There has been an increased focus on the banking sector in the last month, with the collapse of Silicon Valley Bank and only a last minute, government-brokered deal saving Credit Suisse from experiencing the same outcome.

News headlines on banks have been as full of references to panic and turmoil in financial markets as at any point since the 2007-08 financial crisis, but we believe the current situation is not that alike and there currently appears to be far less risk of a banking system-wide crisis than just 15 years ago.

A more in-depth look at recent developments can be found here.

The downfall of Silicon Valley Bank (SVB) was essentially down to mismanaging interest rate risk – sharply rising interest rates caused the bank’s clients (in many cases start-up technology companies) to withdraw deposits while at the same time reducing the value of its assets, a good proportion of which were government bonds whose value tumbled as interest rate increased. As reports of trouble at SVB gained momentum, a bank run began, and the vicious circle was set in motion with depositors rushing to withdraw funds. US regional banks play a key role in commercial real estate lending and the recent issues in the sector, coupled with the expected increase in regulation, will likely mean higher costs of capital going forward, which, if it occurs, could well have knock-on effects to the real estate sector.

Credit Suisse’s problems can be traced further back, as shown by the 99% decline from the 2007 high in its share price to the level at which UBS, a rival Swiss lender, bought the business. In a clear sign of increasing trouble, the Sfr0.76 (Swiss francs) per share deal, paid for with UBS stock, was around 60% lower than Credit Suisse shares closed on the final trading deal before the deal was agreed. Recent scandals involving Grensill Capital and Archegos were the last of a long line of crises faced by Credit Suisse. Last year the bank reported a US$7.9bn loss, effectively wiping out a decade’s worth of earnings. In contrast many banks posted sizable profits for 2022, with UBS, for instance, declaring earnings of US$7.6bn.

Chart one: Credit Suisse shares have sharply underperformed UBS in recent years

Still cheap?

The higher interest rate environment had led us to be positive on the prospect of banks in general in recent months, as it boosts their margins due to more of the increase being passed on to borrowers than savers. However, the recent bank failures serve as a warning, even if SVB was due to factors that are largely specific to US regional banks and Credit Suisse caused by a long run of poor management.

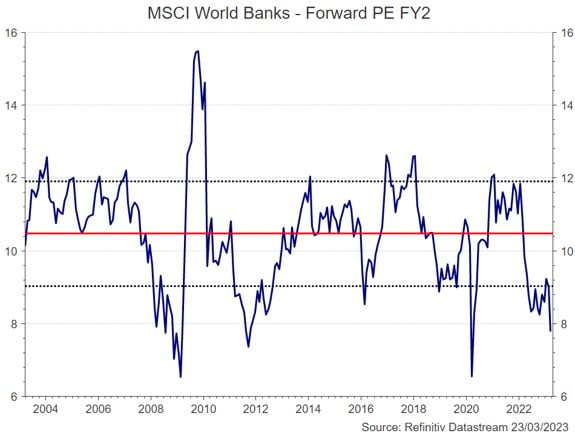

In general, bank’s valuations are low by historical standards, and it appears that current prices are reflective of a fair amount of bad news already being priced in. The price/earnings (P/E) ratio is a widely used measure of valuation and it is currently well below it’s long-term average for the past 20 years. It is also not that far above the level it fell to during the 2007-08 banking crisis.

Chart two: Bank valuations have fallen well below their long-term average and are currently not far from their lowest level in 20 years

Overall, the 2010s were a challenging year for banks, but many of the problems they faced have now gone, or even turned into positives. Near-zero interest rates squeezed profit margins, but the recent sharp increase means that the current environment is much more favourable. Bank’s funding and capital position has improved significantly, and there is not expected to be new, harsher regulation for most banks (US regional banks will likely face increased regulation though). Large fines and, for UK banks, PPI payments that ate into profits are largely a thing of the past, allowing for a greater share of profits to be returned to investors, via dividends and share buybacks.

As we have seen several times before* trouble in the banking sector can not only act as a symptom of an economic slowdown but also serve as a catalyst for one. While SVB was the second largest banking collapse in US history and Credit Suisse of global systemic importance, the contributory issues appear to be specific to these banks (plus US regional banks) and not troubles that can be easily extrapolated to the wider banking system.

For UK banks, such as Lloyds Bank and NatWest, there are several important differences compared to US regional banks that mean they are better safeguarded against recent issues. UK banks are not allowed to take the same kind of interest rate risk as SVB, and even if they did, unrealised losses would show up on their balance sheets. This is because the accounting requirements for UK banks is designed to be far more transparent that that for US regional banks and they are also subject to a higher amount of regulatory scrutiny.

Regulation will likely be increased for US regional banks, but we don’t believe there will be significant changes to UK and European regulations as the measures taken in the wake of the 2007-08 financial crisis are already deemed sufficient. Another positive for UK banks is the diversification of deposits, with a greater number of depositors that, in many cases, have smaller-sized deposits compared to SVB. At the end of 2022, only 2.7% of deposits at SVB were less than US$250,000 .

Rapid interest rate increases have seen the Fed funds rate aggressively increased from 0.25% to 5.00% in little over a year while the Bank of England has lifted its base rate from 0.25% to 4.25% with 11 consecutive increases at policy meetings. However, recent troubles in the banking sector could well dissuade rate-setters from continuing to hike much further in a bid to curb inflation.

The situation for banks remains clearly fluid and uncertainty will likely persist for some time to come but we believe that markets are already pricing-in a large amount of bad news. In the same way that generals are often seen to fight the last war, it is not uncommon for markets to be fearful of a repeat of the last crisis* even though this is rarely the source of the next one. While we believe that the banking sector is not bulletproof and, if economic activity slows further, will face headwinds we still see attractive opportunities in the area. Most banks are well funded and have large amounts of capital on hand and if, as we expect, they continue with share buybacks and large dividends the current valuations do look cheap, on both a historical and relative basis.

If you would like to read a more in-depth article on the banking sector, please view here.

*We are overlooking the pandemic crisis here, as it was relatively short-lived in terms of adverse economic impact.

Author

Subscribe to one of our newsletters

Get the inside view from Quilter Cheviot delivered straight to your inbox.