Health truly is wealth.

But what happens when we need extra help in our later years? Long term healthcare can be expensive, especially where state support is limited and means-tested.

Rest assured; you are not alone. In this article, we share six useful tips and tricks that can help manage this burden to ensure a more fruitful later life. From saving and investing, to using equity release or insurance, these options can make a substantial difference.

The numbers…

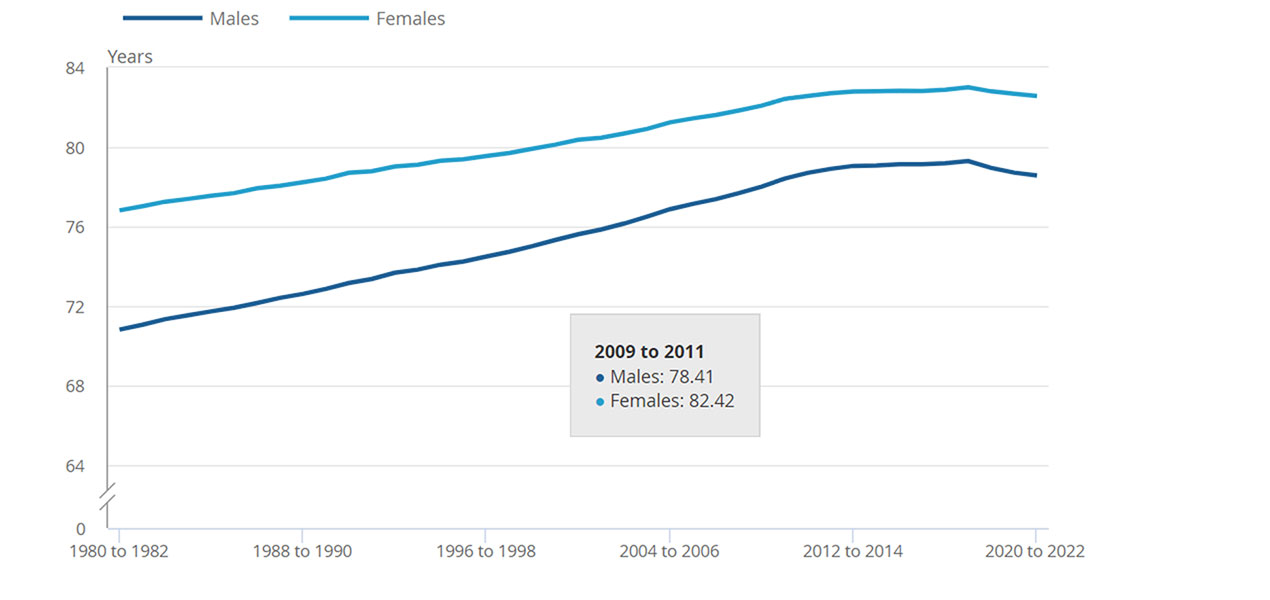

Since 1980, the average UK life expectancy has increased by over eight years. This is a testament to the nation’s medical advancements, but does not come without its difficulties. One of note, is the financial toll a longer lifespan can have on both the individual and their families – particularly if finances are not in order.

The cost of residing in a care home is substantial. On average, it costs around £800 a week for a place in a care home – over £40,000 every single year. For those aged 65 to 69 in care homes, the average life expectancy is over six years, leading to a potential total cost exceeding £240,000.

And if we add the impact of inflation into the mix, costs can escalate even further, placing a significant burden on not only the individual, but families too.

Souce: ONS

Want to know more?

If you would like to learn more about how a financial planner can support your Long-Term Care planning, get in touch with one of our West Midlands Long Term Care specialists today.

Phone: 0121 752 8140

Sources of information:

- Own knowledge CF8 CII

- Government website

- Money Helper

- Age UK