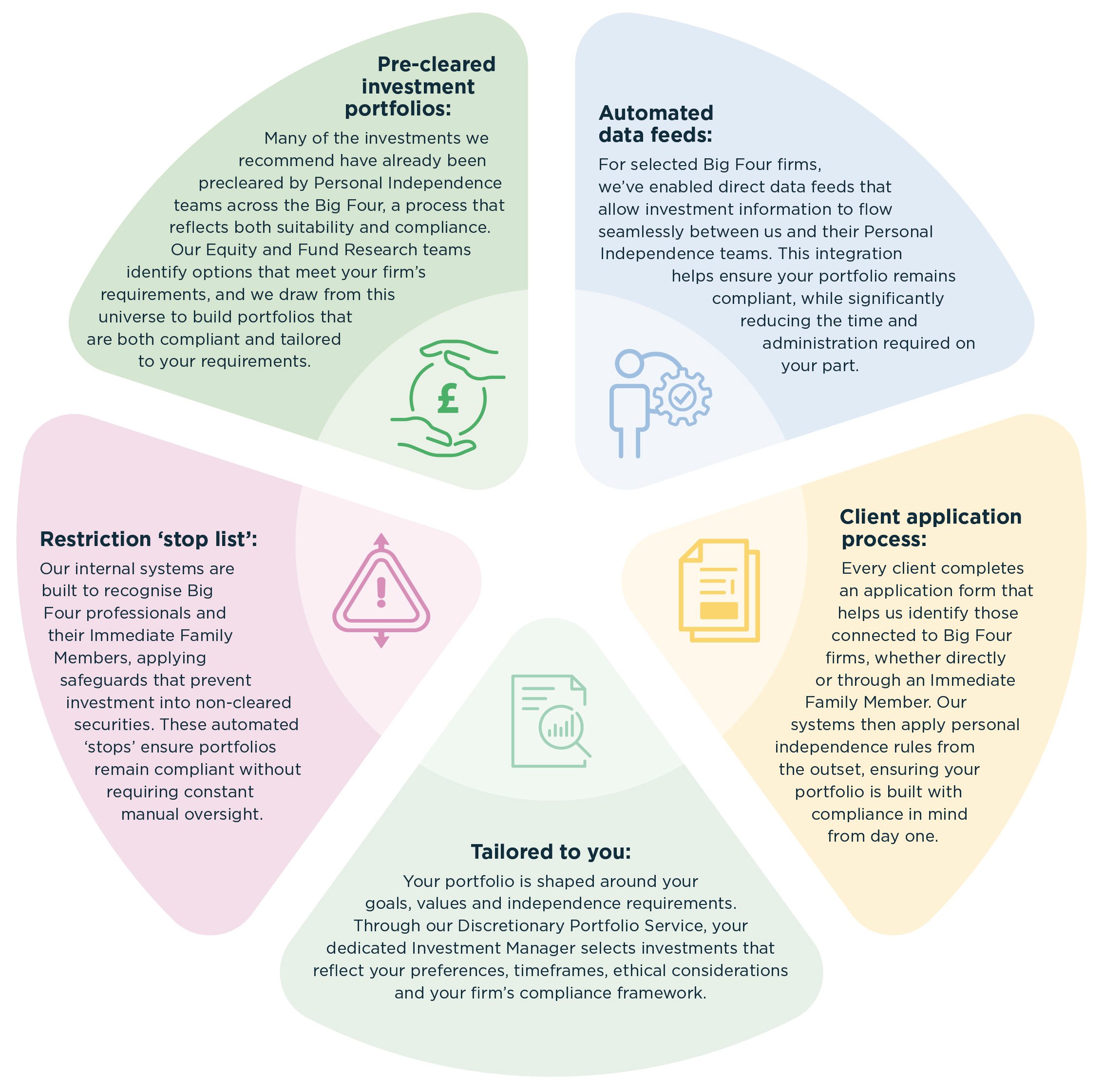

How do we manage personal independence in practice?

A truly personalised service

At Quilter Cheviot, personalisation is the foundation of our approach. Every client is paired with a dedicated Investment Manager who takes full responsibility for building, managing and evolving a compliant investment strategy over time. In practice, this means your Investment Manager will take the time to understand your career, your financial goals whilst knowing the stringent compliance framework you operate within.

They will meet with you regularly to review your portfolio, discuss any changes in your circumstances and ensure your investments remain aligned with your objectives and risk appetite. These meetings are supported by clear, easy-to-read reporting that includes detailed valuations, performance data, market commentary and, where needed, a detailed yearly tax summary.

This level of service is meant to make things easier for you. That said, we remain proactive in keeping you informed and involved in key decisions. And because we understand personal independence procedures, we build diligence into every step of the journey. That way, you can be confident your investments are being looked after properly.

Long-term support

Whether you’re joining a Big Four firm, preparing for partnership or managing family finances, we’re here to support you. We’ve helped clients transfer pensions, navigate trusteeships and manage cohabitation scenarios, all while staying within the personal independence rules.

Our experience across all four firms means we understand the details that matter. We’ll help you build a strategy that is compliant, efficient and suited to your situation.

This is a marketing communication.

This material is not tax, legal or accounting advice and should not be relied on for tax, legal or accounting purposes. Quilter Cheviot Limited does not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting adviser(s) before engaging in any transaction. Trusts, estate planning, taxation and inheritance tax advice are not regulated by the Financial Conduct Authority. Tax treatment depends on an individual's circumstances and may change in the future.

The value of investments, and the income from them, can go down as well as up and that past performance is no guarantee of future return. You may not recover what you invest. Changes in exchange rates may have an adverse effect on the value, price or income of foreign currency denominated securities. Levels and bases of taxation can change. Investments or investment services referred to may not be suitable for all recipients.

Quilter Cheviot and Quilter Cheviot Investment Management are trading names of Quilter Cheviot Limited. Quilter Cheviot Limited is registered in England with number 01923571, registered office at Senator House, 85 Queen Victoria Street, London, EC4V 4AB. Quilter Cheviot Limited is a member of the London Stock Exchange and authorised and regulated by the UK Financial Conduct Authority and as an approved Financial Services Provider by the Financial Sector Conduct Authority in South Africa.

Approver: Quilter Cheviot Ltd 30 September 2025